PE Playbook: C-Store Software

State of Play

Last week, Bloomberg reported that Insight Partners is exploring a $4.5B+ sale of PDI Technologies, a company most consumers have never heard of—but nearly every convenience store depends on.

PDI Technologies has been one of those rare “gifts to private equity”—a niche carve-out that evolved into a category-defining platform. Over the last decade, five PE firms have taken a turn on the cap table, helping transform PDI from a back-office c-store ERP system into a full-stack software and IT services company.

What started as a specialized ERP solution has grown into a multi-product, multi-national juggernaut touching every part of the value chain—from suppliers and logistics providers to retailers and consumer brands.

Let’s break down how it happened.

How PDI Makes Money

PDI’s product suite covers the entire c-store value chain, spanning ERP/back-office solutions, fuel logistics, retail POS, loyalty marketing, mobile payments, and managed services. It makes money across several revenue streams, including SaaS subscriptions, hardware sales, transaction fees, managed IT contracts, and data monetization.

Product Line | Function | Revenue Model | Primary Customers |

ERP (Enterprise Resource Planning) | Fuel inventory, compliance, accounting | SaaS + services | C-store chains, fuel wholesalers |

POS Software & Hardware | Checkout systems, foodservice, mobile payments | License, transaction fees, hardware sales | C-stores, food-forward retailers (e.g. Wawa) |

Loyalty & Offers Software | Digital rewards, CPG promos, redemptions | Subscriptions, CPG data monetization | C-stores, CPG brands (e.g. PepsiCo) |

Payments & Mobile Commerce | Wallets, receipts, fleet card acceptance | Per-transaction fees, app hosting | C-stores, truck stops |

Logistics Optimization | Dispatch, routing, tank telemetry, planning | SaaS | Fuel distributors, delivery operators |

Cybersecurity & Managed IT | Endpoint protection, monitoring, PCI compliance | Monthly managed services contracts | C-stores, quick service restaurant (“QSR”) chains |

Retail Data & Analytics | SKU-level POS data, campaign dashboards | Subscription + data licensing | CPG manufacturers targeting c-store channels |

In short: PDI sells software, services, and data—while capturing both sides of the transaction (retailers and suppliers).

Investment Thesis

📈 1. A massive market…and surprisingly resilient

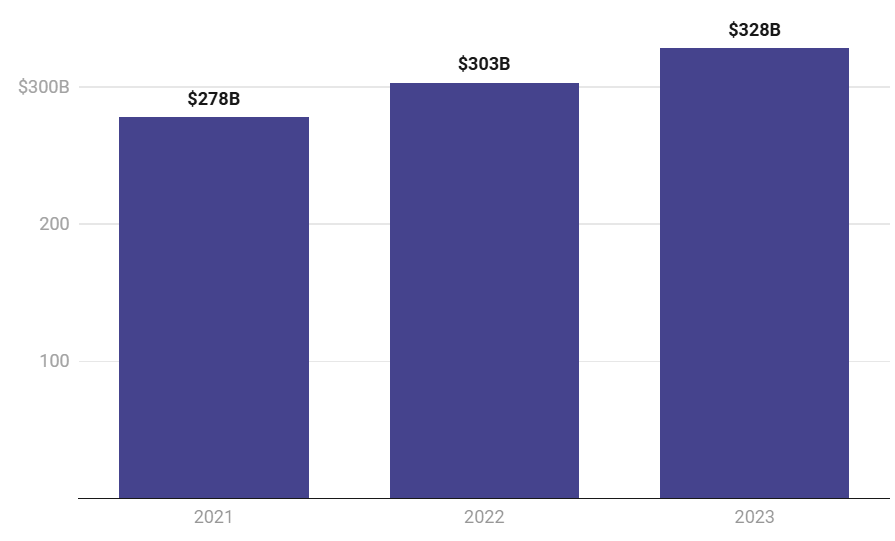

The U.S. c-store market is estimated at $300B+ (excluding fuel) and grew at ~8.5% CAGR from 2021–2023, likely aided by food & beverage inflation.

Source: C-Store Dive

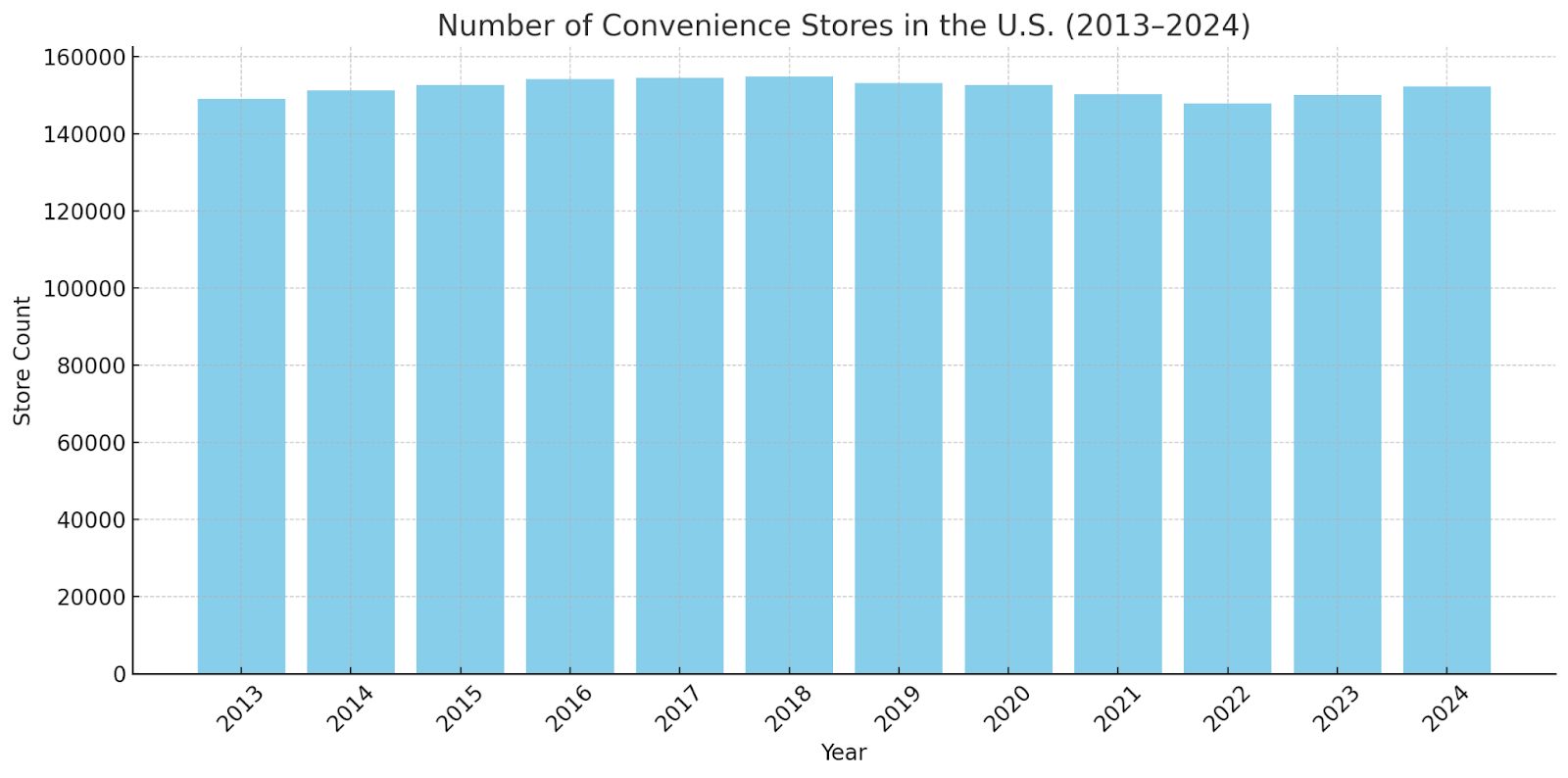

Despite the EV boom, there’s been little dent in the number of stores, which has hovered around 150,000 locations, per NACS. C-store demand remains resilient.

Source: National Association of Convenient Stores (NACS)

🧩 2. Fragmented operators & consolidation buyers

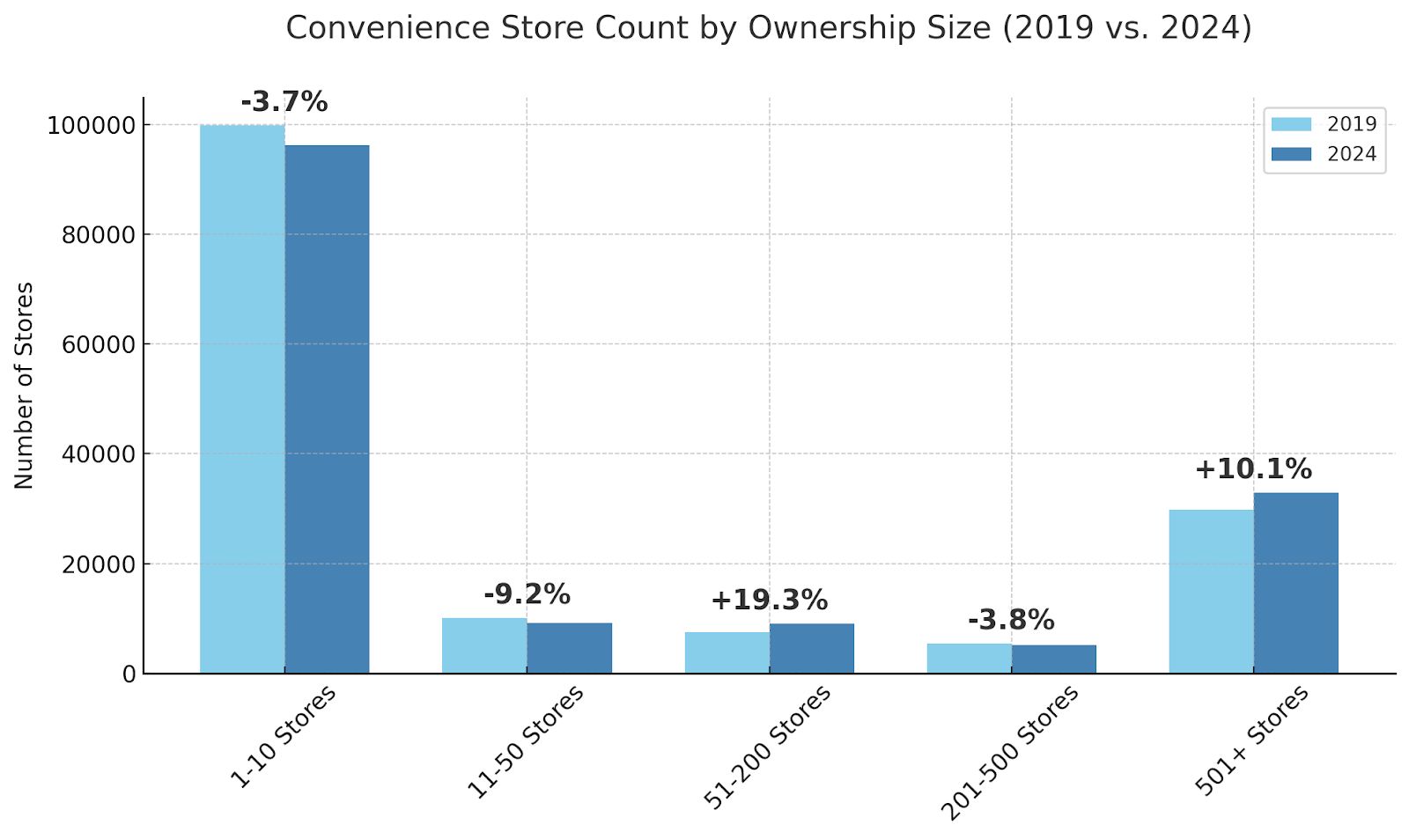

Roughly 65% of U.S. convenience stores are operated by SMBs owning 10 or fewer locations. Of those, 95% are single-store operators—a long-tail ripe for software modernization.

C-Store Count by Company Size (# of Stores Owned)

Source: NACS

At the same time, top players like 7-Eleven (~13k stores), Circle K (~7k), Casey’s (~2.5k), as well as midsized player such as GPM Investments (Fas Mart & Shore Stop) and Maverick are continuing to roll up the industry.

Source: NACS

This consolidation has created demand for enterprise-grade software platforms like PDI that can support hundreds and thousands of locations.

🧩 3. Changing store formats = more tech

The average c-store isn’t just selling snacks and smokes anymore. Stores like Wawa and Sheetz operate like full-blown quick-service restaurants.

That shift turned c-store visits from “once in a while” to “multiple times per week,” with consumers stopping by for lunch, coffee, or groceries. With greater complexity came new software needs, including POS, loyalty, pricing, and data integration.

Source: Earnest Analytics

🧩 4. Legacy tools with room for modernization

The original c-store software stack dates back to the 1980s, when vendors like SSCS launched DOS-based accounting tools. Some are supposedly still in use (!).

With the rise of cloud-based systems and consumer-facing UX expectations, the market was overdue for modernization and full integration across the technology stack.

Company History & Value Creation Playbook:

2015: Carve-Out by Luminate Capital

PDI was spun out of McLane Co., a logistics subsidiary of Berkshire Hathaway. Luminate Capital backed the management buyout, giving PDI its independence. Just one year later, Luminate sold the company to TA Associates. While not common in the industry, Luminate’s strategy includes quick flip of carve-outs and founder-owned businesses (e.g., in 2017, Luminate invested in an alcohol beverage software company called Fintech that they sold to TA a year later in 2018).

2016–2017: TA Associates Builds the Core Stack

Under TA’s ownership, PDI consolidated its foothold in fuel supply chain and ERP.

Supply Chain Software:

Acquired Intellifuel, FireStream, and LOMOSOFT to capture the full gasoline supply chain from midstream (transports crude oil, which is refined to make gasoline) to downstream (processes crude oil to make gasoline) to wholesale (markets gasoline from downstream companies to businesses like c-stores, who then sells to consumers), in addition to expanding into Europe.

ERP/Back-office Software:

Acquired The Pinnacle Corp. and DataMax to eliminate competitors and expand into 50 international markets.

2017–2018: Genstar Joins, Marketing Stack Added

A year in, Genstar Capital joined the cap table. Under Genstar, PDI expanded into front-office and customer engagement tools.

Supply Chain Software:

Acquired TelaPoint and TouchStar for inventory and pricing solutions for wholesalers, as well as mobile workforce management tools for carriers / truckers.

Loyalty & Marketing Software:

Acquired Excentus (fuel loyalty) and Outside Networks (customer engagement). With these two acquisitions, PDI was able to offer a unified customer marketing and engagement platform that enabled targeted promotions and loyalty programs based on the purchasing data sitting in their ERP/back-office software.

These moves gave PDI a closed-loop solution: from inventory, back-office, and logistics to customer promotions.

2019–Present: Insight Partners Scales and Expands

Insight Partners acquired PDI in 2019 at a reported $1.6B valuation, and expanded beyond software:

ERP/Back-office Software:

Acquired CStorePro, a software tool for single-store c-store operators. As covered earlier, this segment accounts for ~60% of the c-store market, and this acquisition broadened PDI’s market to include the long-tail of the c-store industry

Point of Sale (POS):

Acquired Orbis Tech, which offers POS systems that integrate with back-office tools like ERP and supply chain software that PDI has

Acquired Comdata’s POS business, which provided payments hardware and POS software for truck stops. The acquisition, combined with Orbis, completed end-to-end (POS to payments to back-office software) technology stack across both consumer and fleet / truck segments

Adjacent Services: Having captured the software value chain, Insight expanded into adjacent services (with recurring business models)

Acquired Cybera, an outsourced managed service provider of network (e.g., internet wifi) and cybersecurity (e.g., firewalls) and ControlScan’s Managed Security business, which provides 24/7 cybersecurity monitoring and threat detection/response services

These acquisitions enabled PDI to provide outsourced services for their customers, who were harmonizing the technology infrastructure across all their locations (and therefore became interconnected vs. each location having its own on-premise software). This harmonization then created a demand for PDI to manage the technology infrastructure on behalf of the customers

PDI continued to scale their services capabilities, completing the acquisition of Nuspire, another managed security services provider, in June 2024

Through acquisitions, PDI has become a one-stop shop that not only covers front-end (marketing, loyalty, POS) and back-end (ERP, supply chain) systems but also provides hands-on services to manage those systems on behalf of customers. On top of this feat, PDI has also acquired GasBuddy, a popular mobile app that tracks real-time gas prices, to expand from a B2B only business model to a B2B+B2C+B2B2C business model.

Looking Ahead

Over the last decade, PDI has been a massive success story–for example, TA reportedly made a 7x return over 3 years on their sale to Insight. And the question is: who’s the next buyer?

On the strategic side, AspenTech (acquired c-store ERP competitor Petrosoft; now owned by Emerson) and Corpay (formerly Fleetcor, a serial acquirer in vertical software/payments) could be buyer candidates.

On the sponsor side, another continuation fund or even a public offering could be on the table.

Whatever happens next, PDI is a poster child for how private equity can turn a niche carve-out into a billion-dollar industry leader—through disciplined M&A, platform thinking, and complete value chain capture.