This article was supported by RTC’s Research Analyst Joseph Chiang. If you are a college junior or senior with IB/PE experience interested in supporting RTC’s research, check out the internship description.

Today we are shifting gears from roll up case studies to a more esoteric (although becoming more mainstream) topic of investing in professional sports teams.

State of Play

Sports investing is one of the hottest trends in private equity today. Just this past week, KKR agreed to acquire Arctos Partners, a prominent investor in professional sports franchise stakes, for a whopping $1.4 billion.

The sports investing category initially began as a relatively niche strategy pioneered by top media investors buying media/broadcasting rights and independent sports tournaments, including:

CVC’s acquisition of Dorna sports (MotoGP) (1998)

Providence’s acquisition of YES Network (New York Yankees) (2002)

CVC’s acquisition of Formula 1 (2006)

Providence’s acquisition of Ironman (2008)

Now it’s become a more mainstream hunting ground, as the ecosystem of companies matured across consumer, media, and technology vendors dedicated to sports.

Private Equity Backed Sports Companies

Source: Houlihan Lokey

Latest hot trend? Investing in sports teams. Let’s dig into the history, business model, and a case study in Clearlake’s buyout of Chelsea FC in 2022.

A Brief History of PE Investing in Sports Teams

PE investments in sports teams isn’t new, although we will discuss why it’s become much more prominent over the past several years.

A Quick Walk Down the Memory Lane (1990s)

The earliest significant PE-style investment in professional sports teams actually started in Canada. In 1994, Ontario Teachers’ Pension Plan (“OTPP”; one of Canada’s largest pension funds) acquired Maple Leaf Sports & Entertainment, which included Toronto Maple Leafs (NHL) and eventually the Toronto Raptors (NBA).

Timeline of OTPP’s investment to $1.3B exit in 2012

Source: OTPP

3 years later in 1997, the British investment group English National Investment Company (“ENIC”) went on a consolidation spree across the European soccer (ok ok football for the European readers) leagues:

Tottenham Hotspur (UK)

Rangers FC (Scotland)

Slavia Prague (Czech Republic)

Vicenza (Italy)

AEK Athens (Greece)

Unfortunately for ENIC (or perhaps reflection of their expertise), two of their teams AEK Athens and Slavia Prague both qualified for the UEFA Cup during 1998. UEFA ruled that two clubs under common ownership could not play in the same competition. So in just a year, ENIC was forced to divest their holdings, leaving them with only Tottenham today.

Modern Sports Team Investing (2019–Present)

Since the bold play by ENIC in 1997, investing in sports teams has, for the most part, been a playground for billionaires. But starting 2019, there was a big shift in momentum.

2019-2021 Leagues open up ownership

In 2019, Major League Baseball (MLB) became the first major US league to change its bylaws, formally allowing private investment funds to hold minority stakes in multiple teams.

Over the subsequent two years, National Hockey League (NHL), Major League Soccer (MLS), and National Basketball League (NBA) opened ownership to private equity groups.

2019-2021 Massive PE deals

In November 2019, SilverLake announced a 10% investment in City Football Group (Manchester City) for $500 million, setting a huge valuation precedent of $5 billion for the team.

In 2021, CVC signed a massive €2 billion deal with La Liga, buying a share of the league's future broadcast revenue. During the same year, Arctos came out guns blazing with a $3 billion first time fund–validating LP’s appetite for sports investing.

2022 Chelsea FC / Clearlake

Following Russia’s invasion of Ukraine, the UK government announced an unprecedented confiscation and a forced sale of Chelsea FC following sanctions on then owner Roman Abramovich, a Russian oligarch.

A swift 90-day process advised by The Raine Group followed. Ultimately, the American Billionaire Todd Boehly and Clearlake Capital came out on top paying £2.5bn as well as several restrictions, including:

Control owners cannot sell their stake for 10 years

No management fees, debt or dividend recaps

Owners are restricted in the amount and nature of debt they can put on the team

Must commit to investing ~£1.75bn over the next 10 years

Note: Assumes Euro/Pounds FX rate of 0.84.

Now, was the deal worth it? Let’s discuss.

Investment Thesis

Money flows in for good reason.

1. Sports = idiosyncratic growth asset?

Historical returns are never indications of future results, but sports franchise investing has had a good run since 2000.

Source: Michigan Ross.

Note: RASFI = Ross-Arctos Sports Franchise Index.

Note: You can find their methodology here.

And according to the study, sports franchise returns have had only a 19% correlation to US equities returns.

This data would purport that sports franchises are low beta, high alpha asset classes. But is it due to illiquidity? ¯\_(ツ)_/¯

2. Returns supported by revenue growth

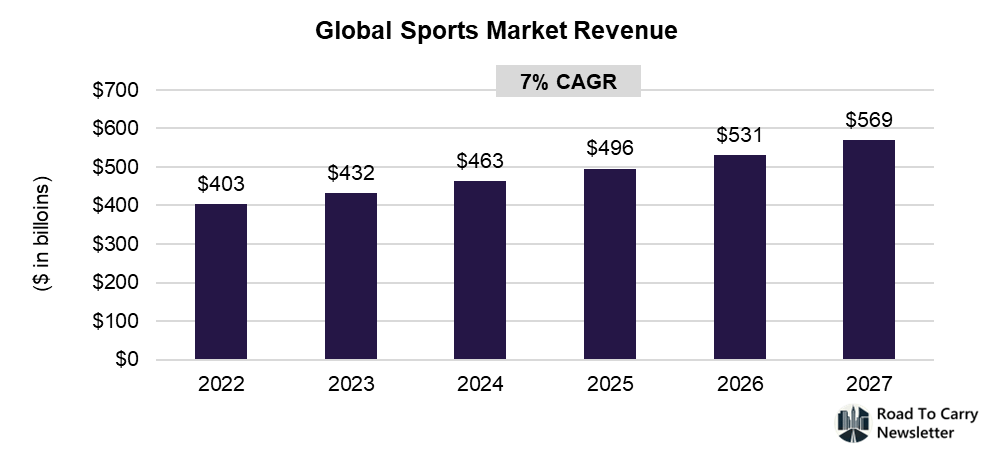

Now, the returns weren’t all driven by billionaire ego fights. The underlying global sports market has and is expected to continue growing.

Source: Houlihan Lokey

First, how do sports teams make money?

Tickets & merch

Media rights

Brand sponsorships

Sports betting (data feeds)

Source: Bain & Company

1. Tickets & merch

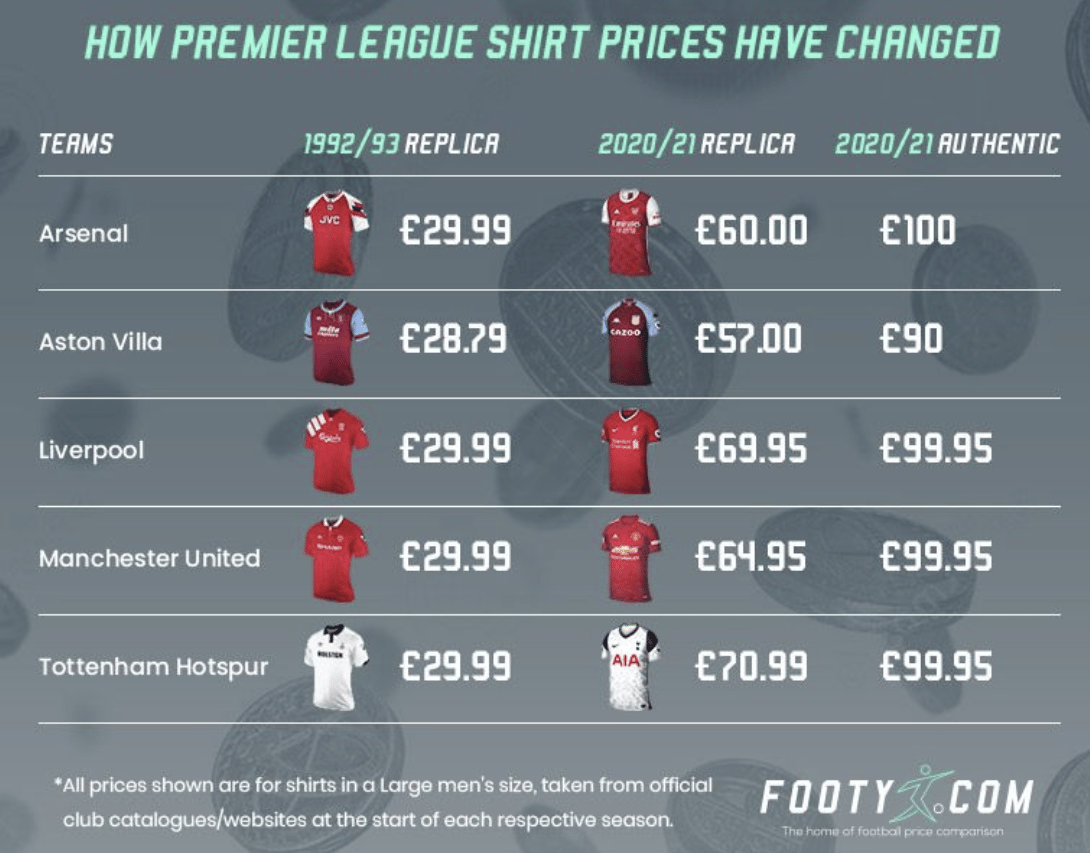

Over the last decade, both ticket and merch prices have more than doubled:

Source: Gametime, Axios

Source: Footy.com

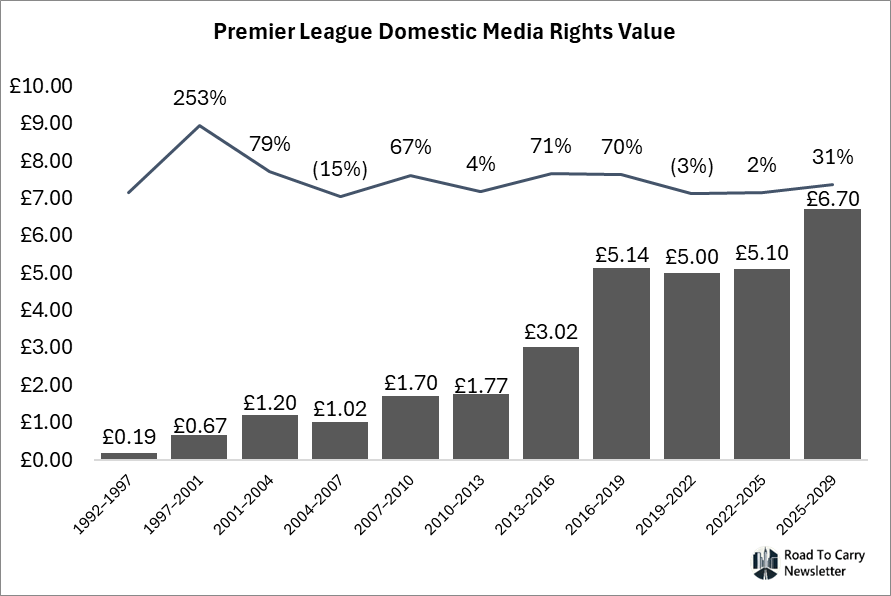

2. Media rights

The value of media rights has doubled every few years.

Source: GiveMeSport

4. Sports betting

Sports betting has become a massive industry and a new source of revenue.

Source: e-Marketer

3. In sports, winner takes all

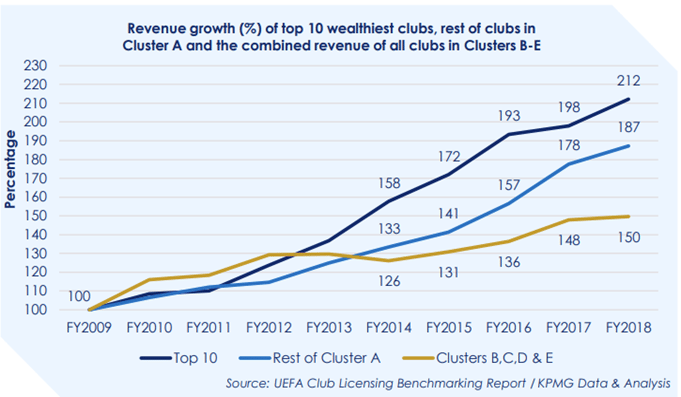

According to the European League, an association representing ~1,200 clubs from all over Europe, the bulk of the soccer industry’s growth goes to the top clubs. Their research suggests that top 10 clubs (which includes Chelsea FC) saw over a 200% increase in revenue since 2009, compared to only 150% increase for less prominent clubs.

Source: UEFA, KPMG

So it’s a self-perpetuating cycle of top clubs → more revenue → more investment → more valuable.

4. Stadium investment opportunity

Other teams have doubled their gate revenues (tickets, merch, hospitality, premium seats) by investing into new stadiums. However, Chelsea FC is one of the only few teams who has not revamped their stadiums. So there was a clear, high ROI opportunity for Clearlake.

Source: European League

Note: Chelsea FC boxed in red.

In summary, Chelsea FC represented an opportunity to invest in a unique, high-growth-potential asset with a clear investment area.

Learn how PE firms actually do deals—from start to finish.

Road To Carry PE course walks you through the full PE deal process, not just modeling. Bite-sized videos & exercises & 40+ real-life files. For analysts, associates, or anyone interested in learning how PE firms do deals. Past alumni include associates from Carlyle, Apax, Charlesbank, and Gryphon.

Looking Ahead

So how is it working out? Thus far, not so great.

Following the 2022 acquisition, Chelsea FC had the worst season since 1994 which led to a 10% decline in broadcasting revenue that year. Then 2024 was a disaster with the team not qualifying for any continental UEFA competitions (Champions League, Europa League, or Conference League).

Source: Deloitte

Note: 2021-2022 Matchday revenue growth is driven by post-COVID return of physical game attendance.

Note: assumes EUR/USD FX rate of 1.18.

And it’s not for lack of trying–their player wage as % of revenue remains elevated at ~72% (compared to their peers in the low 60%s).

In fact, their performance was so poor that they were forced to deploy clever financial engineering tactics to avoid fines (The Premier League’s Profitability and Sustainability Rules prohibit member clubs from sustaining losses exceeding £105 million over a rolling three-year periods)

2022 / 2023 Season: One month before fiscal year end, Chelsea transferred ownership of two hotels to a different subsidiary for £76.5 million to post paper-gains

2023 / 2024 Season: Just 48 hours before fiscal year end, Chelsea transferred the women's team to another subsidiary for roughly £200 million, again to post paper-gains

It’s been a rough ride out of the gate. Do we think they overpaid? Reply to this email and let me know. Here are some comps for you.

Source: Football Benchmark.

Any topics I should cover next? Share thoughts with [email protected]

Were you forwarded this newsletter? Subscribe here.

Make sure you receive Road To Carry every Thursday and Saturday!

Everyone: reply to this email with a “hi”

Gmail mobile: Click the 3 dots (...) at the top right corner, then "Move," then "Primary"

Gmail desktop: Go back to your inbox and move this email to the "Primary" tab

Other users: Follow these instructions