As always, if there’s a sector or company you’d like me to dig into, drop me a note at [email protected].

PE Playbook: Northstar Fertility

State of Play

In this post, we covered how fertility clinics have become a hotbed for private equity, with several PE-backed clinic platforms now dominating the U.S. market. But that’s not the end of PE’s quest to monetize babies (sorry, this is a bit crude to say and want to note that this research reports fertility outcomes have improved since PE’s consolidation).

Another more niche playbook on fertility has been rolling up surrogacy agencies. Launched in 2022 by the private equity firm Cortech Group, Northstar Fertility now brings together multiple surrogacy agencies and donor services under one roof.

In this piece, we’ll unpack the surrogacy agency roll-up and the story behind Northstar (which also involves a successful search fund outcome for a Michigan-MBA, ex-MBB consulting duo).

Surrogacy Industry & Process Overview

If you’re unfamiliar with how surrogacy works (I wasn’t either), here’s a simplified overview. A typical gestational surrogacy—where a third-party carries an embryo on behalf of the intended parents—takes 16–20 months and costs $150,000 to $200,000. It’s a long, expensive, and emotionally involved journey with many stakeholders.

Step | Description | Timing | Cost (USD) |

1. Consultation & Intake | Intake forms, interviews, surrogate matching begins | Month 1 | $1,000–$3,000 |

2. Legal Retainer | Attorneys draft gestational carrier agreement | Month 2 | $8,000–$25,000 |

3. Medical Screening | IVF clinic screens surrogate and prepares for transfer | Months 2–3 | $5,000–$10,000 |

4. Embryo Creation | IVF cycle using donor or parent gametes | Months 2–4 | $15,000–$25,000 |

5. Transfer & Pregnancy | Embryo transfer + pregnancy monitoring | Month 4 | $2,000–$5,000 |

6. Surrogate Compensation | Paid in installments during pregnancy | Months 4–13 | $40,000–$80,000 |

7. Insurance & Escrow | Insurance premiums and fund disbursement | Ongoing | $8,000–$30,000 |

8. Postpartum Support | Medical/legal wrap-up and reimbursements | Months 13–20 | $2,000–$5,000 |

And because the process is so involved, there are many third-party services to support the parents and the surrogates.

Surrogacy Agencies handle recruitment, vetting, matching, and case management. They ensure medical/legal screening and guide both parties.

Egg Donor Agencies manage donor databases, coordinate donation cycles, and often overlap with surrogacy journeys (especially for non-genetic parents).

IVF Clinics handle embryo creation and transfer. They are distinct from agencies but collaborate closely. We covered how PE is consolidating them.

Attorneys specialize in drafting state-compliant contracts and filing parentage orders.

Mental Health Professionals screen all parties (often required by ASRM and state law).

Escrow Providers & Insurers hold and disburse funds to protect surrogate and cover medical expenses.

As we will cover later, Northstar Fertility has gone off to not only consolidate the agencies but also vertically integrate through acquisitions.

Investment Thesis

Acquiring surrogacy agencies can be risky–especially with negative headlines–but it’s also an attractive one.

1. Surrogacy demand is rising

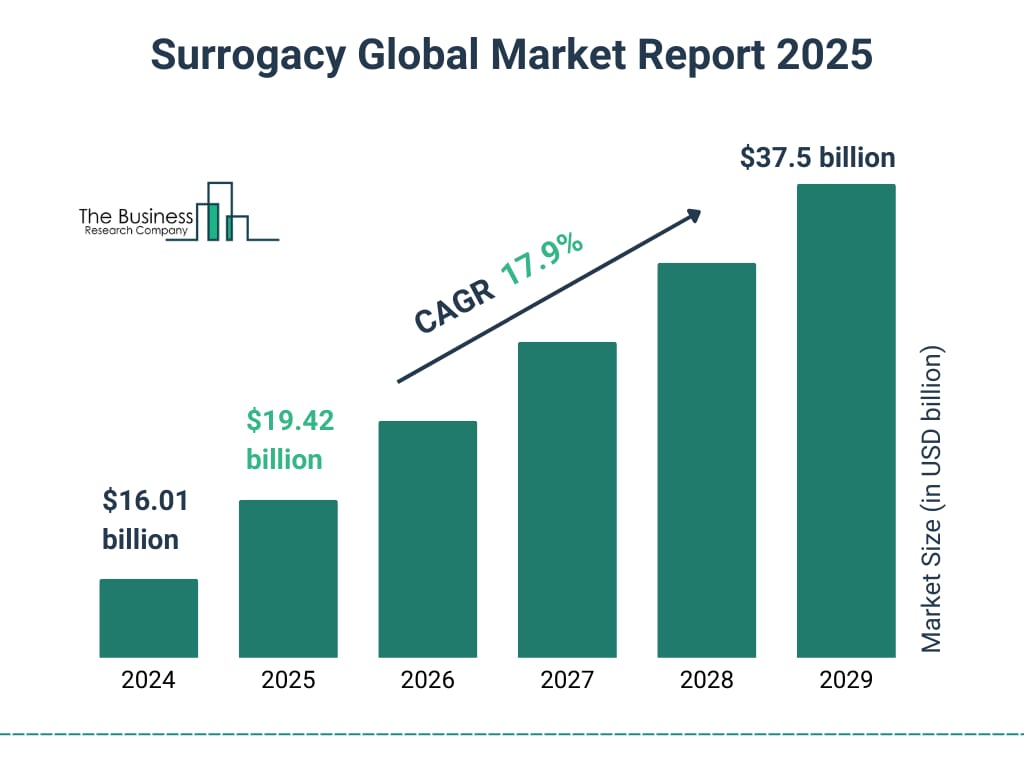

Multiple market reports point to the surrogacy market being a >$10 billion market.

Source: The Business Research Company

I am surprised by this figure, but the theoretical total addressable market is big:

According to the World Health Organization, a whopping 48 million couples / 186 million individuals suffer from infertility annually (48 million x $200,000 per surrogacy = $9.6 trillion. Now, not all want or can afford surrogacy and there is also insufficient supply of surrogates to support this theoretical demand, but these numbers put >$10 billion dollar market in context)

In the U.S. alone, 1 in 5 women aged 15-49 struggle to conceive naturally

The demand is also global–~⅓ of US surrogates are for foreign clients, since many countries either ban paid surrogacy or have no parentage protections

And the market is also expanding from the supply (i.e., surrogate) side. Compared to only ~30% in 2020, over 75% of U.S. surrogates are now willing to work with same-sex couples.

2. High ticket, cash pay, health margins

Of the ~$150,000-200,000 total cost, agencies alone can charge ~$50k of the total. And these fees are mostly paid cash out-of-pocket, mitigating insurance reimbursement risks that exist in other human-healthcare businesses.

Source: Sensible Surrogacy Agency

And according to a business broker listing for an online surrogacy agency, margins can be as high as 75% ($280k cash flow on $370k gross revenue).

3. Consolidated at the top but still a tail of small agencies

Before the formation of Northstar, nearly all U.S. surrogacy agencies were independent. Even today, there are ~300 agencies in the U.S., with just a few large, multi-region players.

Barriers to entry include:

- Complex state-by-state legal compliance

- Relationships with IVF clinics, attorneys, and insurers

- Need for trust and reputation in an emotional, life-changing transaction

Case Study: Northstar Fertility

Northstar, Cortec Group’s surrogacy and egg-donor platform, was formed via the 2022 acquisition of Circle Surrogacy. And Circle Surrogacy is a roll-up story on its own:

Circle Surrogacy & the Search Fund Story

Circle was founded in 1995 in Boston and had completed ~3,000 surrogacy journeys by 2017.

In 2017, searchers Steuart Botchford and Sam Hyde, who were both ex-MBB consultants and graduates from Ross MBA, acquired the company via a Pacific Lake-backed search fund.

Circle Surrogacy was already a vertically-integrated player–in addition to the surrogacy agency, the business included Egg Donation and a small insurance agency catering to the surrogacy market

In 2019, Steuart and Sam acquired Reproductive Possibilities, an agency based out of New Jersey, to expand market presence and also target budget-friendly parents

Then in 2021, they acquired West Coast Egg Donation as they couldn’t keep up with the agency demand and needed to expand the pool of egg donors to serve those clients

By the time they exited to Cortec Group in 2022, Circle had established itself as one of the largest surrogacy agencies, especially with a strong LGBTQ+ and international client base

Northstar & Cortec Playbook

Following the acquisition of Circle in 2022, Cortec went on an acquisition spree, as well as new business launches.

In 2023, Northstar acquired Growing Generations, a high-touch surrogacy agency based in LA catering to wealthy families and individuals

In the same year, they acquired Donor Concierge, which provides match services for parents and surrogacy agencies and egg donation agencies

On top of these acquisitions, Northstar launched:

Surrogacy.com, a community and resource sharing website for surrogacy parents and donors

Everie, a frozen egg bank

Through these acquisitions and launches, Cortech created a vertically-integrated platform that touches on all aspects of surrogacy, outside of fertility clinics:

Surrogacy Agencies: Circle Surrogacy (Boston), Growing Generations (LA), Reproductive Possibilities (NJ) – all matching intended parents with screened carriers.

Egg Donor Services: Everie – a frozen-egg bank started in 2023, plus West Coast Egg Donation.

Support Services: Donor Concierge (a bespoke matching service) and Surrogacy.com (an online community for carriers). Northstar also coordinates escrow, insurance and financing for its clients.

Looking Ahead

Northstar serves as an example of how private equity (or search funders) uniquely played the global infertility trend. And for aspiring search funders, it’s a case study in finding overlooked—but meaningful—markets, vertically-integrating, and driving a strong exit to private equity.

If you're interested in the full story, check out this podcast featuring Steuart and Sam’s journey with Circle Surrogacy.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies