One of the most common threads of conversation among mid-level PE professionals these days is the idea of acquiring and scaling SMBs. HVACs, cleaning services, lawn care—you name it. I’ve always approached that topic with: what’s the real mission behind rolling up a bunch of businesses I’ve never done myself?

Then I came across the story of James Temple—a franchisee who successfully rolled up Mathnasium tutoring franchises and scaled to over $10 million in revenue. So I looked into the company behind the brand... and of course, there was a private equity firm at the top.

If there’s a topic you’d like me to cover, drop me a note at [email protected].

PE Playbook: Math Learning Centers

State of Play

Mathnasium is one of the world’s largest math-focused education franchises, with over 1,100 learning centers across North America, Europe, Asia, and the Middle East. In 2021, it was acquired by Roark Capital—a PE firm well-known for building franchise-based platforms, including Dunkin’, Orangetheory, and Arby’s.

What began as a curriculum developed by a math teacher for his son in Los Angeles has scaled into a global platform with a mission-driven impact and a powerful business model.

Let’s break down the investment thesis and how Roark is building value behind the scenes.

Investment Thesis

Mathnasium’s rapid growth and attractive economics highlight why investors like Roark were drawn to the company.

📈 1. Math tutoring sounds niche, but it’s a huge market

Parents everywhere are willing to invest in their children’s education, and that drives a large, resilient tutoring market. Technavio estimates that the U.S. tutoring industry is already over $30 billion in size.

Source: Technavio

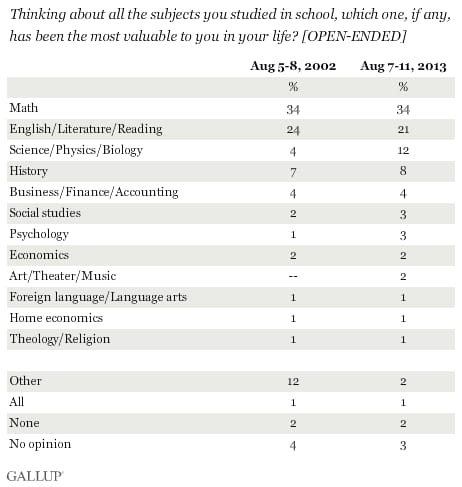

And math is the highest priority subject for parents.

Source: Gallup

While Mathnasium has 1,000+ locations, its global footprint still trails far behind Kumon, which operates 23,000+ centers worldwide. There’s still plenty of whitespace to grow.

💡 2. Scalable franchise model with strong economics

Mathnasium runs a classic asset-light playbook. The company licenses its curriculum and brand to independent operators, who then pay royalties and marketing fees to the franchisor. As a result, the business has strong margins and limited capital needs.

Franchisees, in turn, enjoy attractive economics. The average center generates healthy revenue, and the startup costs are relatively low, which creates accessible entry points with strong ROI potential. According to Mathnasium’s Franchise Disclosure Document, the average / median Mathnasium center generates:

Source: Mathnasium

With initial startup costs as low as ~$113K, the return on investment for a successful center can be fantastic, which helps entice new franchisees and fuels system growth.

💡 3. Strong brand with loyal customer base

Mathnasium built a brand around effective math-only tutoring. As evidence of quality, Mathnasium was named the #1 Tutoring Franchise by Franchise Business Review in 2020. And much like a gym, students enroll with an upfront registration and then pay ongoing monthly tuition fees for continual attendance. Once enrolled, families often stay for years as children progress through grade levels, translating to high customer lifetime value.

In summary, Mathnasium presented a formula of growing market + scalable franchise system + recurring revenues + solid unit economics + strong brand – a combination that adds up well for investors. It’s no surprise Roark Capital saw Mathnasium as a worthy addition to its portfolio of multi-location, high-groth consumer businesses.

Company History: Mathnasium

2002-2021. From founding to a Scaled National Franchise

The story of Mathnasium began with a math teacher, Larry Martinek, who spent years developing an intuitive way to teach math to his young son, Nic. Years later, in 2002, Larry teamed up with educational entrepreneurs Peter Markovitz and David Ullendorff to found Mathnasium in Los Angeles, initially as a company-owned location.

By 2003, Mathnasium began franchising its concept, allowing local owners to open centers using Larry’s Mathnasium Method curriculum and reaching 1,000 across 5 continents by 2019.

2021-Today. Expansion under Roark Ownership

In 2021, Roark acquired Mathnasium for an undisclosed nine-figure sum. Since then, they’ve focused on a few core levers:

Accelerated Franchise Expansion: Roark Capital’s strategic focus on expansion has significantly grown Mathnasium’s footprint since late 2021.

Mathnasium surpassed 1,100 learning centers worldwide by the end of 2023, marking a new high for the company’s network.

In 2023 alone, Mathnasium opened 59 new centers and awarded 81 new franchise agreements to fuel future openings.

This momentum only increased into 2024. By October 2024, Mathnasium had awarded 171 new franchises that year.

International Expansion: In 2022–2024 the brand entered and expanded in multiple new international markets.

Mathnasium signed a Master Franchise agreement in Romania in 2024, marking the brand’s debut in that country with plans to open at least 25 centers over the next six years.

Around the same time, Mathnasium appointed new master franchisees for Australia, opening the first two Mathnasium centers in the Melbourne area.

In Vietnam, Mathnasium recently renewed its master franchise deal for an additional 10 years, with a commitment to open 25 more centers

For Roark, the endgame will likely be a highly valuable franchisor business that could be an attractive IPO candidate like Dunkin’ (which was previously public before Roark’s acquisition).

Looking Ahead

Mathnasium’s success isn’t just a win for its private equity owner – it’s also creating opportunities for individual franchise entrepreneurs. One compelling story is that of James Temple, who acquired a struggling Mathnasium center in Richmond, VA for $40,000 and scaled that single location to over $1 million revenue annually (eventually becoming the top-performing Mathnasium center in the country). Fast forward to today, and James Temple has built a Mathnasium empire with 24 centers generating about $10 million in annual revenue.

Personally (as someone who’s tutored before), that’s a SMB roll up strategy I can get behind!

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies