PE Playbook: Accordion

State of Play

If there’s one consulting firm that quietly prints money while staying out of the mainstream spotlight, it’s Accordion.

During my PE days, our portcos spent millions with them—everything from interim controllers to full ERP implementations.

When Charlesbank bought Accordion in 2022 (after FFL’s growth investment), it made perfect sense: their clients became their owners. That’s product-market fit in private equity.

Let’s unpack how a small consulting shop founded by an ex-banker quietly grew to become the go-to partner for over 300 PE sponsors.

Company History

Today, Accordion offers a comprehensive suite of outsourced CFO services. But it was a long 16 year journey to get here.

Practice Area | Core Services |

Transaction Execution | QoE, Financial DD |

Finance & Accounting | Technical Accounting, Close Optimization |

Strategic FP&A | Budget/Forecast Models, KPI Dashboards, Board Reporting |

Technology | ERP, EPM, Salesforce CPQ/Billing |

Data & Analytics | Advanced Analytics, BI Dashboards, Forecasting |

Performance Improvement | Working Capital, Cost Reduction, Pricing, Procurement |

Turnaround & Restructuring | Crisis Mgmt, Liquidity, Restructuring |

Operations | Manufacturing Excellence, Logistics, Process Reengineering |

Interim Leadership | Interim CFO/Controller, Transformation Leadership |

2009-2017: Building the Foundation

Ex-banker Nick Leopard founded Accordion in late 2009 with a simple insight: PE deals stumble post-close because the finance function can’t keep pace. The firm bootstrapped for ~8 years across operational accounting, FP&A, and integrations—growing to serve 150+ PE firms by 2017.

2018-2022: Rapid Expansion Under FFL

The big break came when FFL Partners, a PE firm that had hired Accordion for various portfolio projects, decided to invest.

In October 2018, FFL took a minority stake from their $2 billion fund. At the time of investment, Accordion had less than 100 employees, which is relatively small for a consulting firm. But FFL's backing validated the model–giving them the stamp of branding and credibility to break into other PE firms–and provided capital to scale exponentially and add incremental Office of CFO services via M&A:

Under FFL, Accordion's EBITDA 4x’ed and its employee count grew from under 100 to over 350. In 2022, FFL sold the business to Charlesbank and Motive Partners for a reported 4.6x MOIC in 4 years.

2022-Now: Blitz-Scaling under Charlesbank / Motive Partners

Like FFL before them, Charlesbank had been an Accordion client–and they knew exactly what they wanted to do with the business: 1) establish an offshore operation and 2) expand outside of CFO to COO and CRO adjacencies. They’d go on to acquire:

Merilytics (May 2023): 500-person India-based analytics firm, Accordion's largest acquisition to date

OperationsRx (February 2024): Operations and supply chain transformation consulting

Kavaliro's Salesforce Division (March 2025): CRM implementation and revenue operations expertise

Today, Accordion has over 1,200 professionals across 10+ offices and works with 300+ sponsors and 1,000+ portfolio companies globally. Let’s unpack how Accordion became PE’s favorite consulting child.

Investment Thesis / Value Creation

1. The Accounting/Finance Talent Crisis

The numbers are staggering: between 2012 and 2022, new accounting graduates fell ~17%.

Why? Tech and Wall St. jobs pay double what accounting does—the average investment banker earns $130k+ (I know you readers make way more, this is just a ZipRecruiter stat) versus ~$75k for an accountant (another ZipRecruiter stat).

2. Juxtaposed by Increasing PE Demand

This talent shortage hit PE especially hard, as the deal activity over the last decade has tripled.

Source: Pitchbook, RSM.

PE-to-PE deals now dominate, meaning more companies stay PE-owned longer.

Source: Pitchbook

PE-backed companies’ accounting & finance departments are under immense pressure–they need to handle crisp reporting, rapid growth, multiple add-ons, systems integration, debt reporting, and eventual exit prep.

We’ve all felt the pain: finding someone with that skillset who wants to join a mid-market manufacturing company in Ohio is…tough to say the least.

3. The Killer Labor Arbitrage Model

Accordion solves this by providing "talent-as-a-service." PE firms get immediate access to vetted accounting / finance professionals—from interim CFOs to technical accountants—who can parachute into portfolio companies.

So how does Accordion get this talent? Yes, the projects are “more interesting” than your traditional audit/tax/quality of earnings work. But a big part of it is higher compensation.

Source: Management Consulted.

Note: Glassdoor says VPs at Accordion make $300k+. You get the point.

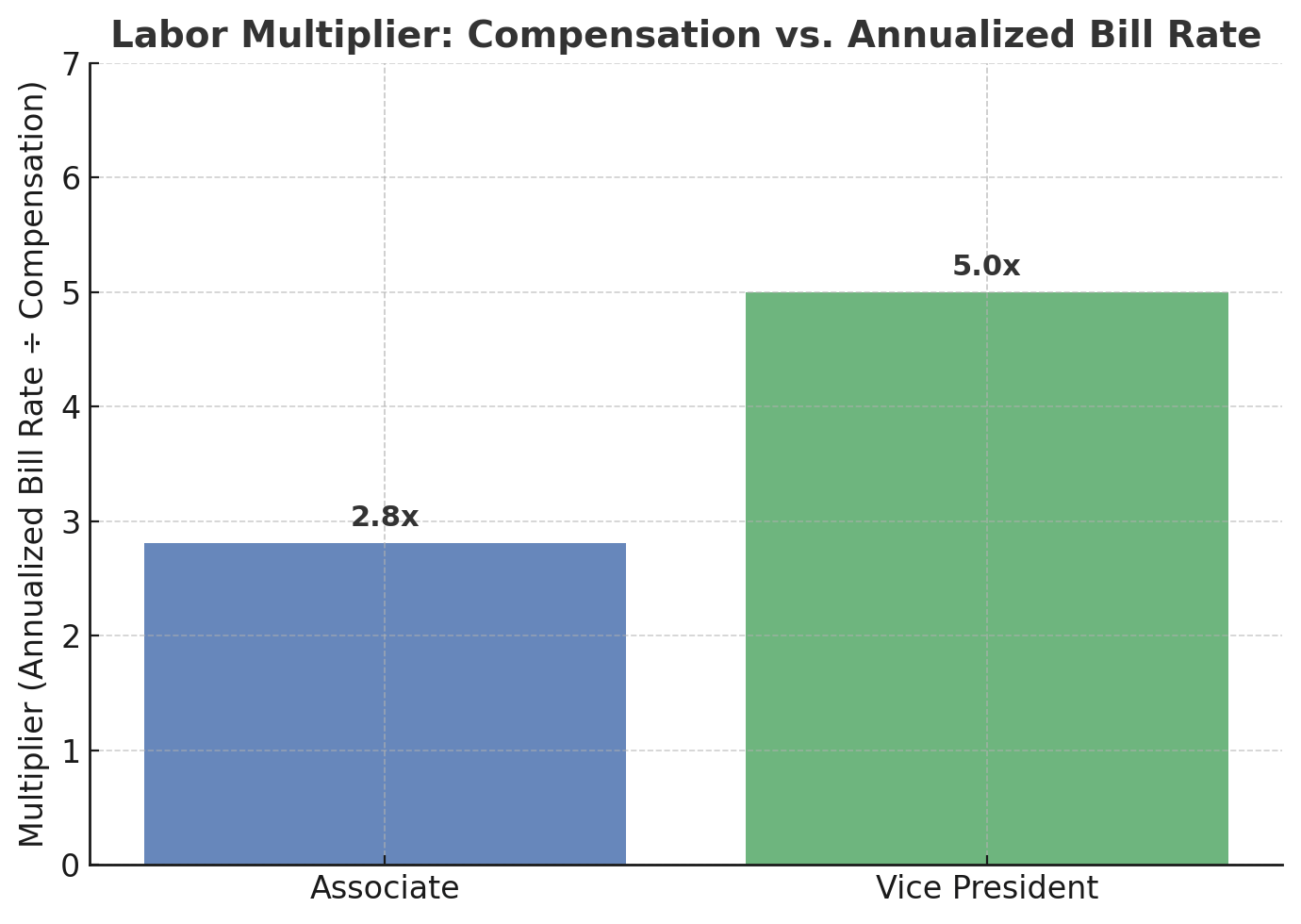

That’s great for employees. But what about for Accordion? Turns out, Accordion is doing just fine. According to this interesting Reddit post, PE FP&A consulting firms charge $7k-$25k a week–translating to a 3x-5x labor multiplier (calculated as annualized bill rate / annualized compensation).

Source: Management Consulted. Reddit.

Now, this doesn’t take into account utilization rate or bench time. But, Accordion sits at the top of the market, and their bill rates are likely even higher than the pricing from boutique consulting firms.

By the way, gross profit in professional services can be implied as (1 - 1/labor multiplier)—meaning, Accordion is likely driving 65-80% gross margins across their projects.

4. Revenue Across the Investment Lifecycle

Accordion’s services map to every stage of PE ownership:

Stage | Typical Services | Duration |

Pre-Deal | QoE, Financial DD, Model Review | 4–8 weeks |

Post-Close | 100-Day Plan, Controls, Reporting | 3–6 months |

Value Creation | FP&A, Systems, Add-on Integration | Ongoing |

Distressed | Turnaround, 13-Week Cash Flow | 6–12 months |

Exit | Carve-out, IPO Readiness | 6–9 months |

This creates a natural flywheel of cross-sell. A sponsor might hire Accordion for diligence on a platform, then for post-close integration, then for add-on support, and finally for exit preparation. Multiply that across a 20-company portfolio and multiple funds, and you have incredibly sticky revenue.

5. Roll-Up and Cross-Sell Opportunity

The PE operations consulting space is highly fragmented—dozens of boutique firms offer pieces of what Accordion does. This presents a classic consolidation opportunity that PE investors love. Their acquisitions since 2021 strategically expanded their reach beyond the Office of the CFO into the offices of the COO and CRO, while building global delivery capabilities:

Acquisition | Year | Core Service | Application Across CFO / COO / CRO |

Mackinac Partners | 2021 | Turnaround & Restructuring | Strengthens CFO offering |

Platform Specialists | 2022 | Enterprise Performance Management (EPM) consulting | Adds tech implementation capability for CFO |

ABACI | 2022 | ERP & EPM consultancy | Adds tech implementation capability for CFO |

Merilytics | 2023 | Data & Analytics / Business Intelligence | Offshore talent base for analytics services applicable across CFO, COO, CRO |

OperationsRx | 2024 | Operations & Supply Chain Transformation | Adds tech implementation capability for COO |

Salesforce Division of Kavaliro | 2025 | Salesforce tools | Adds tech implementation capability for CRO |

FFL made 4.6x MOIC in 4 years by deepening Accordion’s presence in CFO services. Under Charlesbank and Motive Partners, Accordion has significantly expanded its TAM from CFO only to CFO + COO + CRO services and from staffing only to staffing + tech implementation + data services.

Looking Ahead

In my view, the next chapter for Accordion will be defined by three key initiatives. First, they're betting on AI and automation. The Merilytics acquisition brought 500 data scientists who are building proprietary analytics tools and AI-driven forecasting models. This isn't just offensive; it's defensive—as basic accounting gets automated, Accordion needs to stay ahead of the disruption curve.

Second, expect more strategic acquisitions. The consolidation playbook is far from complete. Adjacent areas like cybersecurity and ESG reporting feel very natural.

The exit question looms large. Three scenarios seem most likely: an IPO (following FTI Consulting's path), a strategic sale to a Big Four or PE-backed accounting firm, or another sponsor-to-sponsor flip. Given the trajectory—a billion $ valuation isn't unrealistic.

The bottom line: Accordion represents a case study of a company that captured both the demand (PE deal boom) and supply (underpaid accountants)—resulting in a high-growth and highly profitable consulting firm.

As long as PE keeps growing and portfolio companies keep struggling to find talent, Accordion will be there to fill the gap.

What should I cover next? Send ideas to [email protected]

RATE TODAY’S EDITION

Share Road To Carry newsletter and receive free resources!

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a 30-page guide on the PE landscape and selecting your ideal PE firm.

🔒 4 referrals – a comprehensive PE interview questions bank

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress