What’s Topical: SaaS + Payments Playbook

Source: ExactPay

Last week, we covered Tribute Technology, which is a great example of vertical software + integrated payments strategy. Today’s edition dives into exactly how the strategy works. But first, some background:

Software PE investing has evolved significantly over the years, with each era giving rise to now-prominent investment firms:

- On-Premise to SaaS Transition (2000s–Mid-2010s)

The shift to cloud-based software delivery fueled the rise of today’s top software PE firms, including Vista, Thoma Bravo, Insight Partners, and Francisco Partners.

- SaaS + Payments (Mid-2010s–Early 2020s)

Investors recognized the ability to monetize transaction volumes within software ecosystems, particularly in e-commerce and service industries. This approach propelled the next wave of firms, such as PSG, Cove Hill, and Accel-KKR, while Vista, Thoma Bravo, and others quickly adopted the strategy.

- SaaS + Payments + AI (Early 2020s–Present)

AI integration is the latest frontier in software investing. However, no clear leader has emerged in the PE space, as firms continue experimenting with AI-driven efficiencies and automation.

Despite AI dominating industry headlines, payments remain a key lever for PE firms to drive revenue growth in vertical software companies. Some notable SaaS + Payments (more commonly known as “Independent Software Vendors” or “ISVs”) deals include:

- Silver Lake’s $2B acquisition of Evercommerce from PSG (2019) – Software for healthcare providers, beauty salons, spas, and home services

- EQT’s $2B acquisition of Storable from Cove Hill (2020) – Self-storage management software

- Global Payments’ $925M acquisition of Zego from Vista (2021) – Multi-unit property management software

- Accel-KKR’s acquisition of Tithe.ly (2022) – Church and ministry management software

- Vista’s acquisition of Portside (2024) – Corporate jet management software

Payments 101: How It Works & Economics

When you use your credit card to make a purchase, a complex network of companies instantly communicates in the background to process the transaction. This process incurs fees for merchants, which is why some businesses—like restaurants—offer discounts for cash payments (and no, it’s not just about avoiding taxes!).

Let’s break it down using a restaurant as an example:

You (the Customer) present your credit card to pay for your meal. The server swipes, taps, or inserts it into the credit card reader.

The card reader transmits the transaction details to the Card Network (e.g., Visa or Mastercard).

The Card Network forwards the transaction request to the restaurant’s bank, known as the Acquiring Bank (can be any commercial bank e.g., Wells Fargo), which handles merchant transactions.

The Acquiring Bank then connects with your credit card’s sponsoring bank, known as the Issuing Bank (can be any commercial bank e.g., Bank of America or Barclays), which reviews and approves the transaction.

Once approved, the Issuing Bank transfers the funds to the Acquiring Bank, which then deposits the money into the restaurant’s account—minus processing fees.

For online purchases, the process is similar, except instead of a physical card reader, you enter your payment details through a payment gateway.

Source: NTT Data

This entire process isn’t free—in fact, the global credit card processing market was valued at over $500 billion in 2023. Every transaction incurs fees, which are split across various players in the payment ecosystem.

Let’s break it down with a simple example:

💳 You purchase a $100 product online using your credit card.

📉 The total processing fee is $2.90, so the merchant receives $97.10.

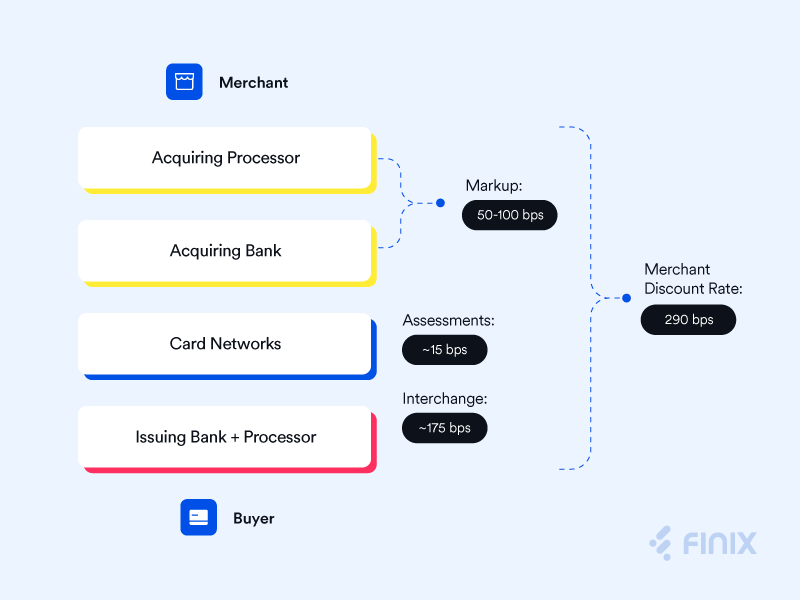

Here’s where that $2.90 goes:

$1.75 → Issuing Bank 💰 (the bank that issued your credit card, e.g., Chase, Bank of America)

This is called the interchange fee, the largest portion of the cost.

$0.15 → Card Network 🏦 (Visa, Mastercard, or AmEx)

This is the assessment fee for facilitating the transaction.

$1.00 → Merchant’s Bank & Software Providers 🏪 (the payment processor/acquirer)

Known as the markup fee, this cut often includes a portion for the payment software (we’ll explain this later).

Even though $2.90 may seem small, when multiplied across trillions of dollars in transactions, it adds up to a massive industry.

Source: Finix

Different Types of ISVs

So, how do vertical software vendors like Tribute Technology, Evercommerce, and Storable capture a share of the payments value chain? They do this by becoming either an Independent Sales Organization (ISO) or a Payment Facilitator (PayFac) for acquiring banks. First, let’s understand the role of Acquiring Banks (i.e., the merchants’ banks) and what parts ISOs and PayFacs play.

🔑 The Role of Acquiring Banks

Acquiring banks are responsible for key functions in credit card transactions, including:

1️⃣ Sales – Bringing in merchants and securing their payment processing business.

2️⃣ Underwriting – Evaluating merchant creditworthiness and conducting compliance checks (e.g., Know-Your-Customer, Anti-Money-Laundering).

3️⃣ Onboarding – Handling paperwork, setting up hardware like card readers, and integrating banking connections.

4️⃣ Merchant Accounts – Establishing bank accounts and offering financial services like tax reporting.

🏦 The ISO vs. PayFac Model

💼 Independent Sales Organizations (ISOs) act as sales agents for acquiring banks.

They take over sales and onboarding while the bank handles underwriting and accounts.

Merchants still sign a direct contract with the bank, just with the ISO’s assistance.

🚀 Payment Facilitators (PayFacs) go further, managing nearly everything except money transfers between banks.

Instead of merchants signing contracts with banks, they become sub-merchants under the PayFac’s master contract with the bank.

This allows instant onboarding—crucial for e-commerce—versus the weeks-long process with an ISO.

💡 The PayFac model is more seamless, which is why many vertical SaaS providers are shifting toward it to deepen their payments revenue and create a frictionless user experience for merchants.

Source: GETTRX

Pros and Cons of Using ISO vs. PayFac for Merchants

Model | Pros | Cons |

Independent Sales Organizations (ISO) | ✅ Ability to negotiate pricing and terms directly with banks, especially for large retailers with high payment volumes | ❌ Longer and more complex onboarding process with extensive bank requirements |

✅ Potential for better pricing through direct negotiations | ❌ Pricing structures can be complex and harder to understand | |

Payment Facilitators (PayFac) | ✅ Quick and seamless onboarding with transparent pricing | ❌ Merchants have little to no ability to negotiate pricing as transaction volume grows |

✅ Ideal for small businesses that need easy setup |

Pros and Cons of Becoming an ISO vs. PayFac for ISVs

Model | Pros | Cons |

Independent Sales Organizations (ISO) | ✅ Easier to get started with minimal upfront technology investment | ❌ Lower revenue share for the ISV, as banks handle core payment functions |

✅ Banks manage underwriting and regulatory compliance, reducing ISV liability | ❌ Lengthy and complex onboarding process for end customers | |

Payment Facilitators (PayFac) | ✅ Higher revenue share and control over pricing for the ISV | ❌ Significant upfront investment in technology and regulatory compliance |

✅ More seamless onboarding process for merchants, improving user experience | ❌ ISV takes on risk and responsibility for underwriting and fraud management |

ISV PayFacs have the flexibility to set their own pricing models for merchants, allowing them to optimize revenue and customer adoption. They can:

✅ Choose a Pricing Structure – ISV PayFacs can charge merchants using different models, such as:

A percentage-based fee on transaction volume (e.g., 2.9% + $0.30 per transaction)

A flat monthly fee, offering unlimited transactions for a predictable cost

✅ Negotiate Bank Fees – Since ISV PayFacs hold the master contract with acquiring banks, they can renegotiate terms over time, lowering their own costs as transaction volume scales. This improves profit margins and enhances long-term economics.

✅ Higher Revenue Share Compared to ISOs – ISV PayFacs typically earn 50-100 basis points (bps) per transaction according to Fractal Software, whereas ISOs earn significantly lower commissions. This makes the PayFac model far more lucrative, though it requires higher initial investment and regulatory compliance.

By controlling both merchant pricing and cost negotiations with banks, ISV PayFacs gain a advantage in monetizing payments efficiently while enhancing customer experience.

Looking Ahead

The software + payments strategy fueled several high-profile, successful exits in the late 2010s and early 2020s. These exits, in turn, created a growing ecosystem of ISV-focused executives who are now shaping the next wave of investments. Notable figures include:

Rob Wechsler (Founder of Blue Star Sports) → Launched Blue Star Innovation Partners

Ross Croley (Founder of Community Brands & Ministry Brands) → Started Greater Sum Ventures

While ISV-related exits have slowed in recent years, largely due to broader softness in the software market, the ISV business model remains stronger than ever. As illustrated below, more merchants are increasingly relying on ISVs to process online payments—tapping into a market that, as mentioned earlier, is worth hundreds of billions of dollars.

Source: PayPers

That’s a wrap for this week’s PE Training. See you Saturday with another Deep Dive!

RATE TODAY’S EDITION

If you enjoyed the newsletter, please share with friends and subscribe at https://perollup.beehiiv.com/subscribe