If there’s a topic you’d like me to explore, drop me a note at [email protected].

PE Playbook: Wine

State of Play

Earlier this week, Atlas Vineyard Management—a full-service vineyard development and farming company backed by Juggernaut Capital—acquired Results Partners, a Clearview Capital portfolio company. The merger creates a scaled third-party vineyard manager that now spans California, the Pacific Northwest, and Texas.

But this isn’t PE’s first swirl around the wine barrel. What began as acquisitions of wineries in the early 2000s has evolved into a broader, value-chain-wide strategy. Today, private equity is consolidating producers, acquiring third-party service providers, and scaling direct-to-consumer channels.

Why Wine is Complicated

Before we get into how private equity makes money here, it’s worth unpacking the unique quirks of the alcohol space.

The U.S. alcohol market operates under a legal framework known as the three-tier system, This system mandates that alcohol products must pass through three separate and licensed tiers and prohibits vertical integration across these tiers:

Producers (Tier 1): Wineries, breweries, and distilleries that manufacture alcoholic beverages.

Distributors/Wholesalers (Tier 2): Entities that purchase products from producers and sell to retailers.

Retailers (Tier 3): Stores, restaurants, or bars that sell to the end consumer.

Below is a graphical representation of the wine ecosystem:

Source: Researchgate

And while the three-tier system is a federal mandate, each state also governs its own alcohol laws, leading to a fragmented legal landscape. This includes variations in:

Licensing and permitting requirements

Distributor franchise laws (some states make it hard to switch distributors)

Direct-to-consumer (DTC) shipping laws

Labeling and packaging regulations

Also, wine's supply chain presents additional challenges that differ from typical CPG categories, as wine requires climate-controlled shipping, as well as state-by-state logistics compliance laws.

Together, these regulatory and logistical complexities make the wine industry uniquely challenging to scale, but also providing attractive investment thesis for private equity investors.

Investment Thesis

📈 1. Massive Market, Steady Growth

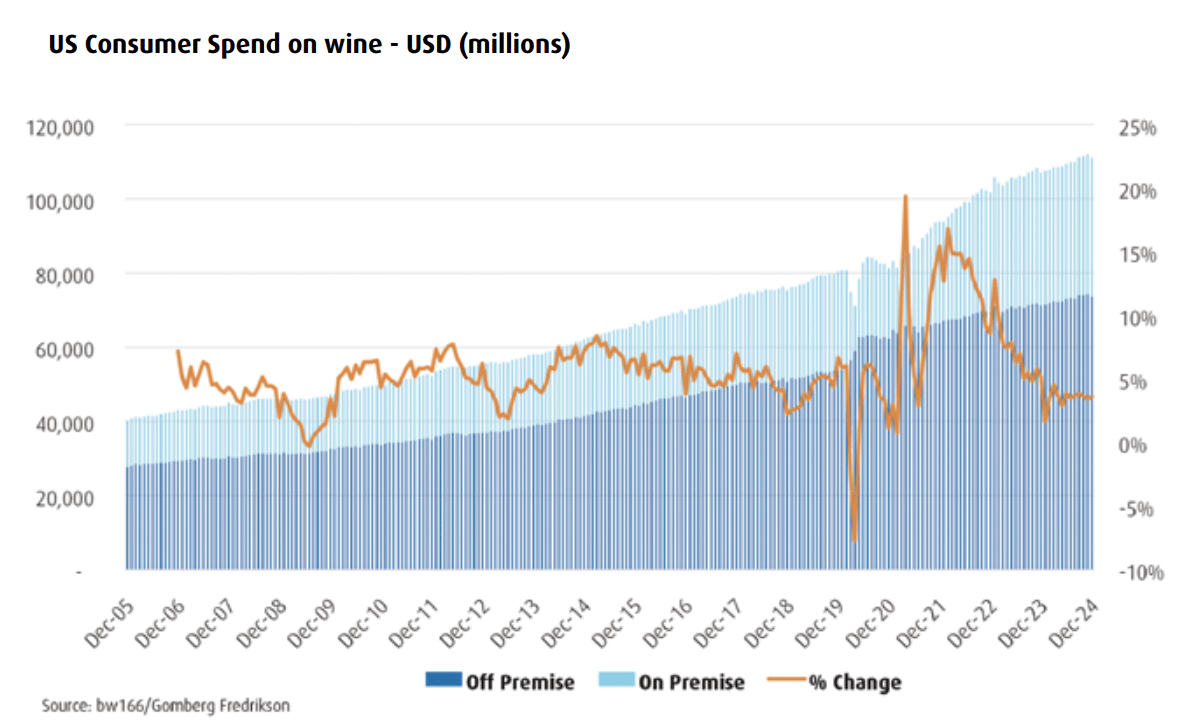

The U.S. remains the world’s largest wine market, valued at an estimated $109 billion in 2024. Despite the dip during COVID, U.S. consumption of wine has grown meaningfully post-COVID.

Source: BMO Wine Market Report

✨ 2. “Premium-ization”

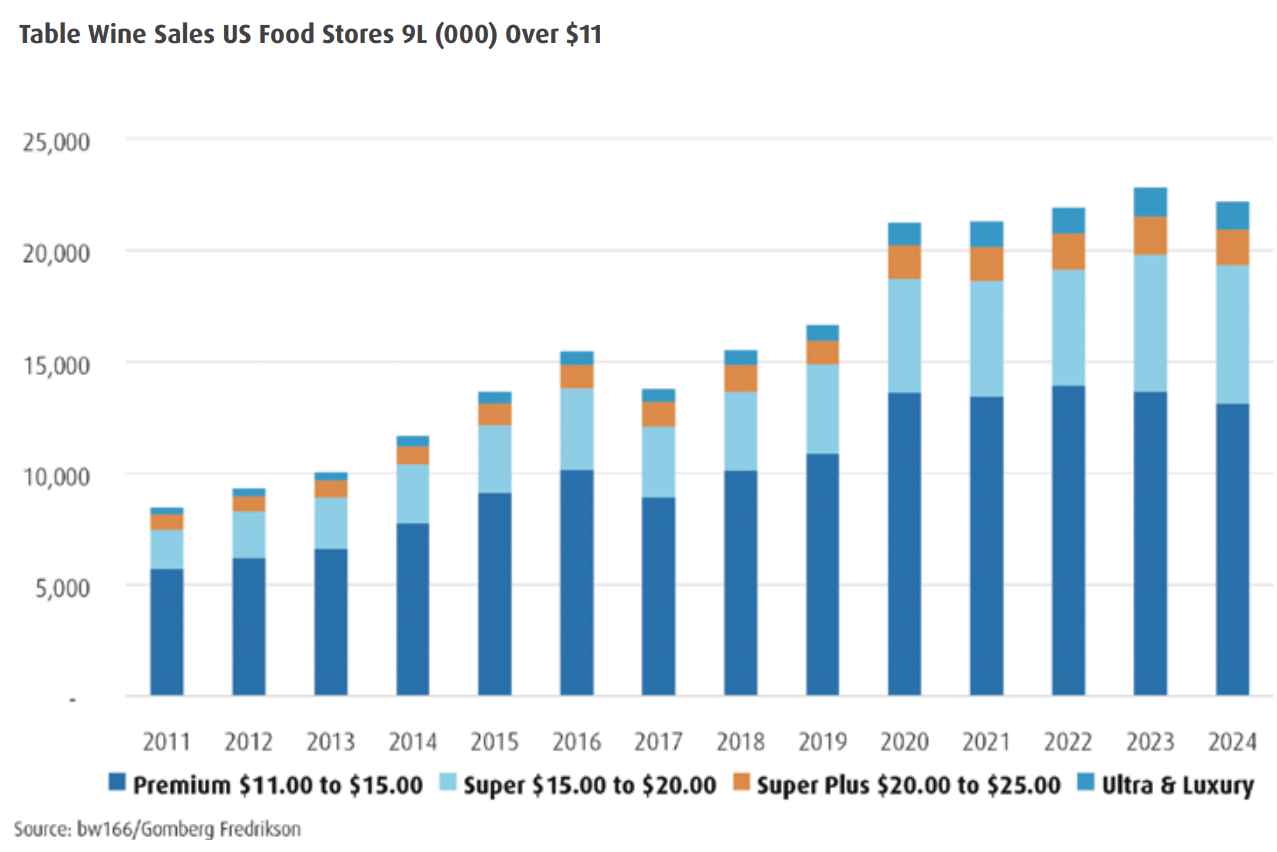

Americans are drinking less but better (better or just more expensive due to inflation…most likely both🤷♂️)

Alcohol servings peaked right after COVID in 2021 but have since declined.

Source: BMO Wine Market Report

And yet the industry has grown through consumers shifting to higher priced bottles.

Source: BMO Wine Market Report

This premium-ization trend has helped PE’s playbook in rolling up premium wine producers.

🧩 3. Consolidated But With Growing Long-Tail

According to Wine Business Monthly, top 10 wine producers control 60% of U.S. production today (was once 80% at its peak), with the top producer–Gallo–accounting for nearly 25% of every bottle produced in the U.S.

Source: Wine Business Monthly

However, the number of wineries in the U.S. continues to increase.

Source: U.S. Tax and Trade Bureau

The increasing number of SMB wineries supports PE’s thesis that the industry will rely more on third-party companies to manage their operations, logistics, and compliance.

⚖️ 4. Regulatory barriers & Compliance Driven Distribution

By law, producers generally must sell through distributors and retailers. Private equity-backed wine producers have extensive legal compliance teams to navigate licensing in all 50 states, while the distribution giants consolidated by PE can leverage this entrenched licensed distribution network as an extremely high barrier to entry.

PE Across the Wine Value Chain

From vineyard to consumer, private equity’s influence now spans every link in the wine value chain.

Case Study: Duckhorn Wine Company

Duckhorn Wine Company began in 1976 as a Napa Valley Merlot specialist and evolved into a leading luxury wine portfolio under private equity ownership.

GI Partners Era (2007–2016)

In 2007, GI Partners, a San Francisco-based middle-market PE firm, acquired a majority stake in Duckhorn for a reported $250 million. Over the next decade, GI implemented several key value-creation strategies:

Portfolio Expansion: GI grew Duckhorn’s portfolio of brands from two to six, tapping into new varieties, price points, and regions. By 2016, Duckhorn’s portfolio comprised six wineries – Duckhorn Vineyards (Napa), Paraduxx (Napa blends), Goldeneye (Anderson Valley Pinot Noir), Migration (Sonoma Coast Chardonnay/Pinot), Decoy (California varietals), and Canvasback (Washington Cabernet)

Distribution Expansion: By 2016, Duckhorn wines were available in all 50 U.S. states and on five continents (50+ countries). GI also expanded Duckhorn’s direct-to-consumer and retail distribution channels, growing its wine club memberships to 55,000 members by 2020

According to GI, the company’s revenue 3x’ed under their ownership, leading to the sale to TSG Consumer for ~$600 million.

TSG Consumer Partners (2016–2021)

Under TSG’s ownership, Duckhorn continued to expand its portfolio through acquisitions:

In 2017, Duckhorn acquired Calera Wine Company, a California Pinot Noir and Chardonnay producer. The following year in 2018, Duckhorn acquired Kosta Browne, a Sonoma winery renowned for Pinot Noir By 2018, Duckhorn’s collection grew to eight wineries with 700+ acres of estate vineyards across California and Washington

In addition to acquiring brands, TSG continued to launch new product lines to fill portfolio gaps. For example, it introduced “Postmark” (a Napa Cabernet label) and “Greenwing” (a Washington Cabernet brand) around 2019–2020, targeting targeted specific price points around ~$35 per bottle

Duckhorn’s portfolio in 2021

Source: Duckhorn prospectus

IPO & Take-Private (2021–Now)

Duckhorn’s initial market capitalization was roughly $1.8 billion at the IPO pricing (3x TSG’s purchase price of $600M), valuing the company at over 20x EBITDA – a rich multiple reflecting strong growth (reportedly grew ~20% CAGR with ~40%+ EBITDA margins under TSG).

Duckhorn’s historical revenue growth

Source: Duckhorn Prospectus

Duckhorn’s most significant post-IPO move was the acquisition of Sonoma-Cutrer Vineyards. Sonoma-Cutrer was one of the top-selling “luxury” Chardonnay brands in the U.S. and it was a large deal at a $400 million price.

However, public market sentiment toward wine stocks turned bearish by 2022–2023, with another public wine group (Vintage Wine Estates) filing for bankruptcy in 2023. In December 2024, Butterfly Equity – a PE firm focused on the “seed-to-fork” food sector – announced a deal to acquire Duckhorn and take it private at a $1.95 billion valuation.

But wineries aren’t the only PE plays in wine. Other PE investments in the value chain includes:

🍇 Vineyard Management – Atlas Vineyard Management

Backed by Juggernaut Capital Partners since 2020, Atlas is a full-spectrum vineyard services provider—site selection, planting, farming, irrigation, pest management, harvest logistics, and ag‑tech tools

📦 Wine Packaging – TricorBraun

Acquired by AEA Investors in 2016 and recapped by Ares in 2021, TricorBraun is a leading packaging supplier for glass bottles, closures, dispensers, flexible packaging, and specialty rigid containers serving wine and spirits, among other industries.

🚚 Distribution – Winebow

First acquired by Freeman Spogli & Co. in 2004 and currently owned by Brazos Equity Partners, Winebow is a wine importer, wholesaler, and distributor for wine & spirits across the Northeast U.S., plus third-party deals nationwide.

📦 DTC Fulfillment – Wineshipping

First backed by Endeavour Capital in 2014 and now owned by Greenbirar, Wineshipping is a temperature-controlled logistics provider specializing in direct-to-consumer wine, handling warehousing, packing, compliance, and shipping.

🛍 Online Retail – Wine.com

First acquired by Baker Capital with investment from Goldman Sachs in 2018, Wine.com is the largest U.S. online wine retailer with proprietary logistics centers.

Looking Ahead

Private equity’s investment into wine continues with the recent take-private of Duckhorn, which had been a success story for its prior PE investors GI Partners and TSG Consumer. And with the growing number of SMB wineries, now could be a great time for Butterfly to acquire mid-sized wineries, especially many wineries started during the 1970-1990s boom whose owners are now approaching retirement.

What was once a passion business of vintners and sommeliers is now getting corporatized—from grape to glass (just like the business of golf courses).

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies