As always, if there’s a sector or company you’d like me to dig into, drop me a note at [email protected].

State of Play

Let’s be honest—I can’t be the only one who’s Googled a mild cough or headache, only to spiral into a diagnosis of something terminal. At the center of that hypochondriac rabbit hole was WebMD.com, an iconic digital health publisher that is now part of Internet Brands, a digital media conglomerate owned by KKR.

Internet Brands—most recently recapitalized at a $12+ billion valuation by KKR and Temasek, with new backing from Warburg Pincus—has come a long way since its origins as CarsDirect.com, an early online car-buying platform. Today, it’s built an empire of healthcare-focused digital media, SaaS, and education properties (plus legal and automotive digital properties).

In this piece, we’ll unpack the evolution of Internet Brands and how KKR reshaped the business through a high-conviction healthcare pivot

Company History: From CarsDirect to Health Conglomerate

Before we get into the investment thesis, let’s look at how Internet Brands makes money and how KKR repositioned the company around healthcare.

1. Internet Brands is primarily a digital media / marketing services company with a portfolio of web properties across healthcare, auto, legal and “other”.

Founded in 1998 as CarsDirect.com, Internet Brands rapidly expanded into dozens of vertical websites (mainly auto, health, and legal), eventually going public in 2007. But in 2010, Internet Brands was taken private by Hellman & Friedman and JMI Equity for ~$640M, equating to a 14.5x EBITDA multiple.

At the time of acquisition, the company was primarily focused on auto and travel, with healthcare as the lowest priority.

Website Properties in 2009

Category | # of Sites | Representative Brands |

🚗 Automotive | 34 | CarsDirect, CorvetteForum, ClubLexus, Ford-Trucks, Rennlist, Honda-Tech |

✈️ Travel & Leisure | 23 | FlyerTalk, CruiseMates, DVDTalk, TrekEarth, WikiTravel, KidsCamps |

🛍️ Shopping | 11 | BensBargains, UltimateCoupons, HighDefDigest, OutBlush, WirelessForums |

🏠 Home-Related | 10 | ApartmentRatings, DoItYourself, DavesGarden, RealEstateABC, Craftster |

💼 Careers | 9 | ModelMayhem, AirlinePilotForums, NursingJobs.org, PPRuNe, GrooveJob |

💰 Money & Business | 4 | Mortgage101, BusinessMart, FinWeb, SmallBusinessNotes |

🏥 Health | 3 | 3FatChicks, FitDay, I-Am-Pregnant |

Internet Brands’ business model was simple:

Create niche content (medical articles, knowledge databases, community forums, and online marketplaces) with dedicated team of doctors, lawyers, and auto experts aided by editorial teams

Drive organic webpage visits via SEO (i.e., ranking highly in search engines)

Sell ads and consumer data to advertisers (e.g., large auto companies)

Rinse & repeat

2. Under KKR’s new ownership in 2014, Internet Brands quickly shifted the mix towards healthcare.

In June 2014 KKR reportedly paid $1.1B (~2x return in 4 years for H&F and JMI) to acquire Internet Brands. Under KKR, Internet Brands went on an acquisition spree in healthcare:

Company | Year | Description |

WebMD | 2017 | Leading consumer health information site; transformative $2.8B acquisition |

Medscape | 2017 | Clinical news & CME platform for physicians (came with WebMD) |

Jobson Healthcare Information | 2018 | Optical & pharmacy-focused B2B media publisher |

Frontline Medical Communications | 2019 | Specialty-journal publisher & events group for clinicians |

ADDitude | 2021 | Digital magazine & community for ADHD patients and caregivers |

Jim.fr | 2022 | French medical news & continuing-education portal for HCPs |

Grupo Saned | 2023 | Spanish medical news, CME and scientific-communications platform |

And today, the portfolio looks more balanced across the verticals

Top Website Properties by Vertical

Source: InternetBrands.com

3. Over time, Internet Brands added B2B SaaS & Education tools that were sold into its large community of healthcare providers and healthcare advertisers.

Company | Acquired | Description |

Sesame Communications | 2015 | Communications and marketing software for dental and orthodontic practices |

Demandforce | 2016 | SaaS CRM and marketing automation for dentists, optometrists, and vets |

Officite | 2016 | Website hosting, SEO, and digital marketing for healthcare practices |

Henry Schein One | 2018 | JV with Henry Schein; provides dental practice software (e.g., Dentrix) |

Aptus Health | 2019 | HCP engagement and multichannel pharma marketing tools (includes Univadis) |

StayWell | 2020 | Patient education and wellness platform |

Krames | 2020 | Patient education content (acquired via StayWell) |

Coliquio | 2020 | German physician community and content platform |

PulsePoint | 2021 | Programmatic ad tech and health data platform for life sciences marketers |

The Wellness Network | 2021 | Video-based health education for hospitals and health systems |

Mercury Healthcare | 2022 | Healthcare CRM and analytics software for hospital systems |

Limeade | 2023 | Employee wellness and engagement software |

Healthwise | 2024 | Evidence-based patient education platform used by providers and payers |

Additionally, KKR sold Internet Brand’s auto dealership software solution AutoData to Thoma Bravo for $1 billion 2019 to streamline the software portfolio to focus on healthcare (side note: Thoma Bravo would then merge AutoData with JD Power just a few months later to create another PE success story–reportedly valued at $8 billion as of 2024).

What started out as a portfolio of auto-focused websites has transformed into a healthcare conglomerate consisting of both a large digital media portfolio as well as B2B SaaS / education portfolio.

Investment Thesis

KKR’s pivot to healthcare made strategic sense on several levels:

1. Diversifying from a Cyclical Sector

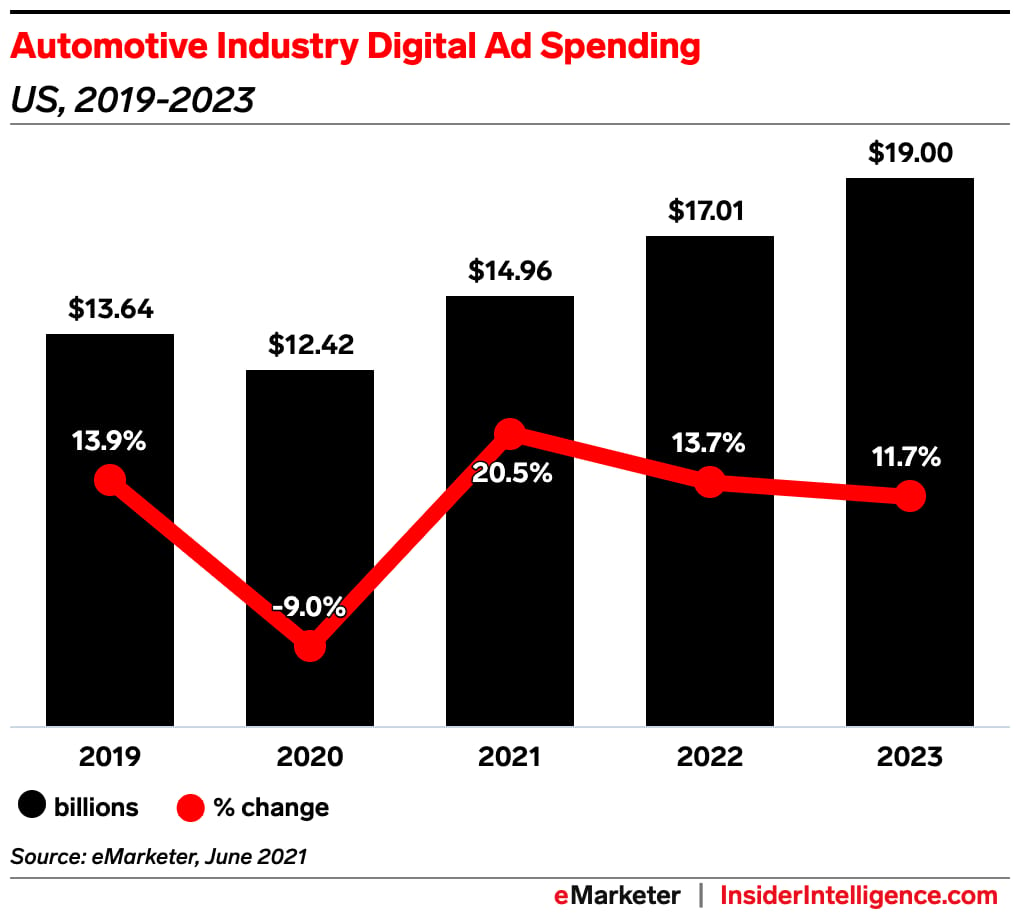

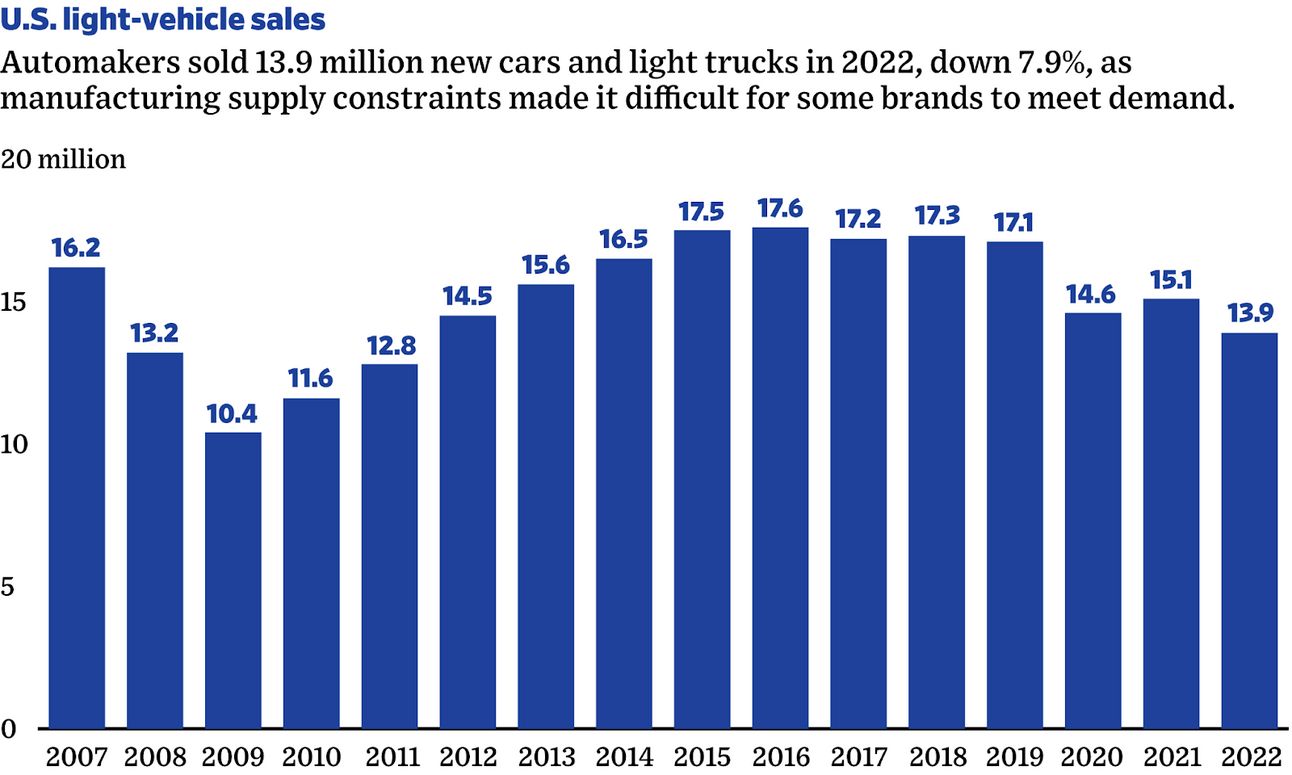

The US healthcare industry spent ~$20 billion in digital advertising in 2024. And while the auto industry is just as large at ~$19 billion digital ad spend as of 2023, the spend is much more cyclical (as seen by the dip in ad spend in 2020 as well as decline in auto sales 2007-2009).

Source: eMarketer

Source: eMarketer

Source: AdAge

2. Publicly Available Target in WebMD–the Most Popular Web Property

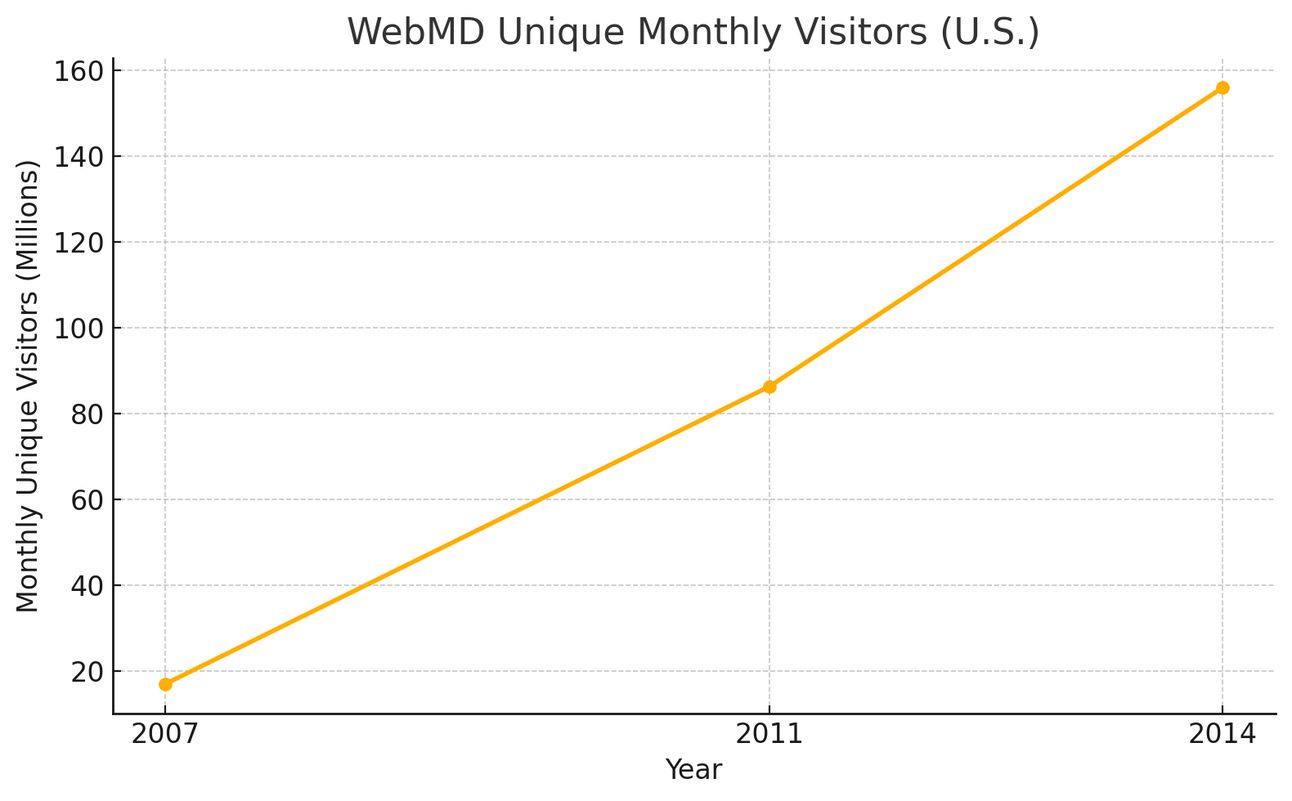

By 2007, WebMD had become the most popular health web property with 17 million unique monthly visits and grew to over 150 million unique monthly visitors at its peak by 2014 (nearly ½ of the U.S. population, supporting my suspicion that I wasn’t the only one going down the WebMD rabbit hole!).

Source: WebMD

However, by 2017, WebMD was facing performance issues and also increasing pressure from activist investors including the Blue Harbour Group, which had accumulated ~9% ownership in the company.

After running a “strategic review”, the company was eventually sold to Internet Brands for $2.8 billion (~12x EBITDA).

Source: WebMD filings.

WebMD not only brought on immediate scale in healthcare but at a reasonable multiple.

3. Larger, More Diverse Software Market

The healthcare IT market is much larger than auto–per Grand View Research, the U.S. Healthcare IT software market is estimated at over $150 billion, whereas the global auto software market is estimated at ~$30 billion.

Source: Grand View Research

Source: Grand View Research

This is driven by the diversity as well as fragmentation in healthcare vs. auto:

Healthcare has dozens of verticals (dental, dermatology, primary care, hospitals, etc.) unlike auto (OEMs, dealerships, and repair shops)

More SMB providers, more fragmentation, and more enterprise software needs

Broader customer base (payers, employers, pharma, providers)

4. Massive Owned Audience–Built-In Distribution channel

With platforms like WebMD and Medscape, Internet Brands owns distribution channels that reach nearly every stakeholder in the healthcare system:

Consumers: Health seekers using WebMD for information

Physicians: Medscape’s 4M+ global members

Employers/Payers: Through WebMD Health Services and Limeade

Life Sciences: Through PulsePoint’s programmatic ads and Medscape’s CME offering

In summary, with the healthcare pivot, KKR has been able to:

1. Diversify its advertising revenue streams away from cyclical auto segment into more stable, but equally large healthcare segment;

2. Leverage its owned audience distribution channel to mass-market and cross-sell software and education tools, which in turn;

3. Not only resulted in lower customer acquisition costs for the software sales but also boosted customer lifetime value as more and more products were sold into the same customer base.

KKR pulled off this transformation while also unlocking value from an overlooked asset—selling Internet Brands’ auto software division, Autodata Solutions, to Thoma Bravo for $1 billion. That sale alone nearly offset the $1.1 billion KKR had originally paid to acquire the entire company.

Looking Ahead

Despite the successful pivot, a transformative acquisition in WebMD, and recent recapitalization at a $12 billion valuation, the road ahead isn’t necessarily bullish.

One sign of trouble is how WebMD’s web traffic has trended. Compared to its peak of 150 million monthly unique visitors in 2017, the company generated only ~57 million unique visitors in April 2025 and has been taken over as the most visited medical site by Healthline (which is owned by Red Ventures–a Silverlake and General Atlantic backed platform).

Website | Monthly Visits (Apr 2025) |

Healthline.com | 95.6M |

MayoClinic.org | 84.5M |

WebMD.com | 57.6M |

It’s unclear what the next strategy is following Warburg’s investment. Perhaps they will try to buy media assets from Red Ventures or create another media-to-software conglomerate in other verticals such as legal.

It’s not just healthcare providers that have been rolled up—private equity has also consolidated how we consume medical information and find providers in the first place.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies