Today, we’re going to talk about behavioral health rollups in the context of the meteoric rise (and subsequent fall) of LifeStance–going from a ~$7B IPO in 2021 to a Hindenburg short report in 2024. Rest assured that the industry remains fragmented and PE roll up continues.

If you missed it, check out this week’s live deals, where we shared a B2B consulting firm and a psych clinic you can go acquire.

PE Playbook: Behavioral Health Clinics

State of Play

The mental health services industry has become a hot sector in recent years, driven by rising demand and awareness—in the U.S., 1 in 5 adults (over 50 million people) experience mental illness. And that’s an opportunity private equity won’t miss.

Rewind to 2015: growth equity firms Summit Partners and Silversmith Capital teamed up and collectively invested $250 million to back Mike Lester—a third-time founder/CEO of healthcare services companies prior to LifeStance.

It was a bold play to quickly roll up a fragmented behavioral clinic market—one that paid off handsomely with a partial exit to TPG at $1.2B and later an IPO at ~$7B—yet ultimately left an example of how healthcare roll-ups can go sideways. Let’s dive in.

Presented With

Proladex helps private equity firms discover service providers across deal origination, company management, and back-office solutions.

We solve the problem of vendor selection and diligence by providing a curated list of reference checked service providers, including:

- Capital Markets & Advisory

- Executive Search & Recruiting

- Quality of Earnings & Diligence

- Consulting & Brokerage

PE investors can sign up at no-cost here

Service Providers can explore our introductory trial by scheduling a call

Company Overview

How do behavioral health clinics make money?

Simply put, these clinics provide therapy and treatment sessions. But there’s more to it.

First, many PE-backed clinics are outpatient—meaning no overnight stays—and they often get referrals from hospitals and independent physician practices.

Second, most referrals happen in-network, meaning clinics establish relationships with insurers so they are (i) listed in insurer directories when patients search “therapist near me,” and (ii) referred by doctors who know the patient’s insurance covers the clinic. For context, LifeStance gets 90%+ of revenue from in-network patients (note: there are also platforms that focus on cash-pay clinics to avoid insurance reimbursement dynamics).

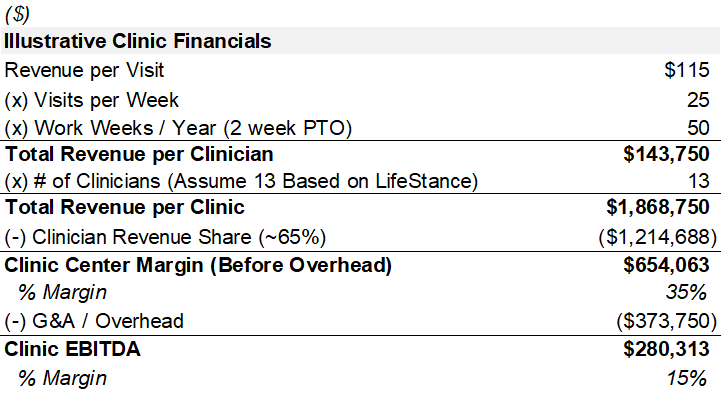

What does unit economics look like?Here’s a breakdown of behavioral health clinic unit economics that leads to average 15–20% EBITDA margins across clinics. But as we’ll discuss later, two key variables went wrong for LifeStance.

Source: UHC, Headway, Heard, Solomon Advising

History of LifeStance

Now that we’ve covered the fundamentals of behavioral health clinics, let’s delve into LifeStance’s case study.

LifeStance’s strategy was relatively straightforward:

Buy or build de novo clinics at scale across the country;

Bring together psychiatrists, psychologists, and therapists under one umbrella;

Contract with insurance payors on favorable terms; and

Achieve economies of scale (and sell at a premium).

The speed of the roll-up is striking. Below is the company’s timeline of rapid expansion:

Year | Milestones |

|---|---|

2015 | LifeStance founded by Mike Lester; Summit Partners & Silversmith invest ~$250M to fund national expansion. |

2018 | Reaches 125 centers and 800 clinicians, serving ~930k patient visits. |

2019 | Grows to 170 centers and 1,400 clinicians, with ~1.4 million visits. |

2020 | Hits 370 centers and 3,000+ clinicians. Rapid telehealth pivot during COVID (from 300 to 40,000 weekly tele-visits). |

Apr 2020 | TPG Capital acquires a majority stake in LifeStance at a $1.2B valuation (reportedly at high-teens EBITDA). Summit and Silversmith remain minority owners. |

2021 | Continues M&A spree (53 practices acquired pre-IPO in total). IPO in June 2021 raises $720M at a >$7B valuation; stock reaches a high of ~$30 per share. |

2022 | Revenue reaches $860M across 500+ clinics; net loss widens to ~$220M. Share price declines to ~$5–9 per share. |

2023 | Strategy pivot under new CEO Ken Burdick (appointed late 2022): halted acquisitions, closed underperforming centers, and refocused on operational efficiency. Share price remains ~$5–9 per share. |

2024 | LifeStance reaches ~$1.25B revenue with ~7,400 clinicians and 569 centers across 33 states. In Feb 2024, Hindenburg publishes a short report. The company pivots fully to free-cash-flow generation to service debt. |

With that context, let’s dig into what makes this industry attractive to roll up—and what went wrong with LifeStance.

Investment Thesis

1. Even Greater Unit Economics at Scale & Mix

One benefit of rolling up provider businesses is the ability to negotiate higher insurance reimbursement rates (if you’re at massive scale, like LifeStance) and to drive a higher reimbursement mix.

According to Payer Price, commercial plans often reimburse therapy sessions at $95–$135 per session (we used a $115 midpoint above). For psychiatric sessions, reimbursements can be roughly 2x, at ~$175–$250 per session. For LifeStance, average revenue per session is ~$160. So let’s compare the unit economics of a single-location clinic vs. a LifeStance clinic.

Source: UHC, Headway, Heard, Solomon Advising, LifeStance

Holding everything else equal, the higher revenue per visit drives EBITDA margins up by ~6%—which, combined with multiple arbitrage, can create highly accretive equity value from M&A. (We’ll touch on where the math broke down later)

2. Multiple Arbitrage

Consolidators typically pay mid-single-digit EBITDA multiples for independent clinics. For example, a 2025 survey of healthcare M&A showed addiction-treatment firms (with roughly $3–5M EBITDA) averaging ~5.5x EBITDA multiple (would love to hear if this is what people still see in the market).

In contrast, in the partial sale to TPG in 2020, LifeStance reportedly sold for high teens EBITDA. The multiple skyrocketed during the 2021 IPO and the Company is trading at 20x+ EBITDA multiple today.

Assuming a “conservative” 15x EBITDA platform multiple, below is the value creation math for $100M of acquired EBITDA:

This ignores financing/leverage, organic growth and cost synergies, which would further boost returns.

Now, let’s layer on the 6% margin uplift:

If I had to guess, this simple (and beautiful, if it held) math is what attracted the huge multiple at IPO.

3. Large Market, Extreme Fragmentation

On top of margin uplift and multiple arb, the extreme fragmentation of behavioral health lends itself to a massive TAM (and therefore, a massive equity value-creation opportunity).

There are over 1 million mental health professionals in the U.S. (including ~45k psychiatrists, ~205k psychologists, and hundreds of thousands of counselors and social workers). For example, LifeStance’s ~7,500 clinicians represent only ~3% of the psychiatrist and psychologist workforce.

A quick search on Inven also yields tens of thousands of them.

Note: Top 3 states are California, Florida, and New York

Source: Inven

4. Growing Prevalence Driving Organic Growth

Mental health issues continue to proliferate in the U.S. According to FAIR Health, the share of patients with mental health diagnoses rose 39.8%, from 13.5% of patients who received medical services in 2019 to 18.9% in 2023. As USAFacts shows, 2021 (the COVID period) was a major driver.

Source: USA Facts

The growth in patient volume continues to fuel organic demand for behavioral health clinics, as well as continued launches of new clinics to meet that demand—expanding the M&A target universe.

Risk Assessment

So despite all these positives, what went wrong—and what were Hindenburg’s accusations?

1. Clinician Retention

Perhaps the biggest risk is failing to keep the clinicians (the lifeblood of the business) happy. LifeStance learned this the hard way: after touting an ~90% clinician retention rate pre-IPO, it later revealed retention had fallen to ~80%, triggering a stock crash and lawsuits. Hindenburg’s own analysis asserted a ~70% retention.

Looking at the math below, the financial implications of declining retention are severe—a fully staffed clinic running at 21% EBITDA margins can quickly fall to ~14% if only 70% of clinicians stay each year (without backfill).

Source: UHC, Headway, Heard, Solomon Advising, LifeStance

Note: Only changing variable is # of clinicians, calculated as fully staffed clinician count (13) multiplied by % retention each column. Assumes G&A / overhead is fixed.

Mitigation: In response, LifeStance shifted from stock-based incentives to cash bonuses to better match clinician preferences and introduced more clinician-friendly payout structures (e.g., earlier contracts advanced pay that had to be repaid if productivity targets weren’t met, which bred resentment). Even so, clinician retention remains the highest investment risk for any behavioral health platform.

2. Provider Mix for Insurance Reimbursements

Another allegation from Hindenburg was that LifeStance’s clinician mix across therapists (who are reimbursed at a lower rate of ~$100 per session) and psychiatrists (reimbursed at ~$200+) have deteriorated. The mix reportedly moved from ~65%/35% in 2021 to ~80%/20% in 2024.

The implication of the mix shift is that part of the benefit from negotiating higher reimbursements is offset by the mix shift. In other words, average revenue per visit—and therefore LTV of patient—is pressured.

Mitigation: Thus far, LifeStance’s annual reimbursement increases seem to have more than offset the mix shift—average revenue per visit rose from ~$150 in 2022 to ~$160 in 2024. However, growth appears to have stalled since, signaling that mix effects are becoming harder to overcome with renegotiations.

Learn how PE firms actually do deals—from start to finish.

Road To Carry PE course walks you through the full PE deal process, not just modeling. Bite-sized videos & exercises & 40+ real-life files. For analysts, associates, or anyone interested in learning how PE firms do deals. Past alumni include associates from Carlyle, Apax, Charlesbank, and Gryphon. Click below for a free preview and 50% subscriber discount.

Looking Ahead

Are we in the early innings or late innings of the mental health roll-up game? On one hand, we’ve already seen the rise and fall of LifeStance. On the other, consolidation is still just beginning given how fragmented the market remains.

Other PE-backed platforms have also launched over the years. For example:

Refresh Mental Health: Backed by Kelso & Co., Refresh rapidly built a network of 300+ clinics by 2022 before selling to UnitedHealth/Optum.

Mindpath Health: Formed by Centerbridge Partners and Leonard Green & Partners in 2021 via the merger of MindPath Care Centers and Community Psychiatry, Mindpath grew to 100+ clinics by 2022, but hit turbulence with layoffs and site closures in 2023.

ARC Health: Backed by Thurston Group, ARC Health has been on an acquisition spree—12 practices acquired in 2023 alone—reaching 20+ practices in 2024.

I’d be curious to hear readers’ thoughts if you or your peers are actively acquiring behavioral health clinics today.

What should I cover next? Send ideas to [email protected]