I'm excited to kick off this two-part series on Petco, the once $6.5B pet retail darling that now trades at under $1B market cap. Part 1 will explore how Petco ended up here—by comparing its trajectory to PetSmart, its long-time rival and fellow 2015 PE-backed buyout.

In Part 2, we’ll dig into Petco’s recent performance and walk through an illustrative PIPE investment pitch and model. I’ll also post a step-by-step video walkthrough so those interested in building out a PIPE model (essentially an LBO + preferred and warrant mechanics) can follow along. Stay tuned!

PE Playbook: Pet Retail

State of Play

Petco (NASDAQ: WOOF) has been a disaster for investors, especially for its PE-backers CVC and CPPIB. After peaking at $27.71 per share post-IPO, it now trades at ~$3 per share—a 90%+ drawdown, implying a market cap of ~$950 million.

And with CVC now investing out of Fund 9, Petco (which was invested out of Fund 6) has become an orphan asset despite CVC being the controlling shareholder.

In part 1, let’s explore how Petco ended up here and compare its strategy to PetSmart, which was acquired by BC Partners around the same time in 2015, and unlike Petco, returned 3x+ MOIC to BC Partners thus far.

Investment Thesis

At the time of acquisition, both companies looked like attractive PE plays. Here’s why:

📈 1. Large market supported by growing pet ownership

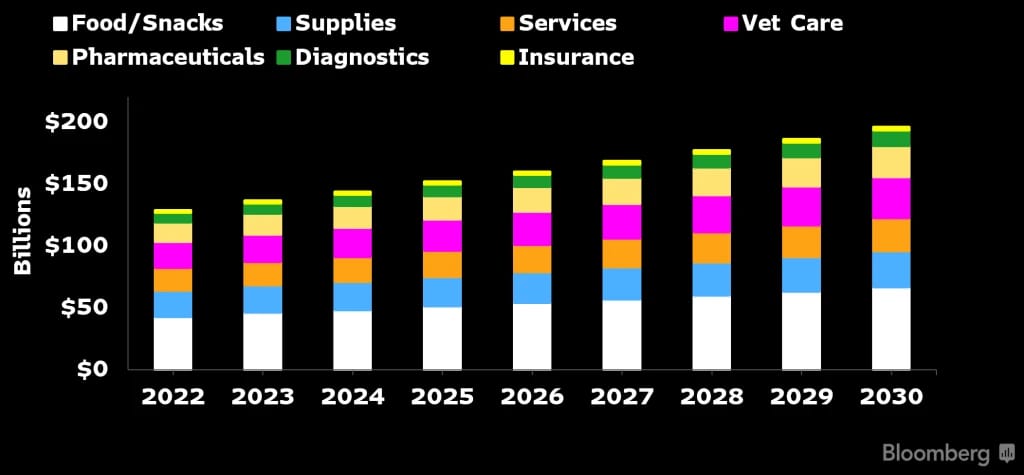

The U.S. pet market is massive at ~$150 billion today, with steady, long-term growth over the last decade, as well as going forward.

Source: Bloomberg Intelligence

A key driver of this growth has been the growth in pet ownership, especially dogs.

Source: American Pet Products Association

As seen above, household ownership of dogs (which is by far the largest category within pets) spiked during COVID. This spike would later come back to bite Petco.

💪 2. Highly resilient and growing spend

Pet spending has historically proven to be insulated from downturns. Even during the 2008 recession, average pet spend grew ~4% CAGR, outpacing inflation.

Source: Bureau of Labor Statistics

And this growth in avg. pet spend has continued to persist over the last decade, accelerating sharply post-COVID.

Source: Bureau of Labor Statistics

🛒 3. (Back in 2015) Increasing, but low e-comm penetration

Back in 2015 when CVC and BC Partners invested in Petco and PetSmart, respectively, e-commerce was a fast-growing, but relatively small part of the pet market. With hindsight, we know that this was going to change drastically–today, the pet product category has one of the highest e-commerce penetration at ~45% in 2025.

For PE buyers back in 2015, the pet retail market looked like an opportunity to own the physical channel while layering in online channels over time.

Source: eMarketer

✌️ 4. (Back in 2015) Duopoly structure in specialty pet retail

In addition to retail being the predominant sales channel for pet products, Petco and PetSmart also held a duopoly position in the market.

In 2015, Petco and PetSmart collectively controlled ~30% (or ~80% excluding independent stores) of the specialty pet retail market, per Petco’s 2015 S-1.

Source: Petco S-1

While we know from hindsight that pet retail has been a tough market due to e-commerce and COVID dynamics, Petco and PetSmart in 2015 looked to be attractive industry leaders with stable growth prospects for private equity buyers.

Petco & PetSmart Value Creation Playbook:

2015-2017: The Chewy Curveball

As Chewy gained momentum, both Petco and PetSmart were hit hard. Petco’s revenue declined from $4.41B in 2015 to $4.39B in 2018. Chewy, meanwhile, was 8x’ing revenue during that time.

Source: Chewy.com

2017-2019: Divergence in Growth Playbook (E-Comm vs. Vet Services)

Faced with declining revenue, the two pet retailers took on a different path to pursue growth:

In April 2017, PetSmart acquired Chewy.com for $3.4B, going all-in on e-comm. This was a widely criticized move as the acquisition added debt burden to PetSmart’s already leveraged balance sheet and as Chewy was unprofitable at the time of acquisition.

Petco, on the other hand, decided to build e-comm in-house while partnering with Thrive Pet Healthcare to open vet hospitals inside its stores to expand into services.

2019-2021: IPOs & COVID Boost

Within 2 years of PetSmart’s acquisition, Chewy had continued to ride on the e-commerce tail, increasing its market share from 13% in 2017 to 28% by 2019.

Source: Earnest Research

This enabled PetSmart / BC Partners to spin out Chewy in an IPO in 2019, which valued the company at ~$9 billion (compared to the $3.4 billion PetSmart paid just two years prior).

Meanwhile, COVID proved to be a boon for Petco, which saw 11% and 18% revenue growth in FYE 2021 and 2022 thanks to the increase in overall pet ownership / spending.

Source: Petco 10-K

That momentum enabled Petco to go public in January 2021, reaching a $6.5B market cap on the first day of IPO. For a brief moment, both companies looked like winners.

2022-Today: COVID Hangover

Then came the unwinding. Pet ownership–particularly among dogs–dropped post-COVID (as shown in the American Pet Products data above), and relatedly, Petco’s high-margin pet sales revenue (captured in “Supplies & Companion Animals” line below) began to decline quickly alongside this ownership trend.

Source: Petco 10-K

This decline in high margin pet sales resulted in a precipitous decline in gross margins as well as Adj. EBITDA over the last 3 years, driving down the stock price from ~$28 at its peak to now ~$3 per share.

Source: Petco 10-k

Looking Ahead

While PetSmart placed a bold bet on e-comm, Petco went the hybrid route—investing in vet services and slowly building digital. Now, both are still battling slow growth and thin margins. But Petco’s decline has been steeper, prompting a recent CEO and CFO shake-up aimed at stabilizing performance and reigniting growth.

Unlike the Walgreens’ buyout (where Sycamore can break apart retail and healthcare into clean pieces), Petco is operationally intertwined, making a traditional buyout trickier. So how can another PE firm get involved?

In Part 2, we’ll explore:

How Vetco (Petco’s vet hospital services business) could be the growth engine

How a PIPE (Private Investment in Public Equity) could provide breathing room

A step-by-step PIPE model with convertible preferred + warrant mechanics

See you next week.