We all agree: quarterly valuations are the least favorite part of the PE job. Endless reconciliation of historical financials, tweaking decade-old Excel templates, and somehow doing it all in the middle of board-meeting season.

That’s why I’m paying attention to what Carta is doing with AI. Instead of trying to replace the intellectually stimulating parts of the job—the investing part—Carta’s PE Admin solution uses AI to streamline the back-office grind: fund reporting, valuations, and portfolio data workflows.

Carta was the OG in automating manual cap-table management for the VC world. Now they’re bringing that same discipline to private equity.

If quarterly valuations eat up your team’s time, this free Carta report is worth sharing with your team to reclaim those wasted hours. It breaks down:

- How AI is reshaping fund reporting and portfolio management

- What “agentic AI” actually means for eliminating repetitive tasks

On Thursday, we shared a $2.5M EBITDA nutrition supplement business you can go acquire. In today’s piece, we dive into PE’s playbook in nutrition supplements, including Nutranext (exited to Clorox for $700M at a 3.5x REVENUE multiple).

PE Playbook: Vitamin, Minerals & Supplements (“VMS”)

State of Play

America is in a wellness frenzy. According to Pew Research Center, 80 percent (!) of adults in the United States have used supplements for dietary or other purposes.

And buy they do: U.S. supplement sales have soared from ~$49B in 2019 to almost $70B in 2024, juiced by a pandemic-era wellness frenzy.

Source: Nutrition Business Journal (NBJ)

Note: 2022 and 2023 are extrapolated estimates. All other years are from NBJ.

At the same time, 7 in 10 believe the FDA lacks the tools to protect them from dangerous products. It’s a Wild West market running on faith and marketing with new entrants popping up everyday.

So how does PE take advantage of a huge market with little trust in individual products? Through brand aggregation and building distribution into trusted sales channels.

Let’s dive into how PE firms are rolling up supplement brands (and make a killing).

Private Equity’s VMS Case Study

Nutranext: From Entrepreneur to Founder of PE Firm

Foundation

Nutranext started out as Nature’s Products, Inc. (“NPI”), a portfolio of brands and contract manufacturers specializing in vitamins, minerals, and supplements. The company was founded by Jose Minski, who previously held a COO role at Trolli, a gummy candy manufacturer and brand that was later sold to Favorite Brands (backed by TPG).

But Jose Minski had bigger ambitions. He’d go on to leverage the company as a tool to launch WM Partners and raise the $300M first fund in 2015—in part by contributing Nutranext as the first platform investment in the fund.

Here is a short write-up on the firm and its history for anyone interested.

The Roll Up Strategy

The strategy was clear from day one: use Nutranext as the roll-up engine for Fund I. Find adjacent supplement brands, acquire them at low-to-mid single-digit EBITDA multiples, and stitch them together into a scaled, vertically integrated wellness house.

Nutranext already had a solid base of manufacturing and distribution capabilities through its wholly owned subsidiary, NPI—a Florida-based GMP-certified supplement manufacturer. NPI gave Nutranext a key advantage from the start: control over production and quality in an industry known for…well, sketchy ingredients and labeling.

On top of the manufacturer platform in NPI, Nutranext had already had assembled multiple brands:

Rainbow Light – a category leader in natural multivitamins and prenatal formulas

Champion Nutrition – a sports supplement line with long-tail retail presence

Blessed Herbs – focused on cleansing and detox

A long tail of direct-to-consumer (DTC) and catalog-era brands like Sedona Labs and Nutri-Health Supplements

Once Fund I was live in late 2015, WM moved quickly.

In Feb 2016, it acquired Stop Aging Now, a direct-to-consumer brand with a loyal middle age consumer base.

In March 2016, it picked up Natural Vitality, maker of the bestselling magnesium supplement Natural Calm.

In 2017, it added NeoCell, the collagen powder/gummies leader riding the beauty-from-within trend.

Over just a few years, WM stitched these brands into a platform — spanning retail, DTC, e-commerce, and multiple need states: sleep, stress, digestion, immunity, beauty, aging, and daily health.

The Exit

Then came the kicker.

In 2018, Clorox acquired Nutranext for ~$700 million, paying an estimated ~3.5x revenue multiple—a massive validation for the roll-up play. The sale gave WM Partners a flagship win out of its first fund, and Nutranext became the early template for how to run a supplement roll-up.

The full list of Nutranext brands at exit spanned more than a dozen labels. But the true value was the infrastructure — vertically integrated manufacturing, regulatory-compliant quality control, and an omnichannel sales engine. That, Clorox was willing to pay for.

Investment Thesis

Why are private equity firms gobbling up vitamin brands like gummy bears? Here’s the bull case for the supplement roll-up:

1. Secular Growth in Wellness

U.S. supplement market is huge and growing: sales have soared from ~$49B in 2019 to almost $70B in 2024. But why?

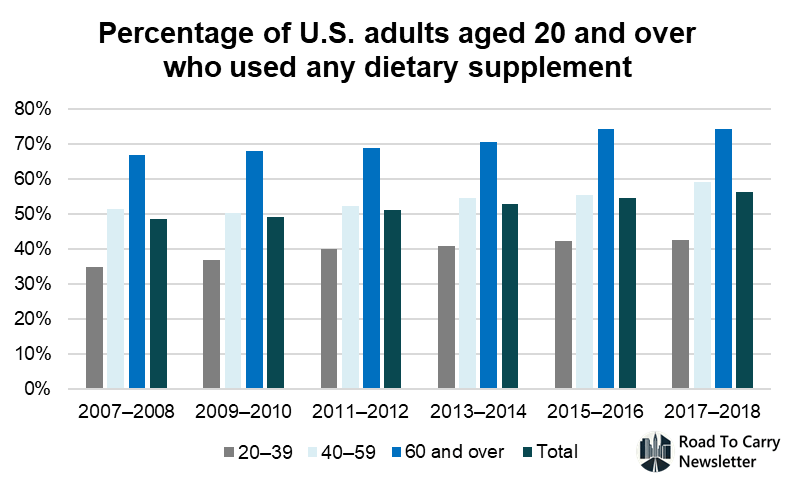

Adoption Over Time & Across Age Groups

Supplement usage has increased across all age groups.

Source: National Center for Health Statistics

While there is not a recent dataset that extends out to 2025, a 2023 survey by Council for Responsible Nutrition reported ~74% of U.S. adults take supplements—likely reflecting increased adoption across all age groups.

Aging Population

Supplements become more important as people age. Not only are baby boomers aging, but also the U.S. adult population in general—the youngest of the Millennials are now 29 years old (!).

Source: Pew Research

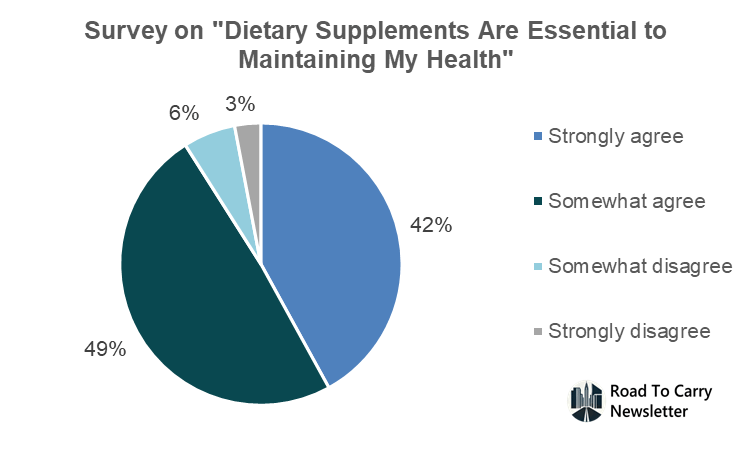

2. Recurring Purchase

Once you’re in the supplements game, you’re in for life—over 90% of supplements users view supplements as "essential" for their health.

Source: 2023 CRN Survey

So where does that lead to? Recurring purchases online.

First, eCommerce market has grown tremendously since COVID.

Source: Nutraceuticalsworld

And now, many brands push subscriptions (online or via Amazon’s Subscribe & Save) – and it works. According to Similarweb, ~38% of revenue for Amazon vitamins & supplements comes from Subscribe & Save.

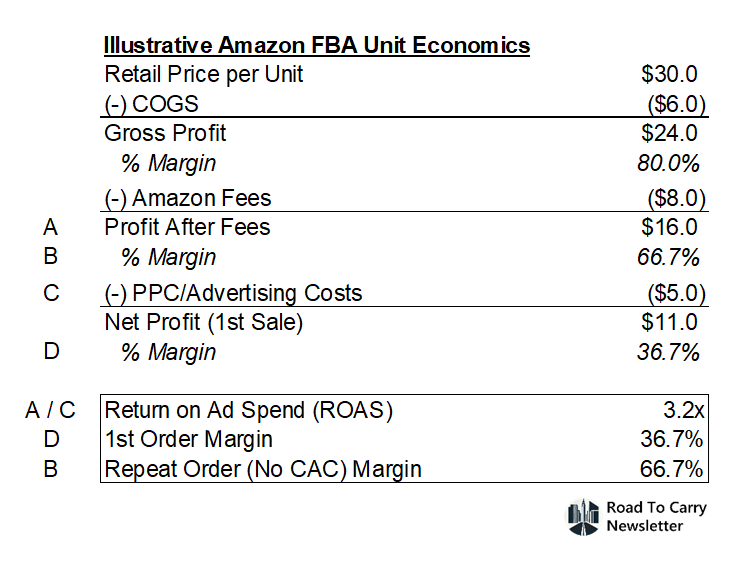

3. Unit Economics

Dietary supplements enjoy high gross margins, often 60-70% for premium direct-to-consumer brands. Even mass-market vitamins have ~30-50% gross margins

Why? Many supplements are commodity ingredients pressed into pills with relatively low COGS, and consumers will pay a premium for perceived quality or branded trust. Thanks to the high gross margins, a well-run platform can achieve healthy EBITDA margins in the 20%+ range.

Additionally, marketing ROI in this space can be attractive: loyal supplement users will subscribe or stick with a brand that works for them, yielding high lifetime values. Even the first orders can command 3x+ return on ad spend.

Source: ShelfTrend

4. Valuation Arbitrage & Buyer Universe

Similar to PE’s investment in beauty, there is a universe of strategics to sell the business to. Strategic buyers across CPG, pharma, and consumer health are actively hunting for strong VMS platforms.

Recent deals prove it out.

In 2021, Nestlé Health Science paid $5.75 billion to acquire the core brands of The Bountiful Company (Nature’s Bounty, Solgar, etc.), valuing it at 3.1x sales and ~16.8x EBITDA

Unilever acquired supplement startup OLLY Nutrition in 2019 to bolster its portfolio, and has since snapped up SmartyPants Vitamins and Liquid I.V.

Smaller DTC vitamin brands might trade at 6-8x EBITDA. Once you achieve a diversified portfolio, you are looking at double-digit multiples.

Risk Assessment

The key risks for a supplement roll up strategy are similar to those of DTC consumer brands:

1. Trend Cyclicality

Risk: Supplement categories rise and fall—fast. Ingredients like raspberry ketones went from viral to irrelevant in months. Being tied to a single hero SKU or fad ingredient exposes the platform to whipsaw demand.

Mitigants: Multi-category roll-ups (VMS, sports nutrition, beauty-from-within, nootropics) create natural hedges via diversification. In-house R&D and agile formulation teams allow rapid entry into emerging trends (e.g., mushrooms, adaptogens, women's hormonal health).

2. Brand Fatigue & Amazon Competition

Risk: With 10,000+ supplement brands on Amazon, legacy brands risk fading into the background as cheap, fast-moving competitors flood listings. On Amazon, attention is the scarcest resource — and brands can lose it overnight.

Mitigants: Modernizing packaging, updating messaging, and deploying influencer/creator campaigns help to maintain brand relevancy. Brands can also reduce dependence on Amazon’s algorithmic volatility by leaning into specialty retail and DTC websites–being a part of platforms with existing retail channels and DTC engines can help de-risk the Amazon risk.

Learn how PE firms actually do deals—from start to finish.

Road To Carry PE course walks you through the full PE deal process, not just modeling. Bite-sized videos & exercises & 40+ real-life files. For analysts, associates, or anyone interested in learning how PE firms do deals. Past alumni include associates from Carlyle, Apax, Charlesbank, and Gryphon. Click below for a free preview and 50% subscriber discount.

Looking Ahead

As private equity continues to shape the vitamin aisle, some big strategic questions loom.

Personalization. Services like Thorne’s at-home blood tests and personalized vitamin packs (e.g. Persona, which Nestlé acquired) hint at a future where one-size-fits-all multivitamins lose favor. But will other strategic buyers be interested in going into personalized nutrition (less proven) or stick to their knitting of mass-market basics?

Focus vs. diversification is another debate: Vytalogy (New Mountain backed) doubled down on pure supplements, while Wellful (Kainos backed) branched into weight loss programs and digital coaching. Which approach wins in terms of consumer loyalty and growth?

One thing’s for sure: the supplements aren’t stopping. Neither is private equity’s interest in squeezing profit from the wellness craze.

Any topics I should cover next? Share thoughts with [email protected]

Were you forwarded this newsletter? Subscribe here.

Make sure you receive Road To Carry every Thursday and Saturday!

Everyone: reply to this email with a “hi”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions