If there’s a topic you’d like me to explore, drop me a note at [email protected].

State of Play

In the last decade, private equity firms have moved swiftly to consolidate the fertility clinic industry—across the U.S., Europe, and parts of Asia.

By 2018, nearly 30% of all assisted reproductive technology (ART) cycles in the U.S. were performed by clinics affiliated with private equity platforms. Today, that share is even higher.

And while the headlines around PE in healthcare often skew negative—citing stories of over-levered hospital groups and underfunded staffing—a 2023 academic study from professors at UC Berkeley and Copenhagen Business School painted a more nuanced picture for fertility clinics. Their findings? IVF success rates increased by 13.6% following a clinic’s acquisition by a fertility platform.

Let’s unpack what’s driving private equity interest in this space—and how firms are building scale.

Investment Thesis

Private equity interest in fertility clinics is grounded in both demographic tailwinds and attractive business fundamentals.

📈 1. Favorable Demographic Trends

More people are delaying parenthood, and infertility rates are rising. In 2023, 1 in 5 U.S. women ages 15–49 experienced difficulty conceiving after a year of trying. Roughly 1 in 4 had trouble carrying a pregnancy to term.

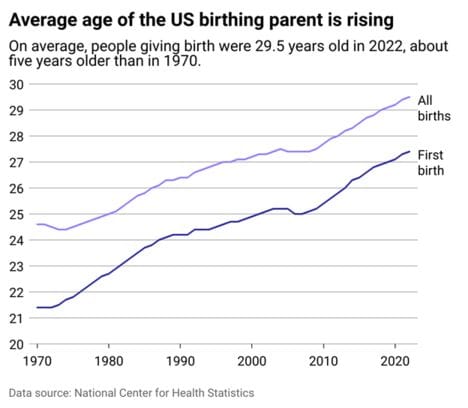

A key driver is the rising average maternal age—making fertility support a more common (and often necessary) part of the journey to parenthood.

Source: Northwell Health

Source: BDA Partners

✨ 2. Rising Adoption via Tech + Insurance

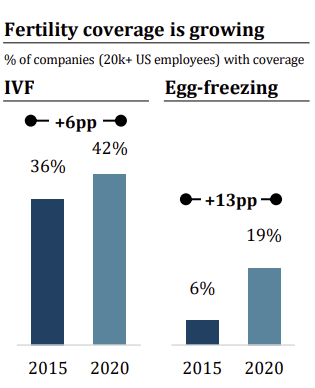

Advances in reproductive medicine have made IVF more effective, while expanding insurance coverage has made it more accessible.

According to Global Health Economics & Sustainability, the live birth rate per IVF cycle for younger patients has climbed from 25–30% in 2000 to 35–45% by 2020.

At the same time, policy shifts have unlocked access:

21 U.S. states now mandate some form of fertility coverage (vs. just 8 in 2005)

Large employers are adding fertility benefits (IVF, egg freezing, surrogacy) to compete for talent

For patients, this means more people can now afford treatments that previously cost $15,000+ per cycle

Source: Axios

Source: BDA Partners

🧩 3. Large and Growing Industry

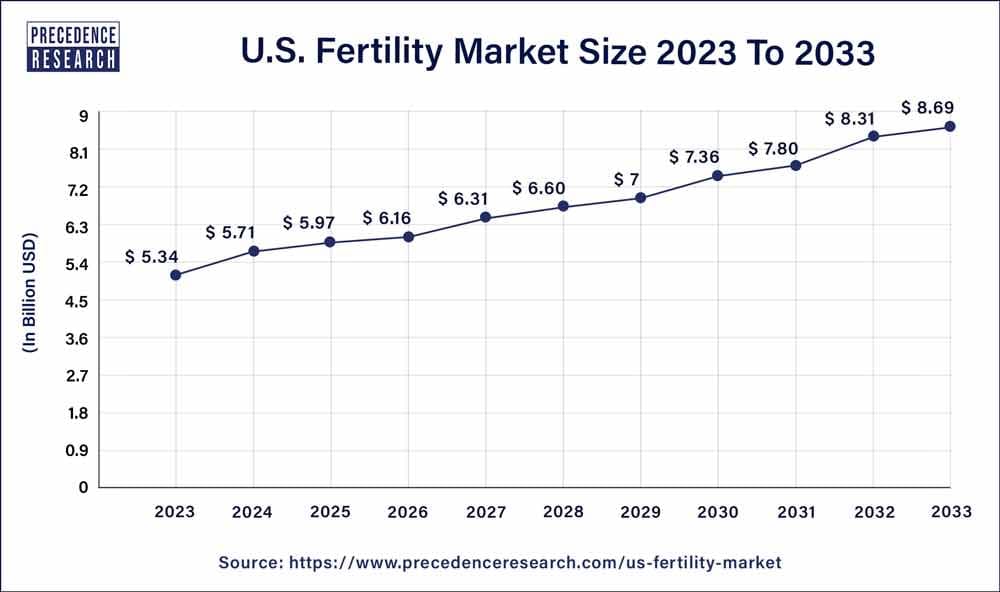

With demand rising and technology improving, the U.S. fertility services market has grown rapidly—reaching $6 billion in size, according to Precedent Research.

Source: Precedent Research

⚖️ 4. Attractive Financial Profile

From a private equity standpoint, fertility clinics check several key boxes:

High customer LTV: The average cost of a single IVF cycle ranges from $12,000 to $20,000 in the U.S. (excluding medications), and many patients undergo multiple cycles – yielding high revenue from each one of the customers

High margins: according to BDA Partners, fertility clinic platforms generate ~33% EBITDA margins

Cash pay: Historically, more than half of fertility spend has been out-of-pocket

Limited government reimbursement risk: Unlike other healthcare verticals, fertility clinics aren’t exposed to Medicare/Medicaid pricing pressure. Most revenue comes from private insurance or employer-sponsored plans.

PE-Backed Platforms

Over the last decade, several PE-backed platforms have popped up across the globe. Some notable U.S./Europe platforms include:

Platform | PE Firm(s) | Invested | Geography |

|---|---|---|---|

FutureLife | Hartenberg / CVC | 2013 / 2021 | Europe |

CCRM | TA Associates / Altas / Ares | 2015 / 2021 | U.S. |

Inception Fertility | Lee Equity / Waypoint | 2016 / 2019 | U.S. |

Pinnacle Fertility | Webster Equity Partners | 2019 | U.S. |

US Fertility | Amulet Capital Partners | 2020 | U.S. |

IVIRMA Global | KKR | 2022 | Global |

Quick Case Study: US Fertility

Among the platforms above, US Fertility (USF) stands out as a textbook example of rapid consolidation through private equity ownership.

Launched in 2020, USF was created by Amulet Capital Partners in partnership with Shady Grove Fertility—one of the largest and most well-established IVF providers in the country. Shady Grove already operated 50+ clinics across major states like Maryland, Texas, California, and New York.

From there, USF scaled quickly:

Acquired IntegraMed’s software business to anchor its MSO model

Rolled up other leading clinics: Fertility Center of Illinois, Reproductive Science Center of the SF Bay Area, IVF Florida

By late 2020: ~55 locations, 80 physicians

Then came a burst of larger M&A moves:

2023: Acquired Ovation Fertility (backed by Morgan Stanley Capital Partners) → reaching 90+ clinics

Later 2023: Acquired Reproductive Medicine Associates of NY → scaling to 130+ clinics

Today, USF is the largest fertility platform in the U.S.

200+ physicians

105+ clinics

32 IVF labs

30,000+ IVF cycles per year

225,000+ patients served

US Fertility is a good case study of how fertility clinics in the U.S. consolidated rapidly under various PE-backed platforms.

Looking Ahead

According to Fertility Bridge, half of all U.S. states now have three or fewer independent fertility practices. In 12 states, there’s just one.

Despite that level of consolidation, PE interest remains high. Valuations for scaled platforms are reportedly trading at 20x+ EBITDA, reflecting the strength of the sector.

Source: BDA Partners

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies