Roll-Up Playbook: Accountants

Source: The Finance Story

State of Play

In January 2025, Blackstone announced its acquisition of Citrin Cooperman, a top 20 U.S. accounting firm, for a staggering $2 billion (15x EBITDA) from New Mountain Capital. This exit marks a 4x+ return 💸 for New Mountain, which had acquired Citrin Cooperman for $500 million (11x EBITDA) in October 2021. Over the ~3-year holding period, Citrin Cooperman reportedly achieved a 2.5x revenue increase 📈, growing from $350 million to $850 million—largely driven by an aggressive roll-up strategy involving 15+ acquisitions.

Investment Thesis

Say what you will about accounting being "boring." For private equity firms, boring = good, and better yet: boring + cash machine + M&A = love at first sight 😍.

But jokes aside, there’s a lot to love about investing in accounting firms from a business model perspective:

🚧 1. Barriers to entry.

The industry has a natural moat, thanks to CPA licensing requirements. While there are ways around this (which private equity is exploiting—more on that in a moment), the regulatory hurdle adds significant protection.

🤝 2. Predictable, stable revenue.

Regulations require public companies to undergo audits, and many private companies follow suit for financing purposes or good corporate governance. Taxes? Everyone has to pay those. Once a client picks an accountant, the hassle of switching makes retention rates sky-high.

💵 3. High cash flow.

Aside from employee compensation, accounting firms have minimal capital expenditure requirements. Sure, tax and audit seasons might create temporary fluctuations in working capital, but with almost zero capex needs, EBITDA essentially equals cash flow in this business.

So, Why Now?

Investing in accounting firms hasn’t always been straightforward. Private equity had to get innovative ✨ to overcome a major industry obstacle: the ownership rule.

This rule dictates that accounting firms (specifically their audit/attestation services) must be at least 50% CPA-owned. This restriction kept investors on the sidelines for years. But where there’s money to be made, private equity always finds a way. Enter the alternative practice structure, a clever workaround.

Here’s how it works:

✂️ 1. Split the business.

The accounting firm is divided into two separate entities: one for attestation services (e.g., audits) and the other for non-attestation services (e.g., tax and consulting).

💰 2. Invest in the non-attestation side.

Private equity takes majority control of the non-attestation business, while CPAs retain majority control of the attestation side. However, private equity may still take a minority stake in the attestation entity.

📑 3. Use an administrative services agreement.

The two entities enter into an agreement where the non-attestation business provides administrative services to the attestation business. These fees effectively transfer the attestation income to the non-attestation business, funneling profits into private equity’s hands.

While the concept sounds simple, the corporate reorganization process can get tricky. Just look at Ernst & Young’s highly publicized attempt—it was an epic fail.

Source: The Wall Street Journal

Value Creation Playbook

To private equity’s credit, they’ve been deploying a variety of operational tactics to accelerate revenue growth and EBITDA profitability in accounting firms. Here are some common strategies PE-backed firms have used in recent years:

1. Leveraging Offshore Labor

Accounting firms have a straightforward revenue model:

Revenue = billing rate x billable time.

In many cases, clients are quoted a fixed project fee (e.g., $100k for an audit), which is calculated in the background by summing billing rates and hours across employees at different levels (e.g., partners costing more than staff auditors).

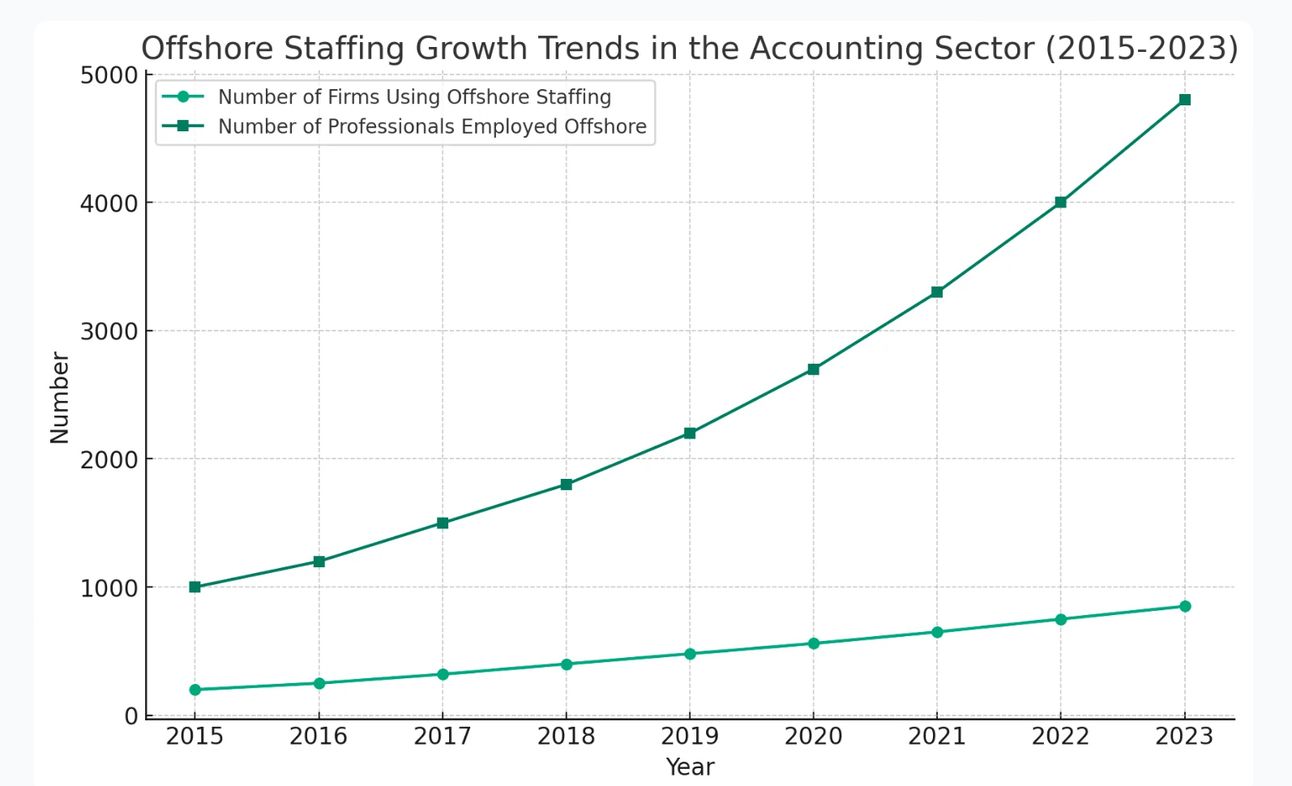

Historically, offshore labor was rare in the accounting industry because clients preferred in-person services. But post-COVID, combined with private equity’s influence, offshore labor has surged—particularly in countries like India and the Philippines. For instance, Citrin Cooperman’s India office grew from just 10 FTEs in 2016 to over 350 FTEs by 2023.

Source: Vintti

You might wonder, “Do these India-based employees hold U.S. CPA licenses?” The answer is no—but firms exploit a loophole: CPAs can delegate non-attestation tasks to non-CPA staff as long as a U.S.-based CPA signs off on the final work.

This offshoring model allows firms to:

Expand profit margins by outsourcing routine work at lower costs while charging clients the same fees.

Boost revenue by enabling U.S.-based employees to focus on higher-value, client-facing tasks.

As the offshore-to-U.S. employee ratio increases, so do both revenues and profits.

2. Cross-Selling Additional Services

Most accounting firms’ primary relationships with clients are through CFOs, whose responsibilities extend beyond just audit and tax. CFOs also oversee:

Financial reporting and planning.

IT systems and management.

Source: Oana Labes on X

Historically, CFOs have sought consulting services for these needs from management consulting firms or the Big 4. Now, PE-backed regional accounting firms are moving aggressively to take over these opportunities.

One example is Citrin Cooperman’s acquisition of the Clearview Group, which provides services such as:

Business transformation.

Software implementation.

IT consulting and managed IT services.

Many PE-backed platforms are expanding their service offerings through acquisitions and actively cross-selling additional services to CFOs from their core audit and tax business.

3. Price Increases

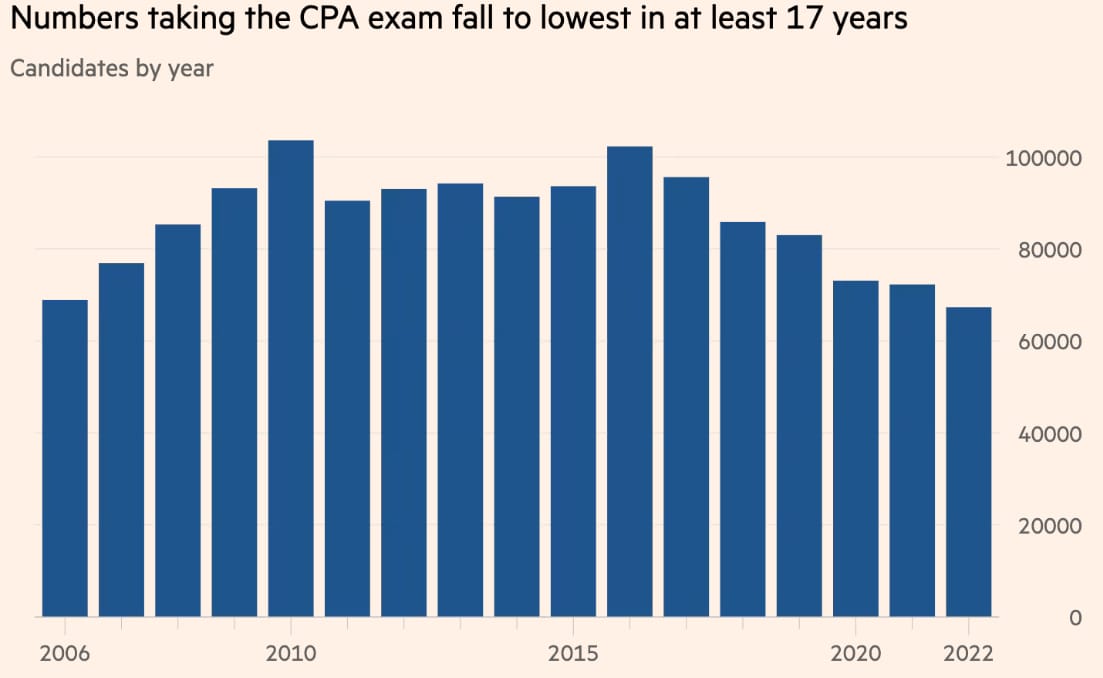

Private equity is notorious for testing how far they can push prices. In the accounting space, this has been easier due to a significant labor shortage.

The number of new CPAs has been declining every year, creating tighter market conditions. According to a study by the American Institute of Certified Public Accountants (AICPA), the number of candidates taking the CPA exam has dropped annually since 2016.

Source: AICPA

With fewer CPAs entering the field, clients face greater challenges hiring internally—making them less price-sensitive.

4. Roll-Up Through M&A

The U.S. is home to nearly 90,000 accounting firms, according to IBISWorld. As shown in a 2023 top 100 accounting firms report, the size of these firms drops off quickly, even within the top 25.

Source: Accounting Today

Private equity thrives in fragmented markets like this, which offer highly accretive consolidation opportunities. Banker sources indicate these acquisitions are being executed at high-single-digit EBITDA multiples (pre-synergies).

Given that Blackstone recently acquired Citrin Cooperman for 15x EBITDA, these roll-ups provide immediate value creation.

Private equity’s playbook for accounting firms—leveraging offshore labor, cross-selling services, raising prices, and pursuing roll-up strategies—shows exactly why they’re drawn to this space. For PE, it’s a cash-rich, scalable, and highly fragmented market that checks all the right boxes.

Looking Ahead

While Citrin Cooperman is the first major exit, New Mountain and Citrin Cooperman are far from alone in this game. Other notable accounting roll-up platforms include:

TowerBrook / EisnerAmper

Parthenon / Cherry Bekaert

Hellman & Friedman / Baker Tilly

Alpine Investors / Ascend

Cinven / Grant Thornton

With this big exit in the books and the multiple arbitrage opportunity validated, the pace of consolidation in the accounting industry is set to accelerate.

Now that the largest private equity firm—Blackstone—has entered the fray, it wouldn’t be surprising to see large-scale M&A among the top 10 players in the accounting industry over the next five years.

Buckle up!

RATE TODAY’S EDITION

If you enjoyed the newsletter, please share with friends and subscribe at https://perollup.beehiiv.com/subscribe