Hi all—excited to share that Road To Carry crossed 3,500 subscribers. Thank you! We’ve also welcomed some very senior investors to the readership. One day, I hope to invite them to share their knowledge with the broader audience. Until then, here’s another piece from me.

PE Playbook: Ellie Mae

State of Play

When Thoma Bravo raised $34B in June, I was shocked. Not only is that a staggering amount of capital, but headlines were full of fundraising struggles and a broader slowdown in PE activity.

But the firm came out roaring with a spree of deals. Over the last three months, Thoma took four public companies—Dayforce, PROS Holdings, Verint, and Olo—private for a combined transaction value of roughly $18B.

In a market cluttered with AI chatter questioning the future of software, Thoma has taken a bold stance and bet a meaningful portion of its new fund. Time will tell if it was the right call, but they’re true experts in software take-privates.

Let’s dig into a prime example: the 2019 Ellie Mae take-private that delivered 4x returns and ~$8B of profits in just 18 months.

Presented With

Our platform helps private equity firms discover service providers across deal origination, company management, and back-office solutions.

Proladex is seeking to solve the problem of vendor selection in our space by providing a curated list of credible service providers for every need:

- Capital Markets & Advisory

- Executive Search & Recruiting

- Quality of Earnings & Diligence

- Consulting & Brokerage

Our vendors reach targeted buyers for their services through our curated directory, vendor news feed, request for proposal page, distribution network and events.

PE investors can sign up at no-cost here

Service Providers can explore our introductory trial by scheduling a call

Company Overview

Company History

Founded in 1997, Ellie Mae started with a simple idea: bring the mortgage process online. Back then, “digitization” meant faxing fewer forms.

Its flagship product, Encompass, launched in the early 2000s as a cloud-based origination platform covering the entire mortgage lifecycle—from application to closing. Core offerings included:

Product / Service | What It Does | Who Uses It |

|---|---|---|

Encompass® LOS | End-to-end cloud platform for managing loan apps, underwriting, processing, and closing. | Mortgage lenders, brokers, banks |

Encompass Connect / Developer Platform | APIs + tools to plug in credit checks, appraisal, e-signature, and other 3rd-party services. | Developers, fintech partners |

Consumer Connect | Digital borrower portal for online apps, doc uploads, and real-time loan tracking. | Borrowers, retail lenders |

AIQ (AI for Quality) | Automates data validation, document recognition, and compliance checks. | Lenders, QA teams |

Velocify by Ellie Mae | Lead management + sales automation for loan officers. | Mortgage originators, sales teams |

Encompass Compliance Service | Real-time rule engine for TRID, HMDA, and other regulatory updates. | Compliance officers, lenders |

Going Public and Setting the Stage

Ellie Mae went public in 2011 and saw its stock soar over the following years as revenue grew quickly during a generally strong post-GFC housing market. By 2018, the stock peaked around $100.

Ellie Mae Stock Price

Source: HousingWire

However, fortunes turned as interest rates rose and mortgage volumes fell in 2018. As U.S. originations declined and lenders merged (shrinking Ellie’s customer base), growth stalled—just 3% YoY in Q4 2018—and margins came under pressure. The stock plunged over 30% in late 2018, setting the stage for Thoma Bravo.

Thoma Bravo’s Take-Private

In April 2019, Thoma took Ellie Mae private at $99 per share in a $3.7B all-cash deal. A few reasons they were among the few who could pull this off:

Thoma’s Take-Private Experience. Prior to Ellie Mae, Thoma had already completed 10+ take-privates since 2010.

Year | Company |

|---|---|

2011 | Blue Coat Systems |

2012 | Mediware Information Systems |

2012 | Deltek |

2013 | Keynote Systems |

2014 | Compuware |

2015 | Riverbed Technology |

2016 | Qlik |

2016 | SolarWinds (with Silver Lake) |

2016 | Imprivata |

2017 | Barracuda Networks |

2019 | Imperva |

Thoma’s Lending Tech Experience. Long before 2019, Thoma had built meaningful experience across the lending software stack—from document management to credit decisioning and digital origination.

Year | Company | Why It Mattered |

|---|---|---|

2007 | Hyland Software | Hyland’s platform helped banks, credit unions, and mortgage servicers digitize underwriting, loan documentation, and compliance |

2018 | MeridianLink + CRIF Lending Solutions | Digital lending platform for all loans (not just mortgage) |

With that context, let’s dive into the playbook.

Investment Thesis

1. Dominant Market Position in a Big TAM

Despite the short-term headwinds Ellie Mae was experiencing, the mortgage lending market was and continues to be a huge market with long-term growth trajectory. And according to a 2019 interview, Ellie Mae was touching ~40% of all U.S. mortgage loans.

U.S. Mortgage Debt Outstanding ($ in trillions)

Source: Statista

2. Recurring Revenue & Stickiness

Ellie Mae exhibited the hallmarks of great B2B software: mission-critical workflows and network effects. With 95%+ retention, Encompass sat at the center of daily operations and connected lenders to partners, investors, and regulators.

But here are the real economics behind the 95%+ retention:

(i) Rising origination costs. The cost per loan nearly doubled from ~$5k in 2008 to ~$9k in 2018.

Source: Freddie Mac

Much of the spend is sales (commissions) and fulfillment/production support (underwriting and processing).

Source: Mortgage Bankers Association

(ii) Profit pressure—and Encompass uplift. Even in a decent year (2021), lenders earned roughly ~$3k per loan.

Source: Mortgage Bankers Association

And according to a 2022 research conducted by MarketWise Advisors, Ellie Mae’s Encompass platform generated $971 incremental profits per loan on average.

That’s a 30% profitability increase.

(iii) ROI on software. A 2019 interview noted Ellie Mae earned ~$185 per loan. If that approximates customer cost, the ROI is 5x+.

In short: Ellie Mae’s software was a small cost (2% of total expense) that drove a 30% uplift in average loan profit (translating to an 8% improvement in profitability).

3. Operational / Cost Efficiency

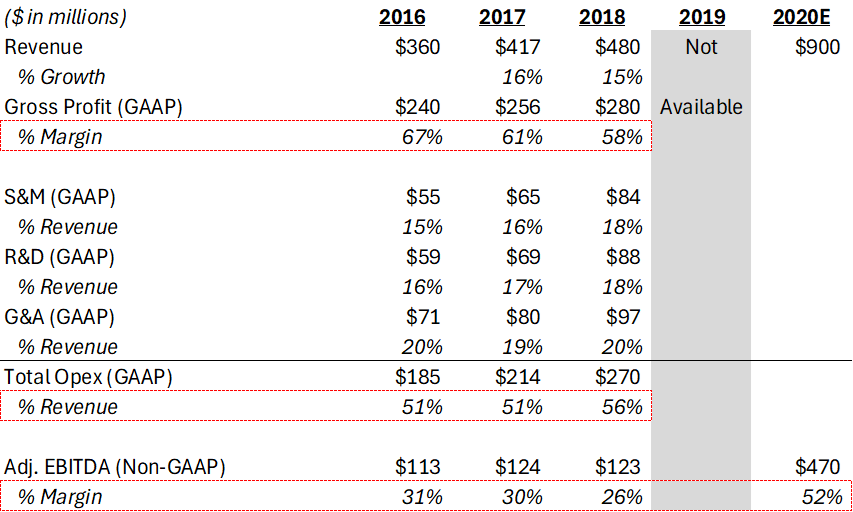

Heading into the buyout, Ellie Mae’s profitability was slipping: (i) gross margin declined; (ii) opex rose; (iii) EBITDA margin fell ~5 pts. Growth had cooled to 3% YoY in Q4 2018, triggering the stock drop.

Source: 10k, company announcements

But by their exit in 2020E, company was reportedly generating $470M of EBITDA at a whopping 52% EBITDA margin. While the specific numbers are not publicly available, we can glean a few operational initiatives (many of which are common take-private playbook for Thoma):

(i) Pricing increases: Ellie Mae had an attractive 5-year contract structure, but the contracts didn’t have any built-in price increases. Under Thoma, the company aggressively increased prices and added annual price escalators as contracts came up for renewal.

(ii) Cost cuts: Thoma reportedly cut $50M of costs right off the bet–with a focus on the R&D department. With the acquisition of Capsilon (which we will touch on more below), the company aggressively laid off Ellie Mae’s R&D team based in California and transitioned to a R&D hub in India where Capsilon already had a significant presence.

4. Tech Acceleration (via M&A)

Just months after the take-private, Ellie Mae announced the acquisition of Capsilon, an AI and document automation company. The strategic rationale was clear:

Speed to innovation. Instead of a multi-year R&D push, Ellie Mae could instantly embed Capsilon’s automation engine into its Encompass platform, dramatically reducing near-term R&D costs.

Expansion of TAM. By owning more of the mortgage workflow—from document ingestion through underwriting—Ellie Mae could cross-sell deeper into existing customers.

Defensibility. Automation made Encompass more indispensable. Once lenders adopted these features, switching costs rose even more.

Plus the acquisition was financial accretive–once integrated, Capsilon reportedly generated $45M of revenue and $20M of EBITDA.

Thoma was contrarian when public markets punished a growth slowdown, but they knew the plan post-close and executed fast.

Risk Assessment

So what could have gone wrong here?

1. Technology Disruption

Competitors were already pushing modern, API-first platforms that threatened to make legacy systems look dated. A failure to keep pace with automation and user experience could have driven churn for Encompass over time.

Mitigation: Company moved aggressively to close this innovation gap via M&A, specifically via acquisition of Capsilon. This allowed the company to maintain technological relevance without risking near-term profitability through heavy R&D spending.

2. Mortgage Cyclicality

Ellie Mae’s growth was tied to U.S. mortgage origination volumes, which are highly sensitive to interest rate cycles.

Mitigation: Thoma likely underwrote the downside case stability banking on Ellie Mae’s 5-year contract subscription model and 95%+ retention. And while refi activity might ebb and flow, the long-term digitization of the mortgage process—including compliance, data, and analytics modules—offered structural tailwinds beyond cyclical mortgage demand.

3. Execution & Integration Risk

Execution of cost cutting initiatives and Integrating a high-growth AI acquisition like Capsilon into a mature platform carries risk.

Mitigation: Again, the multi-year contracts and customer stickiness provides wiggle room to iterate on integration. ICE acquired Ellie Mae within ~18 months, so we can’t fully judge long-run standalone impacts of the cost program.

Learn how PE firms actually do deals—from start to finish.

Road To Carry PE course walks you through the full PE deal process, not just modeling. Bite-sized videos & exercises & 40+ real-life files. For analysts, associates, or anyone interested in learning how PE firms do deals. Past alumni include associates from Carlyle, Apax, Charlesbank, and Gryphon. Click below for a free preview and 50% subscriber discount.

Looking Ahead

Ellie Mae is a standout success story in B2B software take-private with incredible returns of 4x+ MOIC / 200%+ IRR in 18 months.

While the operational playbook did wonders to the business to grow the revenue from $480M in 2018 to $900M in 2020 and EBITDA from ~$120M in 2018 to ~$470M in 2020, there was also luck involved–mortgage origination volume was literally at its trough in Q1 2019 (when Thoma acquired Ellie Mae for $3.7B) and near the peak in Q3 2020 (when ICE acquired Ellie Mae for $11B).

Source: Attom.

It’ll be interesting to see whether Thoma Bravo’s recent spree becomes a new wave of B2B software deals worthy of case-study write-ups. I’ll be cheering them on.

What should I cover next? Send ideas to [email protected]

RATE TODAY’S EDITION

Become a Sponsor & reach 3,500+ PE professionals every week

Want to put your company in front of the private equity community? Road To Carry is opening up sponsorship opportunities for value-add vendors in the ecosystem. Click below to learn more about our audience, key stats, sponsorship packages, and current availability.