PE Playbook: Walgreens buyout by Sycamore

State of Play

Sycamore Partners, a New York-based private equity firm, is acquiring Walgreens for $11.45 per share in cash, plus an additional right to receive up to $3.00 per share from the planned divestiture of VillageMD (announced midway through this write-up!). This values Walgreens at an enterprise value of approximately $23.7 billion*, implying an EV/EBITDA multiple of ~5.6x**. Excluding the contingent $3.00 per share from divestitures, the deal is valued at ~$21 billion***, translating to an EV/EBITDA multiple of ~4.8x****.

Walgreens has historically been a gift to private equity—at the expense of its own shareholders. The 2014 acquisition of Alliance Boots generated ~4x MOIC for KKR, while the 2010 sale of Duane Reade netted Oak Hill a ~1.5x return. Since its 2015 peak, Walgreens’ market cap has plummeted from $100 billion to under $10 billion, as the result of a series of strategic missteps.

So what exactly does Sycamore see in Walgreens? In short—financial engineering. And if there’s any firm positioned to pull it off, it’s Sycamore.

—Footnotes:

*Per Walgreens’ announcement, based on cash consideration of $11.45 per share, plus up to $3.00 per share from divestiture rights, plus net debt, capital leases, present value of opioid liability and Everly settlement, less fair value of all equity investments.

**Based on $4.2B LTM Adj. EBITDA per Q1 2025 filings.

***Calculated as $23.7B total enterprise value, less $2.7B maximum proceeds from divestiture rights.

****Calculated as $4.2B consolidated LTM Adj. EBITDA per Q1 2025 filings, plus $141M CY2024A Adj. EBITDA loss from VillageMD.

How Walgreens Makes Money

Before diving into what happened to Walgreens over the last few years and why Sycamore is interested, let’s first break down their three core revenue segments:

🇺🇸💊 1. U.S. Retail Pharmacy Segment (FY2024: $116 billion revenue)

Prescription Drug Sales (~77% of segment) – Walgreens fills over 1.2 billion prescriptions annually, making money through insurance reimbursements, co-pays, and cash purchases. Prescription drugs are low-margin, high-volume products.

Retail & Front-End Sales (~23% of segment) – Walgreens sells OTC medications, beauty, personal care, and convenience goods. Private-label products (e.g., Walgreens-branded vitamins) have higher margins than branded goods.

🇬🇧⚕️ 2. International Segment (FY2024: $24 billion revenue)

Boots Pharmacy & Retail Chain (~49% of segment) – The largest retail pharmacy chain in the UK, Boots earns money from prescription dispensing and health/beauty product sales. Beauty products generate higher margins than traditional pharmacy items.

Wholesale Distribution (~51% of segment) – Walgreens still operates some wholesale pharmaceutical distribution businesses, primarily in Germany.

🏥 3. U.S. Healthcare (FY2024: $8 billion revenue)

Primary Care Clinics (75% of segment) – Walgreens operates VillageMD and CityMD urgent care clinics, generating revenue from doctor visits, chronic disease management, and value-based care contracts.

Specialty Pharmacy aka Shields Health Solutions (7% of segment) – Shields partners with hospitals to provide specialty medications for complex conditions. This is a high-growth, high-margin business.

Home Healthcare aka CareCentrix (17% of segment) – CareCentrix manages home-based healthcare services like post-hospital care, durable medical equipment (DME), and home infusions. Revenue comes from insurance reimbursements.

Company History

All three major pharmacy retailers—CVS, Walgreens, and Rite Aid—have faced mounting industry headwinds, from the rise of e-commerce to declining pharmacy reimbursement rates. However, over the past five years, their strategic choices have led to vastly different outcomes: CVS has maintained (relative) stability, Walgreens has suffered a steep decline in value, and Rite Aid has collapsed into bankruptcy.

Source: Google Finance

Source: Google Finance

The biggest driver of this gap in performance is their M&A strategy. Whereas CVS focused on a vertical-integration strategy, Walgreens went on a haphazard acquisition spree:

CVS Health’s Vertical Integration Strategy: Building a Healthcare Ecosystem

Through acquisitions, technology investments, and service expansion, CVS now operates across pharmacy, insurance, primary care, and home healthcare, creating a closed-loop ecosystem that captures patients at multiple stages of their healthcare journey

CVS’s acquisition strategy was built around three major components:

Pharmacy Benefit Management (PBM) – Caremark Acquisition (2006)

In 2006, CVS acquired Caremark Rx, making it one of the largest pharmacy benefit managers (PBMs) in the U.S.

This deal allowed CVS to control prescription drug pricing, negotiate better deals with drug manufacturers, and steer prescriptions toward its own pharmacies, giving it a competitive advantage over Walgreens.

Health Insurance – Aetna Acquisition (2018)

In 2018, CVS acquired Aetna, one of the largest health insurance providers in the U.S.

By owning a health insurer, CVS can direct Aetna patients toward CVS pharmacies, MinuteClinics, and affiliated providers, reducing out-of-network healthcare spending.

Primary Care & Home Health – Expansion into Direct Care (2022–2023)

Acquisition of Signify Health (2022), which specializes in home-based healthcare

Acquisition of Oak Street Health (2023), which operates primary care clinics

Walgreens’ M&A Strategy: A Haphazard Attempt at Vertical Integration

Historically, Walgreens followed a retail-focused acquisition strategy, consolidating pharmacy chains to expand its footprint. However, after seeing CVS’s success with Caremark (PBM) and Aetna (insurance), Walgreens belatedly pivoted toward healthcare services, but without a clear roadmap.

Pre-2015: Expansion via Pharmacy Acquisitions

The company aggressively acquired pharmacy chains like Duane Reade (2010) and Boots Alliance (2014–2015) to expand domestically and internationally.

2015–2020: Playing Catch-Up with CVS, But Without a PBM or Insurance Arm

Unlike CVS, Walgreens never acquired a PBM or an insurer, making its integration into healthcare services much weaker and less effective.

Instead, Walgreens experimented with partnerships, such as a failed 2018 deal with Humana to integrate insurance services.

2020–Present: Haphazard Healthcare Acquisitions with No Clear Strategy

Walgreens finally shifted toward healthcare services in 2021–2022, but its approach was scattershot and reactive, with acquisitions that lacked synergy.

Acquired VillageMD / CityMD (primary care clinics), Shields Health Solutions (specialty pharmacy), CareCentrix (home health)—but without a clear operational integration strategy.

This disorganized set of assets sitting inside the retail pharmacy giant is why Sycamore is interested in Walgreens.

Investment Thesis

Sycamore Partners’ acquisition of Walgreens is a classic private equity play focused on unlocking value through a corporate breakup. Sycamore sees an opportunity to split the company into separate businesses, optimize each unit’s performance, and maximize returns through asset sales or IPOs. While I don’t have a crystal ball into Sycamore’s exact strategy, a potential breakup could look like:

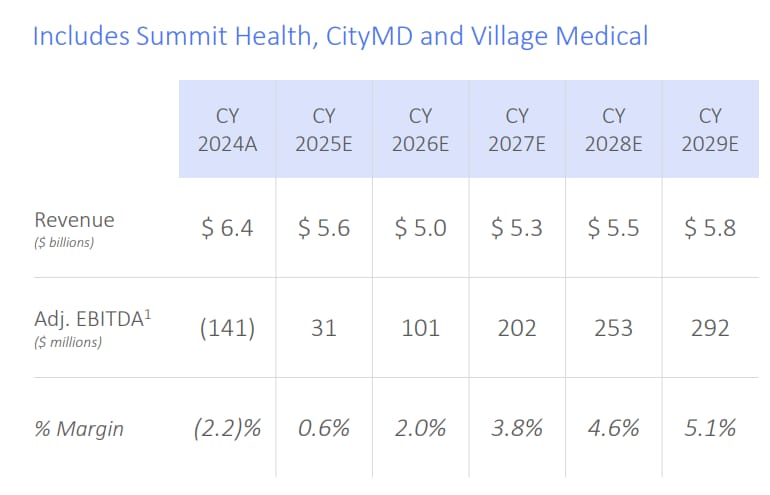

🏥 1. Sale of VillageMD (FY2024: $6.4 billion revenue)

The announced deal comes with a planned sale of VillageMD, which includes primary care clinics Summit Health, CityMD, and Village Medical

Walgreens acquired a controlling stake in VillageMD, investing $6.2 billion across 2020 and 2021. In 2023, VillageMD acquired Summit Health / CityMD for $8.9 billion, with Walgreens contributing $3.5 billion to retain its largest shareholder position (53%) in the combined entity. In total, Walgreens has poured ~$9.7 billion into these primary care clinics.

The chances of Walgreens recouping anything close to that $9.7 billion investment appear slim. According to the announcement, VillageMD is projected to barely generate any EBITDA in the near-term:

Source: Walgreens investor presentation

Even if we slap on a normalized Adj. EBITDA margin of 5% to CY2026E revenue of $5 billion (equating to $250M normalized Adj. EBITDA) and a 10x multiple, that’d only result in $2.5 billion proceeds.

The good news? Walgreens receives 100% of the proceeds up to the $3.4 billion in debt it lent to VillageMD. The even better news—for Sycamore? They take a 30% cut of the proceeds. At a $2.5 billion valuation, Walgreens shareholders would walk away with just $1.75 billion, while the newly Sycamore-owned Walgreens would pocket $750 million.

℞ 2. Restructuring U.S. Retail Pharmacy Segment (FY2024: $116 billion revenue)

Walgreens’ U.S. Retail Pharmacy segment has a margin problem.

With a shift toward lower-margin pharmacy sales and continued reimbursement pressure from PBMs, the U.S. Retail segment's gross margin declined from 20% in FY2023 to 18% FY2024.

Walgreens U.S. Retail Pharmacy Revenue Split:

Source: Walgreens FY2024 10-K

Despite gross margin and profit dollars declining, the segment’s overhead SG&A costs remained the same. This has led to a ~40% decline in Adj. Operating Income despite a 5% growth in revenue.

Walgreens U.S. Retail Pharmacy Segment Financials:

Source: Walgreens FY2024 investor presentation.

The Company has already announced a plan to close ~1,000 stores; however, there’s more room to cut. According to management, the bottom 25% of its ~8,500 locations, which equates to over 2,000 stores, were unprofitable.

While CVS’s pharmacy margin of ~4.5-5% may not be obtainable for Walgreens without a PBM business, their margins serve as a clear benchmark for what’s possible with improved operations.

CVS Pharmacy & Consumer Wellness Segment Financials

Source: CVS FY2024 earnings release.

🇬🇧⚕️ 3. Monetizing Boots UK & International Assets (FY2024: $24 billion revenue)

Boots is the largest UK pharmacy that has less PBM exposure, better growth prospects, and a stronger e-commerce operation (FY2024: ~12 billion revenue)

Unlike the U.S. pharmacy business that has ~77% drugs / ~23% retail revenue mix, Boots operations has a ~30% drugs / ~70% retail mix, reducing its exposure to declining drug reimbursement rates

While the U.S. pharmacy business’s retail revenue declined ~5% in FY24, Boots retail revenue increased ~7% in FY24. Part of the growth driver is their retail product mix, which leans more heavily into beauty & health, as well as success with the e-commerce operations which grew 23% year on year and accounted for 22% of all retail revenues

While detailed financial information is limited, Boots UK's 2023 annual report reveals a much stronger gross profit margin of ~35%, significantly outperforming the U.S. retail pharmacy segment, which operates at less than 20%.

Assuming a 12% Adj. EBITDA margin and 8x multiple, the Boots business could be sold for ~$11 billion*

—Footnotes:

*Calculated as $12 billion revenue x 12% Adj. EBITDA margin x 8x multiple.

This segment also includes a B2B wholesale drug distribution business in Germany that can be monetized standalone (FY2024: ~$12 billion revenue)

~51% of the International segment is the wholesale drug distribution business, which was formed in 2019 as a joint venture with McKesson and then later fully acquired from McKesson in 2021. The wholesale business posted a healthy growth of 5.6% in FY2024

Walgreens has a history of divesting wholesale operations. In 2021, it sold Alliance Healthcare—a distributor covering the U.S. and Europe (excluding Germany and Italy)—to Cencora (formerly AmerisourceBergen) for $6.5 billion. At the time, Alliance Healthcare generated $19 billion in revenue and ~$550 million in Adj. EBITDA (~3% margin).

Assuming the same margin and multiple, the Germany wholesale business could be sold for ~$4.2 billion*

—Footnotes:

*Calculated as $12 billion revenue x 3% Adj. EBITDA margin x 11.8x multiple.

🏥 4. Scaling remaining U.S. Healthcare assets (excl. VillageMD) for future sale or IPO (FY2024: $2 billion revenue)

Shields Health (specialty pharmacy services company) and CareCentrix (home health company) have better growth and profitability

Shields Health, which helps hospitals and drug manufacturers with distribution and access of specialty drugs, reported ~$600 million revenue in FY24 and a 28% revenue growth. Meanwhile, CareCentrix reported $1.4 billion revenue in FY24.

These two business generated ~$315 million* of LTM Adj. EBITDA in Q1 2025. Assuming a 10x multiple**, these two businesses could get sold for ~$3.2 billion.

—Footnotes:

*Calculated as total U.S. Healthcare (incl. VillageMD) FY24 Adj. EBITDA of $66M, plus $70M of Q1 2025 Adj. EBITDA, plus $39M of Q1 2024 Adj. EBITDA loss, plus $141M of CY2024 Adj. EBITDA loss from VillageMD.

**Per online estimates, CareCentrix was acquired at a 11.1x EBITDA multiple.

Sum-of-the-Parts Valuation

A potential breakup scenario, as outlined above, would result in a pro forma sum-of-the-parts valuation (excluding proceeds from the planned VillageMD sale) ranging from $31–$44 billion in enterprise value, depending on the EBITDA margin Walgreens’ U.S. retail business can achieve (assumed at 3–4%):

Note: these estimates and multiples are high-level assumptions.

For context, this valuation compares to Sycamore’s $21 billion purchase price, excluding any divestiture proceeds from VillageMD.

Sycamore is reportedly financing the transaction with ~$12 billion in debt and ~$9 billion in equity. With a potential $10 billion+ value unlock, Sycamore is positioning itself to more than 2x its equity investment by breaking Walgreens apart.

Looking Ahead

If there’s any firm that knows how to navigate complex retail carve-outs and execute financial engineering at scale, it’s Sycamore Partners. Just look at their Staples deal in 2017—where they separated the company’s corporate and retail divisions, spinning off the faster-growing B2B segment while managing the declining retail footprint. Sycamore thrives on deals like this. If they can pull off another transformation, this could be yet another defining moment in their portfolio. Must be many sleepless nights for the team there!

💰 Whether by rolling up companies or breaking them apart, private equity finds a way to profit on both ends.

RATE TODAY’S EDITION

If you enjoyed the newsletter, please share with friends and subscribe at https://PENewsletter.com/subscribe