Hi members of the Road To Carry community –

This is the last Road To Carry post of 2025. Instead of our usual case study, I wanted to share a behind-the-curtains look at how RTC started, what unfolded this year, and how I’m thinking about what comes next.

First, here’s an interesting year-end PE economics report from our sponsor, Carta, that you can check out for free.

2025 was a confusing year for private markets.

PE fundraising dropped ~15% YoY, yet the top 10 firms walked away with ~46% of all capital raised.

Carta’s 2025 Fund Economics Report pulls back the curtain using data from ~2,000 VC and PE funds on the Carta platform, revealing how managers are actually running their funds in this environment.

The report skews VC, but many of the insights translate directly to PE and the broader private markets.

What a year 2025 was!

How Road To Carry Got Started

It may be hard to imagine, but back in 2024, I felt lost as a 30-year-old VP in private equity. PE was a good career, but internally, I knew I wanted to try something beyond traditional middle-market PE (some of the readers may empathize).

But I didn’t have a bright startup idea, nor did I immediately want the responsibilities of reporting to investors and employees. So I packed up and went on a two-week solo trip to Asia to reflect.

Quick Side Story: Ideas

Since 2020, I’d spent most weekends sketching business ideas—most of which never left a Google Doc. The last two ideas were accounting firm roll-ups and a PE-focused media company.

Flight to Japan

The first destination in Asia was Japan. The world is such a funny, coincidental place sometimes. I noticed the guy sitting next to me was about my age and also traveling solo. Turns out, he was a burned-out accountant working at Cherry Bekaert–one of the first accounting firms acquired by PE in 2022.

We chatted about our careers, accounting and PE, and ended up hanging out in Tokyo.

My chat with him reminded me of the business ideas in my Google Drive. I figured I should revisit them first before exploring new ones. So I began thinking about rolling up companies and, on the side, writing a PE-focused newsletter—accounting roll-ups became the first topic I wrote about.

Roll-Ups

Building a roll-up is hard. Especially if you’re trying to do it alone and run the company post-close. It’s no longer just about your career, but a five- to ten-year commitment that also impacts your family.

But I trudged along and used the newsletter as a forcing mechanism for researching ideas—in the early days, Road To Carry was me reflecting on niche ideas.

Newsletter

I started writing anonymously at first. Later, I would occasionally post on LinkedIn. Despite relative anonymity, the readership kept growing.

Audience, Growth & Mission

When RTC hit 1,000 readers, I began to wonder—who was actually reading it?

I analyzed it and was surprised.

Who Is Reading? July 2025 Version

The majority of RTC readers were working professionals in PE (and IB). Followed by students.

The majority of professionals were mid-career (mid-20s to late-30s)

Senior people were reading, too. I still remember one afternoon, a reader introduced herself as the Head of PE at a $100B asset manager. That happened in the middle of a golf trip, so despite hitting poorly, I was beaming the whole trip.

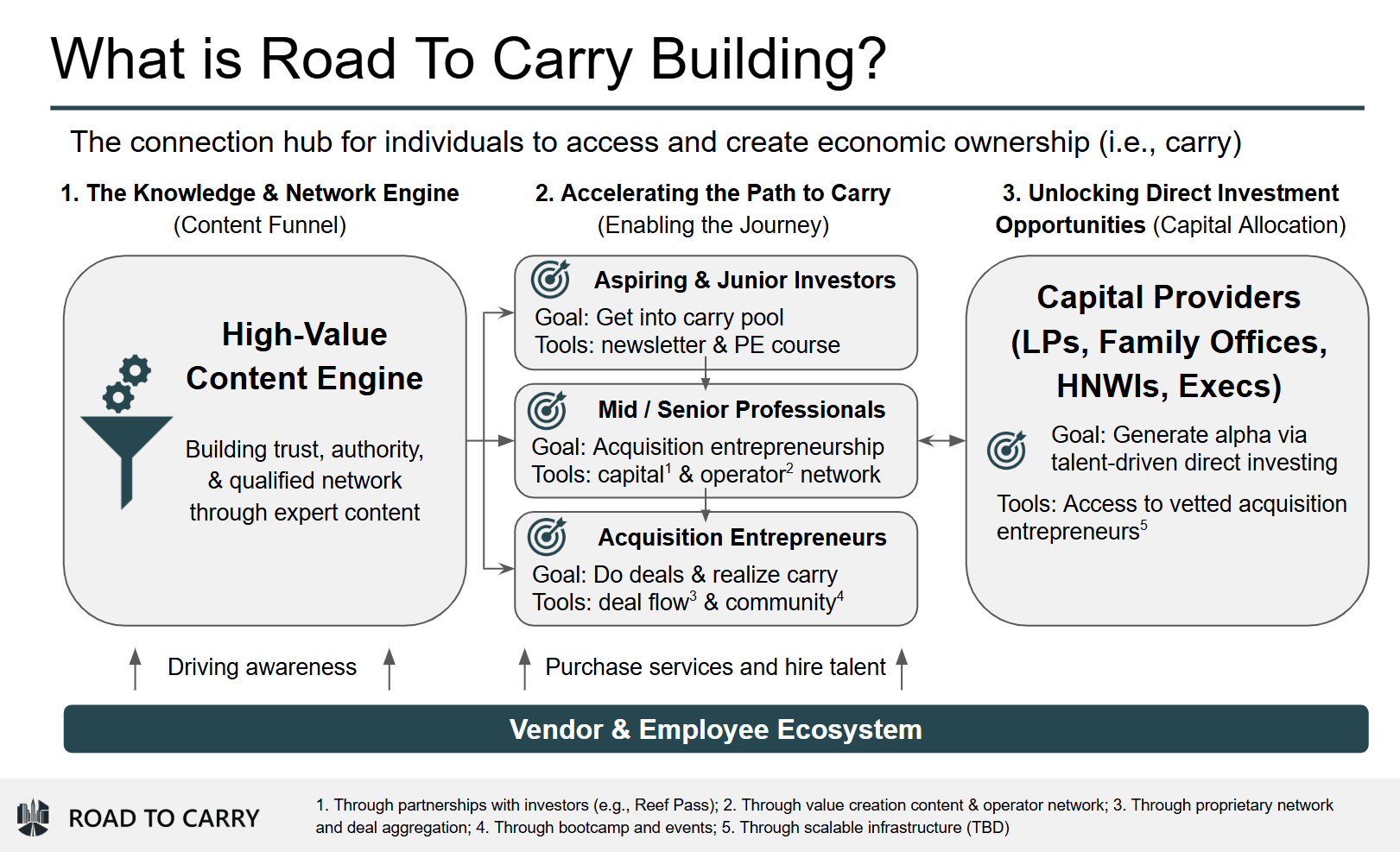

Realizing that my peers and even seniors in PE were reading the newsletter gave me the confidence to be more public about it on LinkedIn.

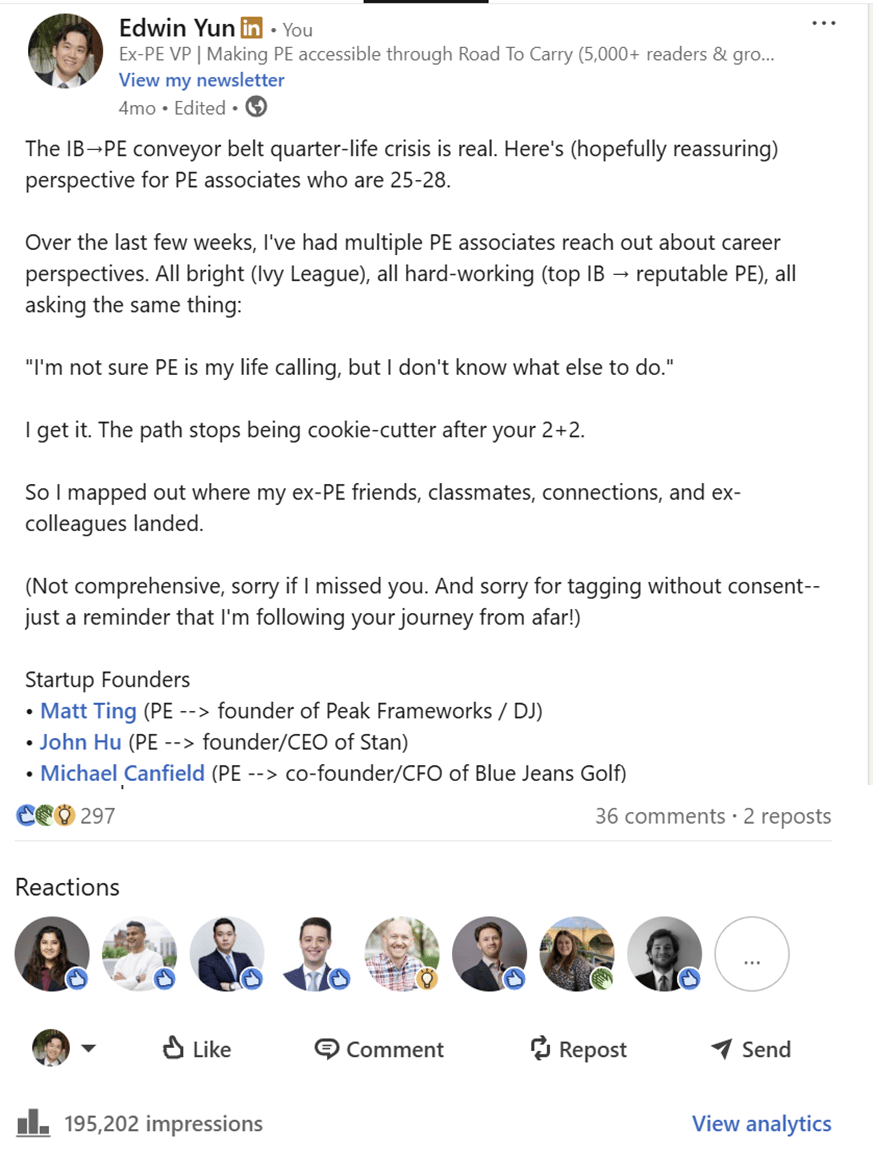

But I didn’t know what to write about. So I just wrote about what was top of mind for me and for my readers: career choices after PE/IB. It kind of blew up, reaching ~200k impressions.

And the newsletter started to pick up steam, growing from 1,000 to 3,500 in ~3 months:

Revisiting the Mission

The core mission from day 1 has remained steady: bring transparency to private equity, which controls a significant portion of the economy in relative opacity.

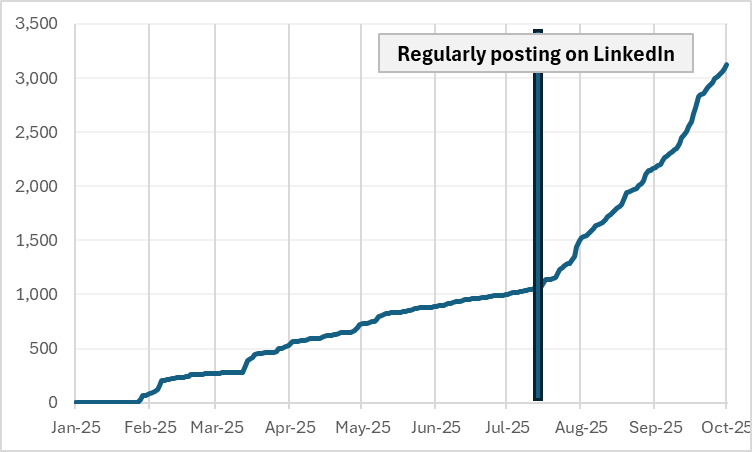

But I had struggled to define what that means in a practical sense, especially as the audience evolved. More recently, I’ve begun to develop some clarity by breaking down the audience into groups:

Aspiring/Junior PE Investors: educate how private equity works–helping them get into the carry pool

Mid-Career PE Investors: facilitate transition to acquisition entrepreneurship–forging their own road to carry

Acquisition Entrepreneurs (Searchers/Indy Sponsors/Micro-Cap PE): enable deal making–realizing carry in their own terms

This was the moment when RTC stopped being “a newsletter I was writing” and started becoming something larger. I want to help people own a piece of the private equity economy. I believe everyone deserves a higher-agency life built on the foundation of ownership.

2025 Progress & Updates

Looking back, 2025 wasn’t about scale—it was about experimentation. Some things worked, others surprised me, and a few quietly laid the foundation for what’s next.

Readership Growth

First off, I am super grateful for all your support. We crossed 6,000 readers in the RTC community!

Content

In 2025, we wrote over 50 posts. Some of my favorites—because they reflect how broad and unintuitive PE really is—are:

Rolling Up Ski Mountains. One that readers mention the most.

Buying Out Walgreens. Had a ton of fun ripping through publicly available data.

Beer Keg Logistics. Just another reminder that PE is everywhere, and great businesses exist in plain sight.

I’ve also started bringing some of the interesting conversations I’m having into the public arena—for example, my podcast-style chat with Zach Morrison, CEO of Tinuiti.

Sponsorship

With growing content and readership, I was fortunate to have dozens of sponsorship interests. Most recently, I got an inbound from Carta, who signed up as a sponsor for December. Having a great company like Carta support the newsletter was an incredible validation.

PE Course

The private equity course is another creation I am very proud of. It’s something I wish I could have given to my associates, so they wouldn’t have to struggle so much to ramp up in their new PE seats. Over 40 analysts and associates from top banks and PE firms have gone through it.

Reef Pass Partnership

I pondered a lot about how to accomplish this mission for mid-career readers: “facilitate transition to acquisition entrepreneurship–forging their own road to carry.”

This is something I deeply resonate with. I tried to do this alone and it was hard.

So when I got the opportunity to partner up as an Origination Advisor to Reef Pass Investors, an investor group that backs serial acquisition holding company platforms (most often launched by ex-PE professionals), it felt like a no-brainer.

This partnership doesn’t change RTC’s editorial independence—it expands what readers can do after they learn. I think of it as an “action-layer” with real capital behind it to support mid-career transitions.

So if you’re seriously exploring a serial acquisition path, let’s chat. You can reply directly to this email.

What The Heck Are You Actually Building?

This is a graphical summary of how the various pieces to-date are falling together (I’m constantly evaluating so the thinking may evolve):

2026 Goals

Goal #0. Be mission-driven. Have fun.

Yes, I need to build the business so it’s financially sustainable. But as my wise wife said to me one evening when I was crashing out, “if PE money didn’t make you happy, why do you think money is going to solve all your problems?”

That gave me clarity. I’d like to build RTC as a mission-driven company that brings personal fulfillment. Hopefully financial success follows.

Goal #1. Bring the community together in-person.

I can’t emphasize this enough. The RTC community is special. We have investors at pretty much all the top PE funds.

And middle market PE (I couldn’t capture them all):

And c-suites at PE-backed companies (again, couldn’t capture them all):

Whether through conferences or small group dinners / happy hours, I’d love to find more ways to share this network with the broader RTC community.

Quick Announcement

RollUpEurope and Road To Carry have teamed up to launch ROLLUP BOOTCAMP—a 4-week, application-only online program for finance professionals exploring serial acquisition and roll-up strategies.

Starting in late January, the program features 5 practical modules taught by experienced serial acquirers and active investors, including Reef Pass and Shore Capital.

Modules include:

1. Choosing the right capital structure for your acquisition platform

2. Picking the right industry and building the winning team

3. Personal branding and deal searching

4. Designing an exit-ready platform from Day 1

5. How investors evaluate emerging roll-ups

At the end of the bootcamp, participants will be invited to pitch to investors in London (Feb 26) or NYC (Mar 31).

Interested? Apply Below.

Deadline: Jan 15, 2026

Goal #2. Reach even more people.

Over the last few months, I focused on reaching the mid-career PE investor audience partially because they are my peers. But I’ve been reminded since that the mission is broader–it’s about helping everyone involved in private equity throughout their entire career cycle.

So I’m going to try and broaden the audience funnel to reach anyone serious about PE.

Goal #3. Leveling up content & data engine.

My goal is to make this newsletter the highest-ROI asset in your inbox. To do that, some ideas include:

Ramping up research by teaming up with interns.

Expanding collaborations with contributors.

Another area I’m thinking about is data. Some ideas include:

PE deal transaction database. Helping you easily find deal comps and deal advisors through a robust transaction database.

Deal flow database. Providing you with thousands of actionable deal opportunities segmented by industry, size, and location.

What kind of content and/or data would be interesting to you? Please let me know by replying to this email.

Wrap

2025 has been a very meaningful year for my career and personal growth. I am acutely aware of the fact that the building blocks of Road To Carry have been—and always will be—readers like you. Thank you again for your support.

If you’ve been quietly reading RTC, 2026 is the year I’d love you to lean in—reply, attend, collaborate, or just say hello.

Sincerely,

Edwin

P.S. As RTC grows, here are a few ways you can engage—depending on where you are in your career:

College student serious about PE → Apply to Become a PE Research Analyst

Exploring acquisition entrepreneurship → Participate in Rollup Bootcamp / Conference

Operators / industry experts → Collaborate on a piece or record a podcast. Share your work with the PE community—and potentially unlock advisor or consulting opportunities