PE Playbook: Beauty Brands

State of Play

Private equity has been a dominant force behind beauty M&A over the last two decades—and the momentum isn’t slowing down. According to DC Advisory, private equity accounted for over 60% of all beauty deals since 2022. That pace has continued into 2024/2025, with recent investments including:

- General Atlantic in KAYALI (2025) – fragrance products

- L Catterton in Stripes (2024) – menopause-focused skincare

- L Catterton in Kiko Milano (2024) – affordable makeup and skincare

Private equity has long been active in beauty—but what’s changed is the strategy. What began as a retail or healthcare-adjacent playbook has evolved into a diversified set of bets across DTC brands and global markets.

Let’s break down why beauty remains an attractive sector—and how the PE playbook has changed over time.

Investment Thesis

📈 1. A massive and growing market

According to McKinsey (and yes, you know it's a hot market when McKinsey is giving out free research), the global beauty industry is valued at ~$450 billion, with North America making up ~$100 billion of that total.

Despite its size, beauty keeps growing: ~9% YoY growth in 2023 in North America, with projected growth of 6%+ annually over the next few years.

And the growth isn’t concentrated in one product category—it’s coming from everywhere: skincare, fragrance, makeup, personal care. In other words, PE investors have a wide menu to pick from.

Source: McKinsey

💄 2. Recession resilient–aka, the “Lipstick Effect”

Leonard Lauder, former chairman of Estée Lauder, coined the “Lipstick Effect”—the theory that consumers are more likely to splurge on affordable luxuries like cosmetics during economic downturns.

While economists still debate whether the Lipstick Effect is real 🤷🏻♀️, the data tells a compelling story:

According to McKinsey, beauty was one of the few consumer sectors that grew during the 2008 recession

Source: McKinsey

A 2023 LendingTree survey found that 75% of Americans consider beauty products essential

♜ 3. Constant brand creation + dependable strategic acquirers

More than 25% of all new brands launched each year are in beauty or personal care, according to Euromonitor. That’s an unusually high hit rate in consumer.

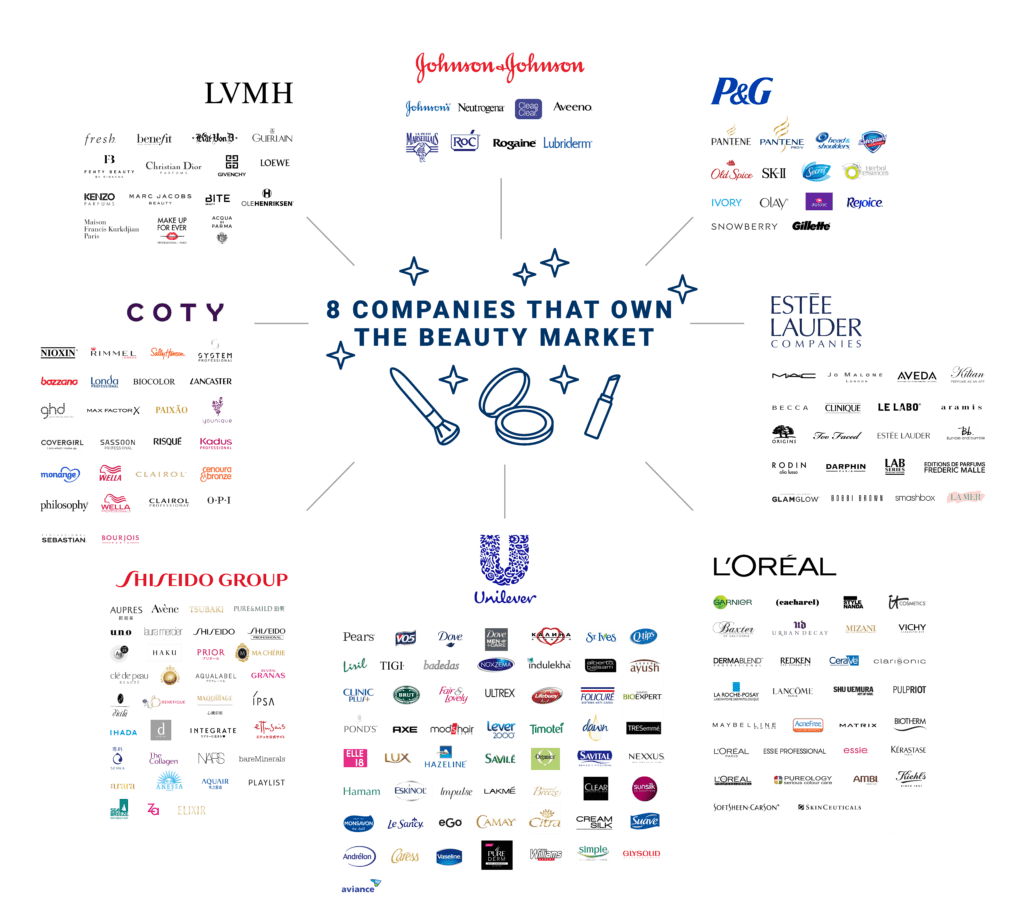

At the same time, global CPG giants—Estée Lauder, L'Oréal, P&G, Unilever, Shiseido—remain active acquirers. These incumbents have scale and distribution but often struggle to build new brands in-house. So, like pharma companies buying biotech, they pay premium valuations to bolt on the next big thing.

Source: CB Insights

Evolution of PE Playbook:

Over the last two decades, the beauty industry has undergone major changes, including e-commerce adoption, rise of outsourced manufacturers, and shifting consumer expectations.

2000s - Retail & Healthcare Playbook

Source: Sally Beauty

In the early 2000s, beauty was still a retail game. E-commerce was barely a factor—just 8% penetration by 2015, per industry reports. Notable PE deals include

CD&R carved out Sally Beauty, a beauty supply distributor and retailer, in 2006 from Alberto-Culver, a beauty product manufacturer. They unlocked value by expanding B2B distribution and retail footprint. CD&R took it public and made 3.4x MOIC.

Castanea Partners invested in Bluemercury, a high-end beauty retailer found in metro areas. In addition to rolling out new stores, the company built private labels and that added services like facials and skincare consultations to increase wallet share. Bluemercury was later sold to the retail giant Macy’s for $210M in 2015.

The early PE investments in beauty brands also had a healthcare bend with companies having their own patented formulary. For example, in 2009, L Catterton invested in StriVectin, an anti-aging skincare brand known for its stretch-mark cream featuring a patented ingredient called NIA-114.

2010s - Direct-to-Consumer (DTC) Playbook

Source: Glossier

The DTC beauty boom was pioneered by Glossier, which was founded in 2014 as a web-only brand—no stores, no wholesale, just cult-brand energy and online conversions.

Following the success of Glossier, private equity began to acquire DTC beauty brands.

VMG Partners

In 2017, VMG Partners invested in Drunk Elephant, a skincare brand that was sold to Shiseido, a Japanese multinational cosmetics company, for $845M in 2019

L Catterton

In 2017, L Catterton invested in the DTC skincare brand Tula Skincare, which was later sold to P&G in 2022

In the same year, they also invested in Kopari Beauty, a DTC bodycare brand

Others

In 2017, Main Post Partners invested in Milk Makeup, a vegan DTC makeup brand

In 2018, TPG invested in Beautycounter, a clean beauty company that was later sold to Carlyle for $1B+ valuation in 2021

Many of these investments had similar playbooks:

1. Founders weren’t traditional beauty insiders → Drunk Elephant (stay-at-home mom), Tula Skincare (gastroenterologist), Kopari Beauty (stay-at-home mom), Beaountycounter (retail consultant)

2. Started online and expanded into retail (e.g., Sephora, Ulta, Target) and marketplace (e.g., Amazon) with private equity support

3. Sold to incumbent strategics who couldn’t figure out DTC → Drunk Elephant (acquired by Shiseido), Tula Skincare (P&G), Kopari Beauty (Unilever Ventures)

You may be wondering–how did stay-at-home moms and a gastroenterologist suddenly start 9-figure beauty companies?

The Rise of Original Design Manufacturers (ODMs) in Beauty

ODMs are companies that formulate, design, package, and manufacture a product that a beauty brand can label and sell as its own. As large brands like Estée Lauder began to outsource development and manufacturing to reduce costs, they created an ecosystem of ODMs that later enabled entrepreneurs to launch lean, digital-native brands with an asset-light business model that private equity loves

While industry-wide data is not available, one of the biggest beneficiaries were ODMs based in Asia–like Cosmax out of Korea–that fueled the rise of DTC brands in the 2010s and K-beauty brands in the recent years. As seen from the chart below, these ODMs experienced supercharged growth as DTC brands gained market share.

Source: Korea Joongang Daily

💻 2020s - Riding the E-Commerce Wave & Looking International

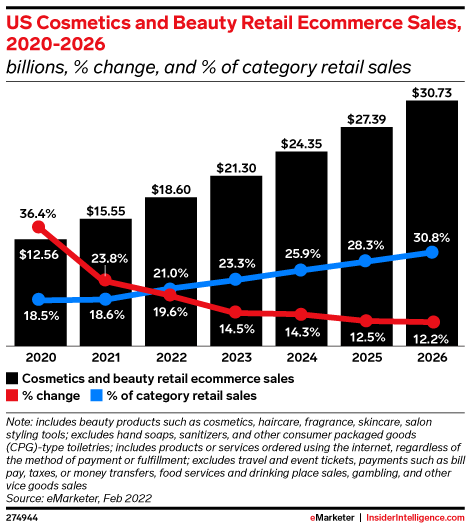

Leading up to COVID and further fueled by COVID, e-commerce penetration in the beauty industry has been accelerating, increasing from 18% in 2020 to over 23% in 2023

Source: eMarkter

And PE firms have made bets riding on this mega trend:

Source: PrivateEquityInfo.com

As the U.S. market began to get crowded, more global funds entered emerging markets. For example, in India:

In 2021, Warburg Pincus invested in Good Glamm Group, a beauty and personal care brand

In 2022, L Catterton invested in Sugar Cosmetics, a premium makeup and beauty brand

Looking Ahead

Private equity, especially growth investors like VMG Partners, L Catterton, and General Atlantic continue to be active investors in the beauty ecosystem. But, despite all the strong attributes (large, growing, and recession-resilient market), investing in beauty can still be a capricious task given the B2C business model.

The cautionary tale of this business model is Beautycounter, a business that Carlyle acquired from TPG for $1 billion in 2021. By 2024, Carlyle lost all of their $700 million equity investment after strategic missteps, including diminishing brand equity and poorly executed sales organization restructuring.

With a large loss like Beautycoutner in recent memory, it remains to be seen if beauty is just a niche PE playbook for growth firms or if large-cap PE firms can also monetize successfully.