This week’s edition is another reader request—thank you! If there’s a topic you’d like me to explore, drop me a note at [email protected].

Hope everyone is enjoying the U.S. Open (which looks brutally difficult based on the latest Grant Horvat YouTube video) and Father’s Day weekend.

PE Playbook: Golf

State of Play

The U.S. golf course industry has quietly consolidated over the last two decades, with a growing number of courses now controlled by private equity-backed platforms:

- Invited (formerly ClubCorp): 200+ courses | backed by Apollo

- Arcis Golf: 70+ courses | backed by Fortress / Atairos

- Heritage Golf: ~40 courses | backed by KSL Partners

- Concert Golf: ~35 courses | backed by Clearlake

- Troon (outsourced operator, not owner): 600+ courses under management | backed by Leonard Green / TPG

This is a stark change from twenty years ago, when most courses were independently owned or municipally run. But starting in the early 2000s, private equity began a steady roll-up campaign. Let’s look at the thesis behind it and a case study.

Investment Thesis

Golf courses are a unique investment—part operating business, part real estate play. But the fundamentals have become increasingly attractive, especially with favorable demographic tailwinds post-COVID.

📈 1. Golf’s Post-COVID Resurgence

The COVID-19 pandemic unexpectedly sparked a golf boom. As other recreational activities shut down in 2020, golf – with easy social distancing outdoors – experienced a surge of interest. In the U.S., on-course participation jumped from ~24M in 2019 to ~25M in 2020 and has risen every year since.

Source: SBJ.com

And if you include off-course venues like Topgolf or simulators, total participation hit a record 47+ million players in 2024.

🛒 2. Younger, More Diverse Golfers—With Money to Spend

Golf has traditionally skewed older and male, but that’s shifting

Junior golfers (ages 6–17) in the U.S. grew to 3.7 million in 2024, a 48% increase since 2019

The sport has become more gender-inclusive: nearly 8 million women played on-course in 2024, up 2.3 million (+41%) since 2019. Women now comprise 28% of golfers, the highest ever, and they account for an outsize share of new beginners (39% of newbies)

The coveted young adult (18–34) segment remains golf’s largest cohort at 6.8 million players on-course, with millions more only playing off-course at driving range venues

As seen below, the off-course venues have been a major contributor of the golf penetration among younger generations, females, and people of color.

Source: NGF.org

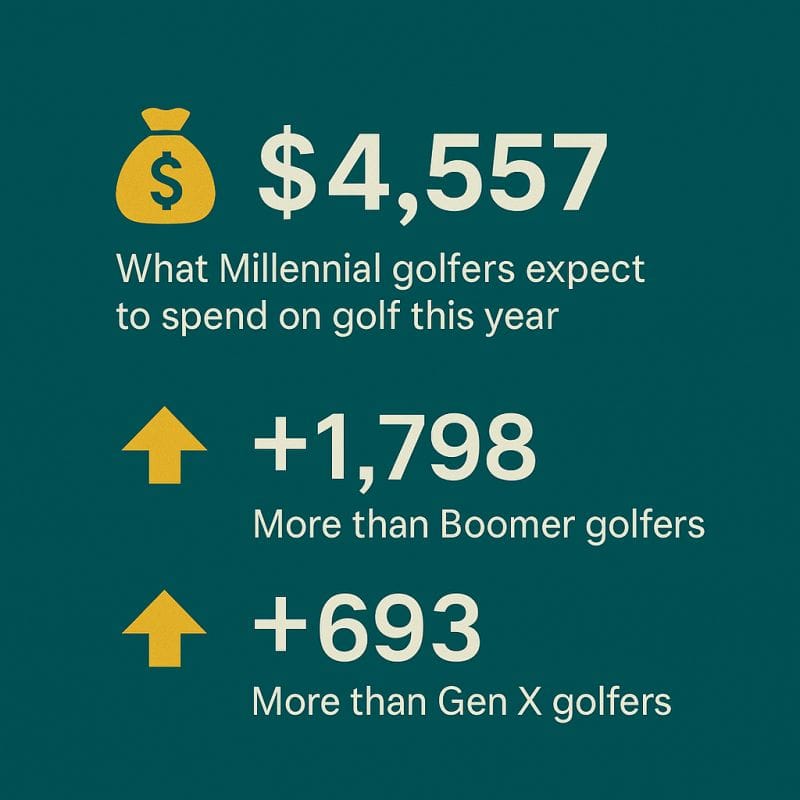

And this new generation isn’t shy about spending. Axios reports that Gen Z and millennials are spending freely on clubs, gear, and simulator time. Private equity sees an opportunity to build offerings tailored to both traditional seniors and the next wave of golfers.

Source: Axios

💰 3. Operational Upside from the Roll-Up Playbook

Beyond macro trends, PE sees opportunity in operational improvement. Many legacy courses have been inefficiently run—especially those owned by municipalities, member groups, or local families.

PE platforms bring:

Ancillary revenue expansion: Weddings, events, and upgraded food & beverage programs

Tech upgrades: Yield management, dynamic pricing, centralized procurement

Cross-club membership models: Arcis, Heritage, and Invited now offer memberships that span multiple cities or states—driving retention and wallet share

For example, Arcis Golf has spent over $150M upgrading properties with resort-style amenities and premium dining, turning passive clubs into lifestyle destinations.

Source: Arcis owned White Columns Country Club

🧱 4. Downside Protection from Real Estate

An 18-hole course typically sits on 110–190 acres—often in desirable suburban areas. For private equity, that land offers downside protection. Several underperforming courses have been repurposed into residential communities or even logistics centers:

Apple Ridge Country Club (New Jersey)

The Mount Pocono Golf Course (Pennsylvania)

This dynamic makes golf a hybrid asset class—cash-flowing operations with real estate optionality.

Case Study: Invited (Formerly ClubCorp)

1957–2006: Growth Under the Dedman Family

1957: Founded in Dallas by Robert Dedman Sr.

1975: Reached 49 clubs

1999: Topped ~$1B in revenue

Known for owning iconic properties like Pinehurst and Firestone

2006–2017: KSL Capital Ownership & IPO

2006: KSL Capital Partners acquired ClubCorp for ~$1.8B (Pinehurst was carved out)

2013: Took ClubCorp public (NYSE: MYCC)

Growth via M&A, notable examples:

- Sequoia Golf (2014): Added 50 clubs, including The Woodlands CC (TX)

- Private Club acquisitions: Firethorne CC (NC), Ravinia Green (IL), Ford’s Colony (VA)

- University clubs: Texas Tech Club, othersDespite rapid growth, the business became highly levered and capital-intensive.

2017–Present: Apollo Global & Rebrand

2017: Apollo acquired ClubCorp and took it private in a ~$2.2B deal (including debt)

Changed name to Invited in 2022

Strategic shifts:

- Lifestyle clubs: Launched The Collective in Dallas (co-working + wellness + social)

- Technology upgrades: Full Swing simulators, Topgolf’s Toptracer as amenities

- Continued M&A: Added TPC Craig Ranch (TX), Ridge Club (MA), othersReportedly explored a 2022 IPO at a $4.5B valuation (~4x return for Apollo)

Looking Ahead

There are over 15,000 golf courses in the U.S., and while many high-end assets are already consolidated, there’s still room to grow—especially with smaller courses and niche formats.

There’s also a budding micro-rollup opportunity. For example, a Providence Equity alum is building a portfolio of modernized driving ranges featuring Toptracer tech and elevated F&B offerings. Check them out below!

Golf might not be the first industry that comes to mind in PE playbooks, but with demographic tailwinds, recurring membership models, and real estate optionality—it’s proving to be an interesting playbook.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies