If there’s a topic you’d like me to cover, drop me a note at [email protected].

PE Playbook: Fitness Chains

State of Play

There’s been a flurry of fitness-related PE deals over the last few months. Most notably:

- May 2025 – TSG Consumer Partners acquired EōS Fitness, an HVLP (high-value, low-price) chain based in Dallas, for $1.5 billion

- April 2025 – Leonard Green recapitalized Crunch Fitness, another HVLP chain previously owned by TPG, at a $1.5 billion+ valuation

- In Europe – Waterland Capital (a $4B+ AUM PE firm) invested in Wellness Sports Club, a premium French fitness chain

Over the years, fitness chains have become one of the few retail categories where PE has consistently found repeatable success. Let’s dive into why.

Investment History

Private equity has returned to the fitness industry again and again—each time backing different models, formats, and outcomes.

1999 - Gold’s Gym / Brockway Moran & Partners

One of the earliest private equity forays into fitness was Brockway Moran’s acquisition of the iconic Gold’s Gym. The firm proved the investment model could work by scaling both physical locations and brand equity:

Expanded corporate-owned gyms from a single unit to over 37 locations

Professionalized and accelerated the franchise system, growing franchise-owned units from 400 to 500+

Licensed the brand across 600+ consumer products—from apparel to supplements—creating a recurring revenue stream outside gym memberships

2000s - Divergence in Business Model: Corporate-Owned Premium vs. Franchise-Based No-Frills Gyms

After Gold’s, PE firms took divergent paths in scaling fitness concepts—some upmarket, others asset-light.

Equinox / North Castle & J.W. Childs (2000)

Premium, luxury-focused positioning

Vertically integrated offerings: personal training, spa, wellness

Crunch Fitness / Angelo Gordon (2005)

Positioned as a “no judgments,” affordable alternative with a cult-like community

The company leaned into the franchise-model out of necessity, as the company was acquired out of bankruptcy due to high leverage

Despite limited capital, grew substantially through an asset-light franchise model but took over 15 years under Angelo Gordon’s ownership before exiting the investment

2010s - Gym Investments on Steroids

The 2010s brought in a frenzy of private equity activity—some winners, some cautionary tales.

The Duds: Corporate-Owned Giants:

24 Hour Fitness / AEA Investors (2014)

Focused on corporately owned growth but struggled under heavy debt and operational inefficiencies

Filed for Chapter 11 during COVID after closing 100+ locations

Life Time Fitness / Leonard Green & TPG (2015)

Taken private by Leonard Green & TPG for over $4 billion

Strong brand and revenue base, but capital intensity and slow payback on new clubs made scaling tough

Re-IPO’d in 2021 at a lower valuation, generating modest returns

The Winners: Franchise-Fueled Growth:

Planet Fitness / TSG Consumer (2013)

Low-cost, no-frills model with national appeal

Nearly 100% franchised—resulting in explosive, capital-light growth

IPO’d in 2015; TSG reportedly realized ~10x return on invested capital

Orangetheory Fitness / Roark Capital (2016)

Built a loyal community through high-intensity, tech-enabled workouts

Expanded globally to 1,500+ studios, nearly all franchised

Roark retained ownership well into 2020s and is using it as a platform to build “ fitness chain holding group”, similar to their “fast-food holding group” playbook

The New Formats: Boutique & Premium Experiences:

Barry’s Bootcamp / North Castle Partners (2015)

Capitalized on group fitness trend and lifestyle brand appeal

Expanded into new markets and retail, pushing into a high-income demographic

CorePower Yoga / L Catterton (2013)

Fast-growing yoga chain with upscale studio experience

Leveraged L Catterton’s consumer expertise to expand footprint and optimize unit economics

2020s - Post-COVID Recovery

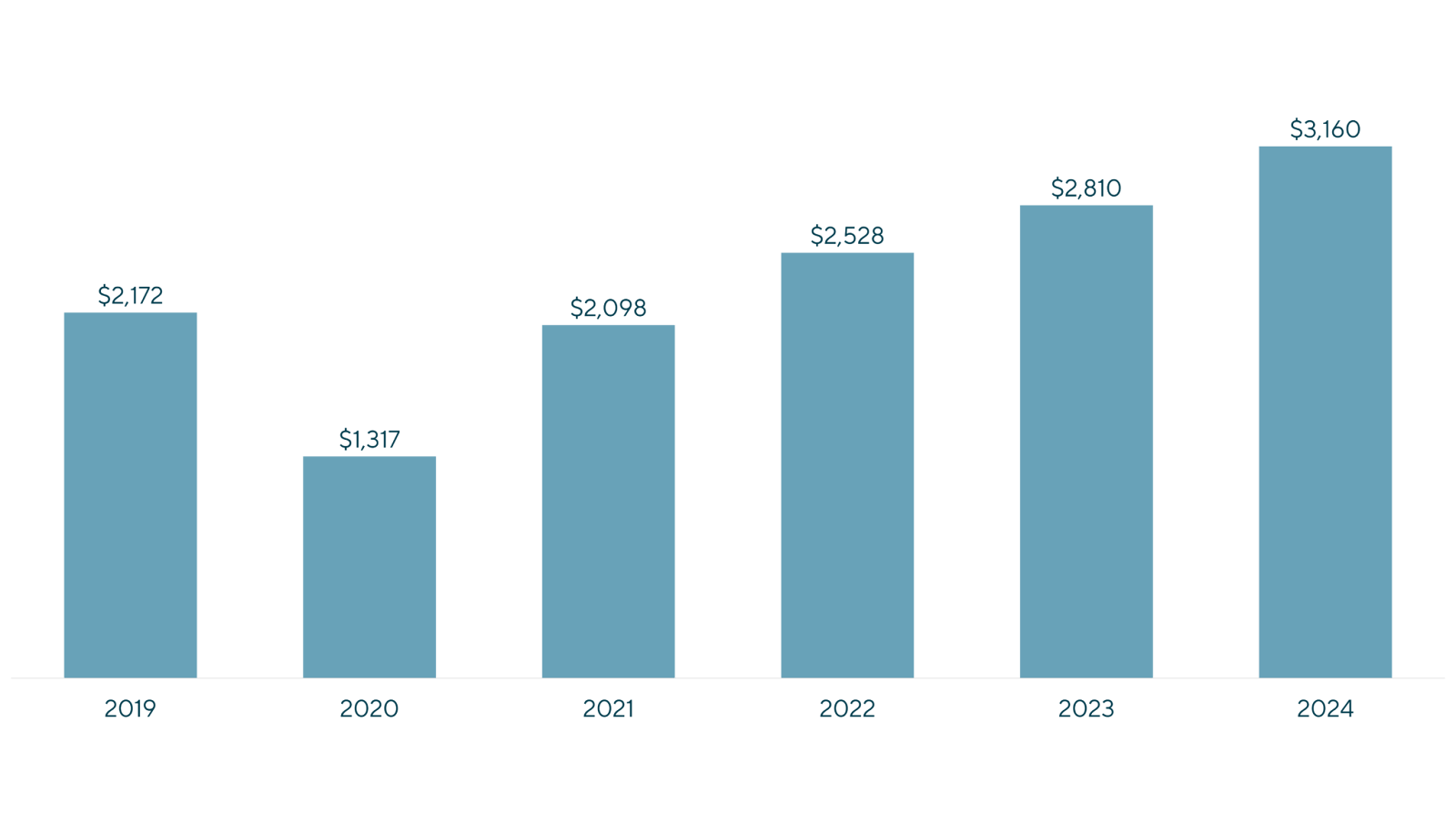

The pandemic was a near-death experience for the fitness industry—about 25% of U.S. gyms shut down between 2019 and 2022, disproportionately affecting independents. But that created fertile ground for consolidation.

Number of Health Clubs in the U.S.

Source: Health & Fitness Association

As the dust settled, private equity firms doubled down on resilient, scaled operators—especially franchisees with strong unit economics and recurring membership bases.

Olympus Partners acquired Excel Fitness (2022), a major Planet Fitness franchisee with 90+ clubs, accelerating regional expansion

Sentinel Capital bought Bandon Holdings (2022), the largest Anytime Fitness franchisee with 213 clubs

TSG Consumer acquired EoS Fitness (2025) for $1.5 billion, betting on the value-oriented, large-format gym trend

Leonard Green recapitalized Crunch Fitness (2025) at a reported $1.5 billion+ valuation, marking a return to the space nearly two decades after Lifetime

Investment Thesis

Private equity’s renewed interest in gyms stems from:

📈 1. Post-COVID Recovery and Growth

After a steep pandemic dip, health club visits are rebounding quickly—some chains are even exceeding 2019 traffic. Memberships are also climbing after years of stagnation.

Source: Health & Fitness Association

1) Total health club visits include non-member visits.

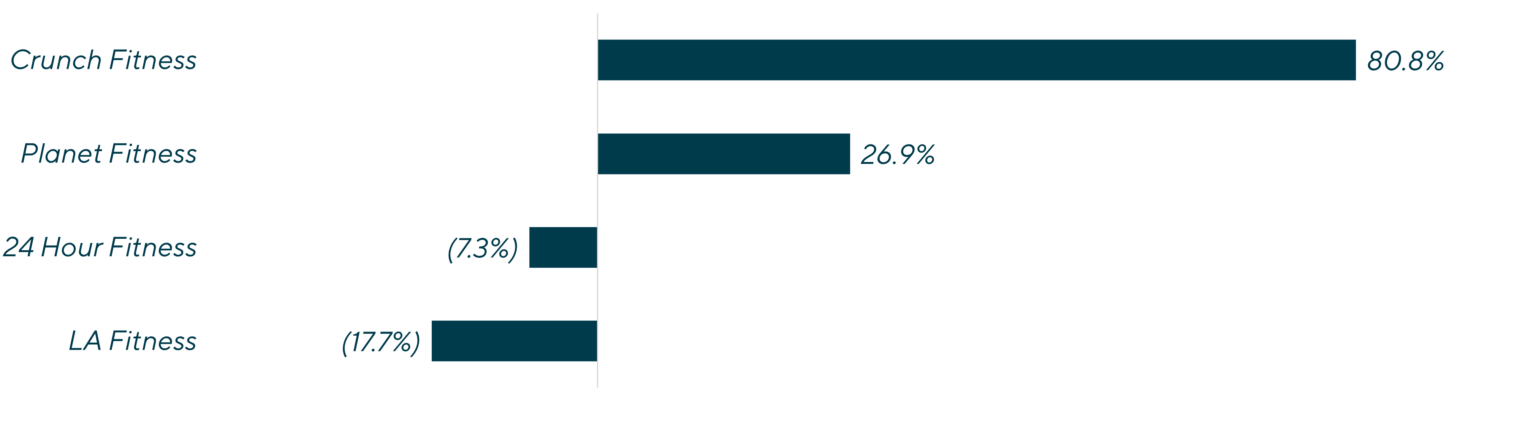

💰 2. Continued Move Towards High-Value, Low Price

As high-end gyms (like Equinox or Life Time) push price to maintain margins, a growing share of consumers are trading down to HVLP chains like Planet Fitness and Crunch. This has opened up a broad opportunity set for budget-friendly, volume-driven fitness platforms—which is where private equity is placing its bets.

LifeTime Fitness Avg. Revenue per Customer

Source: Lincoln International

Change in Visits to Leading Fitness Chains (Q4 2023 vs. Q4 2019)

Source: Lincoln International

💡 3. Franchising as Growth Engine & Market for Consolidation

Many of the fastest-growing fitness concepts rely on franchising to scale—and this creates a fragmented landscape that’s ideal for consolidation. Private equity is already behind many of the largest franchisees across top brands, including United FP, the largest Planet Fitness franchisee (190+ units) backed by American Securities.

Yet the white space remains significant:

~70% of Anytime Fitness locations are owned by single-unit operators.

~90% are owned by franchisees with fewer than 3 locations.

In Planet Fitness, over 120 franchisees own and operate 2,000+ locations—averaging ~16–17 locations per group, leaving room for roll-ups.

And scale unlocks valuation upside:

Single-location gyms trade at 4–7x EBITDA.

Multi-location groups command 8–10x.

Large platforms and public comps trade at low-teens multiples.

EV / LTM EBITDA Multiples over Time

Source: Lincoln International

Looking Ahead

The last 25 years have proven that fitness is a category PE firms return to again and again, with each generation of platforms fine-tuned for new consumer habits, pricing pressures, and growth levers.

The market still seems fragmented, with most franchisees owning fewer than five gyms. That opens the door for roll-up strategies that arbitrage valuation multiples—acquiring mom-and-pop operators at 4–6x EBITDA and building platforms that trade at 10–12x.

Put simply, we’re moving toward a fitness industry that looks a lot like QSR (quick-service restaurants): franchised, consolidated, budget-conscious, and PE-owned.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies