I've been watching PE firms chase med spas like they're the last deals on earth. And yes, even I briefly considered investing in one local to my parents' place in North Carolina.

The med spa gold rush is here, and everyone from KKR to search fund operators is racing to inject capital into these Botox boutiques.

PE Playbook: Medical Aesthetic Spas

State of Play

The med spa sector has become private equity's newest obsession. There are nearly 10,500 med spas in the U.S., and 90% remain independently owned—that's over 9,400 mom-and-pop shops just waiting to be rolled up.

The money flooding in is serious. KKR took a minority stake in SkinSpirit in late 2022. BC Partners led a $120 million growth round into Princeton Medspa Partners in 2024. Ares Management backed LaserAway's 70+ clinic empire. Even search funds are piling in—Aesthetic Partners, launched by a Harvard MBA in 2018, acquired 30 clinics before attracting Norwest Equity Partners as a minority investor in 2023.

The frenzy reminds me of the dental and vet clinic roll-up boom over the last two decades—except with better margins and Instagram-worthy storefronts.

Let's explore why PE has fallen in love with the med spa industry and the different models being deployed to cash in.

Meda Spa Investment Thesis

1. Demographics Are Better Than Ever

The core customer base—women aged 35-54—is growing and has more disposable income than ever. But the real story is generational normalization. Nearly 30% of Americans aged 18-24 have already used med spa services, with another 16% planning to try them. Even men, historically just 10% of customers, are growing at 5% annually.

Age Group | Current Penetration Rate | Growth Rate | Key Driver |

18-24 | 30% | +8% YoY | Social media normalization |

25-34 | 42% | +12% YoY | Preventative treatments |

35-54 | 55% | +15% YoY | Core demographic |

55+ | 35% | +10% YoY | Anti-aging focus |

Male (all) | 15% | +5% YoY | Stigma reduction |

Social media has obliterated the stigma, and the "tweakment" has become as routine as a gym membership.

2. Recurring Demand–Because Self-Care is Forever

Here's what makes med spas special: 70% of first-time customers become repeat clients. This isn't one-and-done retail. Botox needs refreshing every 3-4 months. Fillers last 6-12 months. Laser treatments require multiple sessions. It's subscription-like revenue.

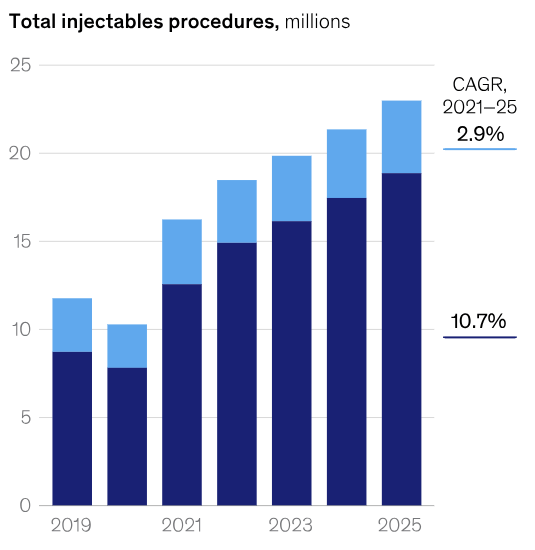

This repeat nature was proven again post-COVID, when pent-up demand drove 50% YoY growth in injectable procedures from 2020 to 2021.

Source: McKinsey.

3. Beautiful Unit Economics

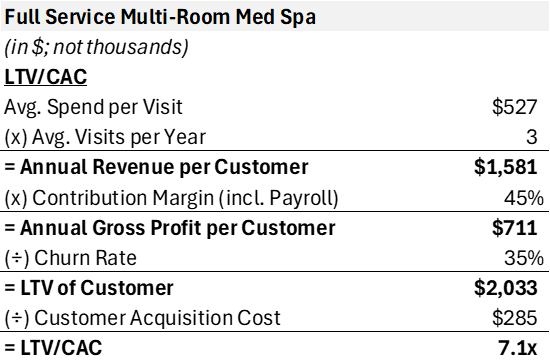

Med spas have some of the best unit economics across retail businesses. The startup costs can be hefty for individual investors, but the return on investment once the location is fully ramped is attractive.

Source: Workee, MavenFP, Yocale

And because of the repeat nature of the business and high-ticket procedures, LTV/CAC economics are eye-popping. (It almost sounds too good to be true and I may be missing something. But even if discounted, given that 3x+ LTV/CAC is generally considered good, the unit economics here remain very strong.)

Source: AmericanMedSpa, Ankura, MedicaDepot, FirstPageSage

Note: Industry retention rate is quoted at 60-70%

The icing on the cake? Unlike traditional healthcare, med spas operate entirely on cash-pay. No insurance hassles. No reimbursement risk. No claims denials.

4. The Irresistible Roll-Up Math

Approximately 90% of U.S. med spas are single-location businesses owned by individuals.This extreme fragmentation is exactly the kind of landscape where a roll-up strategy can thrive. It also helps that med spas are growing in number – over 1,600 new med spas opened in 2023 for example.

Investors can acquire practices at relatively low multiples, integrate them to achieve efficiencies, and reap "multiple arbitrage." Small one-location med spas might trade at 4-6x EBITDA, whereas a multi-clinic group could command double-digit multiples.

Business Type | EBITDA Multiple | Typical Revenue | Example |

Single Location | 4-6x | <$2M | Local Mom & Pop |

Small Chain (2-5) | 6-8x | $2-10M | Regional player |

Platform (10-30) | 8-12x | $10-50M | Princeton Medspa |

National (50+) | 12-15x+ | $50M+ | LaserAway |

Source: ScopeResearch

This is the same playbook that built Heartland Dental (1,600+ locations) in DSO roll-ups and National Veterinary Associates (1,400+ clinics) in vet roll-ups.

5. Proven Roll-Up Playbook, But Better

As with other medical roll-ups, successful med spa platforms often employ a "friendly PC" model, where a physician-owned PC (professional corporation) provides clinical services (to comply with state laws against corporate practice of medicine) and the PE-backed entity functions as an MSO (management services organization) that handles business operations and charges the PC to capture the clinical services revenue.

This structure, borrowed from dental and vet practices, lets investors effectively control and profit from clinics while technically keeping licensed providers as owners on paper. However, unlike dental or veterinary groups which require a dentist or DVM as the main service providers, med spas have more flexibility in provider staffing.

Most cosmetic treatments (injectables, laser hair removal) can be performed by nurse practitioners, physician assistants, or registered nurses under MD supervision. The supervising physician might only be on-site periodically or serve as medical director.

This means a med spa roll-up isn't constrained by the supply of specialist doctors—a distinct advantage over dental chains that must attract scarce DDS graduates. Med spa operators can staff clinics with mid-level practitioners and aestheticians, scaling more easily in markets where physicians are in short supply.

Are you convinced yet? Writing this is rekindling my interest in med spa acquisitions!

Private Equity Investment Models

Investors are employing several different models to get a piece of the action:

Franchise Platform Plays

In the franchise model, the PE firm backs a franchisor that sells med spa units to individual owner-operators, rather than owning all clinics directly.

VIO Med Spa exemplifies this approach. The Ohio-based franchisor founded in 2017 began franchising in 2018 and quickly grew to 60+ locations. In 2024, Freeman Spogli & Co., a consumer-focused PE firm, acquired a majority stake in VIO to accelerate its nationwide rollout.

Another franchisor drawing interest is 4Ever Young, a Florida-based med spa and wellness franchise focused on services for men. 4Ever Young received backing from Search Fund Partners in 2023 as part of its expansion strategy.

Franchise models allow private equity to leverage entrepreneurs "on the ground" (franchisees) to scale units quickly, while the central franchisor earns royalties and becomes a profitable platform. Some of the earliest and largest PE-backed med spa platforms (Ideal Image backed by L Catterton & TPG) are franchise models.

Pure Roll-Up Acquisitions

The classic roll-up model involves acquiring majority stakes in existing med spa clinics and integrating them under one corporate platform (often keeping local clinic brands initially).

Aesthetic Partners, founded in 2018, set out to aggregate physician-led cosmetic dermatology and med spa practices. Over five years the company acquired about 30 practices, demonstrating proof of concept, and in 2023 attracted significant minority investment from Norwest Equity Partners to fuel further growth.

Similarly, Shore Capital (a healthcare SMB specialist) created Empower Aesthetics. MedSpa Partners (MSP)—originally backed by Canadian investors—has dozens of clinics across the US and Canada.

These roll-up platforms typically emphasize being a "partner of choice" for med spa owners who want to join a larger organization, offering owners an exit or partnership while preserving clinics' local brands and culture.

Minority Investment & Partnership Models

Not every investor is buying outright control. Some are experimenting with partnership models that prepare med spas for a future sale without an immediate takeover.

Aviva Aesthetics exemplifies this approach. Rather than acquiring clinics, Aviva partners with med spa owners to grow collectively toward an eventual PE sale, all while owners retain 100% equity in their businesses in the interim. Aviva (formed in 2024 by DuneGlass Capital alongside a med spa owner) functions as an accelerator or MSO—helping independent med spas scale up, standardize operations, and increase profitability—with the understanding that down the road, the group of partner clinics can be sold as a de facto platform in one package.

It's a newer approach, so success remains unproven, but it underscores the creativity in deal structures in this young sector.

Looking Ahead

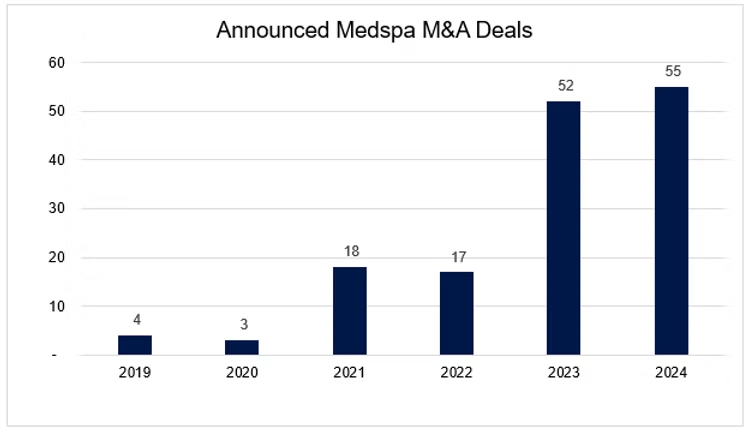

The med spa consolidation is just warming up, with larger platform M&A deal volume continuing to grow.

Source: Scope Research.

Note: Does not capture all the small clinic acquisitions.

While the gold rush continues, there are real risks. Maintaining quality across dozens of locations isn't easy (and you hear about those injectable horror stories via social media—or in my case, through my wife's social media). Regulatory complexity varies state by state. Competition intensifies as dermatologists and plastic surgeons expand into non-surgical aesthetics. And valuations might get frothy—we saw veterinary practices hit 20x EBITDA before reality set in.

But the fundamentals are powerful. Americans aren't getting younger or less image-conscious. Social media ensures we're constantly aware of our appearance. The normalization of cosmetic procedures continues accelerating.

As the founder of Advanced MedAesthetic Partners (backed by Leon Capital) said, "the medical aesthetics industry is a unicorn to private equity...They think of it as retail medicine—scalable, multi-site healthcare with a highly desired cash-pay model."

What should I cover next? Send ideas to [email protected]

RATE TODAY’S EDITION

Share Road To Carry newsletter and receive free resources!

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a 30-page guide on the PE landscape and selecting your ideal PE firm.

🔒 4 referrals – a comprehensive PE interview questions bank

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress