On Thursday, we shared a data center HVAC cooling company for sale, which inspired this piece. Today’s write-up is a slightly different format–aimed to give you a good understanding of the history of PE investing in data centers and less about the investment thesis (which is simple: stability of real estate with long-term contracts + insatiable demand due to exponential data growth).

We will also touch on second-order investment themes around data centers (and telecom infra more broadly) and do a deep dive on it next week!

RTC Interviews: CEO of Tinuiti (New Mountain Backed)

Before we dive in, excited to kick off another event! This time we’re interviewing Zach Morrison, CEO of Tinuiti. I encourage everyone to RSVP here and reserve your seat!

PE Playbook: Data Centers

State of Play

AI is the hot thing today, and relatedly, data centers that power AI have been a big focus area among the investing community.

Case in point: in October, Meta partnered up with Blue Owl to raise $30 billion in a data center joint-venture. The news made waves as $27 of the $30 billion was private debt–making it the largest private credit deal in history.

But rewind back to fifteen years ago when PE started to make data center investments. Back then, it was a niche business model of renting out server spaces to companies (called “colocation”) and only a handful of PE firms invested in the space. Over time, we’d go on to see the birth of digital infrastructure firms such as Stonepeak and EQT Infra as data center investing evolved.

Let’s delve into the history of the asset class through 3 key mega trends: (1) transition from on-prem to the cloud & colocation; (2) digital content boom & edge computing; and (3) AI compute.

Presented With

Proladex helps private equity firms discover service providers across deal origination, company management, and back-office solutions.

We solve the problem of vendor selection and diligence by providing a curated list of reference checked service providers, including:

- Capital Markets & Advisory

- Executive Search & Recruiting

- Quality of Earnings & Diligence

- Consulting & Brokerage

PE investors can sign up at no-cost here

Service Providers can explore our introductory trial by scheduling a call

*Interested in reaching 4,500 readers in the PE ecosystem? Inquire about our sponsorships.

PE Data Center Investment Overview

Phase 1 - Transition From On-Prem To The Cloud & Colocation

The Backdrop

The 2000s and 2010s marked a pivotal shift in enterprise IT infrastructure. Traditionally, companies maintained on-premise servers requiring substantial capital expenditure.

Example server room. This is what your IT team used to be responsible for (and some still do).

But building and maintaining in-house servers demanded significant upfront investment in hardware, real estate, and ongoing IT expenses.

The emergence of data centers (which is just a large space purpose-built for fitting as many servers as possible) offered an attractive alternative to enterprises–converting these capital expenditures on servers and real estate into variable operational expenses by sharing capacity in data centers owned by third parties.

Amazon Web Services launched EC2 in 2002 allowing users to host applications in shared environments on Amazon-owned servers sitting inside Amazon-owned data centers (called “public cloud”).

Simultaneously, other shared data center models emerged alongside public cloud, offering enterprises either an option to rent dedicated physical space in a data center to operate their own hardware (called “colocation”) or an option to rent dedicated environments on shared hardware in a data center (called “private cloud”).

These different models across colocation, private cloud, and public cloud offered different levels of control (over physical assets and data), security, and scalability that allowed most enterprises to take advantage of the cost efficiencies offered by data centers. The result? Massive adoption of cloud.

Source: Zippia, Statista

Source: Zippia

Private Equity Play

So how did private equity capitalize on this migration-to-the-cloud trend? Not surprisingly, in all ways possible–across colocation, cloud, as well as managed services.

Sponsor (PE Fund) | Target Company | Entry Date | Strategy & Notes |

|---|---|---|---|

Oak Hill Capital | ViaWest | Apr 2010 | Colocation play. Oak Hill scaled ViaWest to 27+ data centers across the U.S., focusing on hybrid IT and colocation for enterprise workloads. Sold to Shaw for $1.2B. |

GI Partners | SoftLayer | Aug 2010 | Cloud play. SoftLayer was an early provider of cloud hosting and private data centers. Sold to IBM for ~$2B, becoming the backbone of IBM Cloud. |

Avista Capital Partners | DataBank | Jun 2011 | Colocation play. Avista scaled DataBank through acquisitions and organic buildouts across Tier 2 markets, focusing on enterprise edge colocation. |

Apollo | Rackspace | Aug 2016 | Managed services play. Apollo took Rackspace private for $4.3B to pivot toward designing, building, and operating cloud environments for customers. |

These early deals set the stage: PE investors realized data centers have sticky customers on long-term leases as many enterprises moved from on-prem servers to cloud & collocation servers.

Private equity coined the term “digital infrastructure” investing.

Phase 2 - Digital Content Boom & Edge Computing

The Backdrop

Another defining trend in the 2010s was the explosion in digital content (e.g., Netflix, Instagram) consumption that fundamentally reshaped data center requirements. For context, by 2010, Netflix streaming alone accounted for about 20% of peak downstream bandwidth in the U.S., and by 2011, streaming video was officially the largest source of internet traffic.

But what does it mean by “reshaped data center requirements”? Unlike one-off downloads typical in corporate settings, streaming meant handling millions of users pulling low-latency, continuous flow of data concurrently.

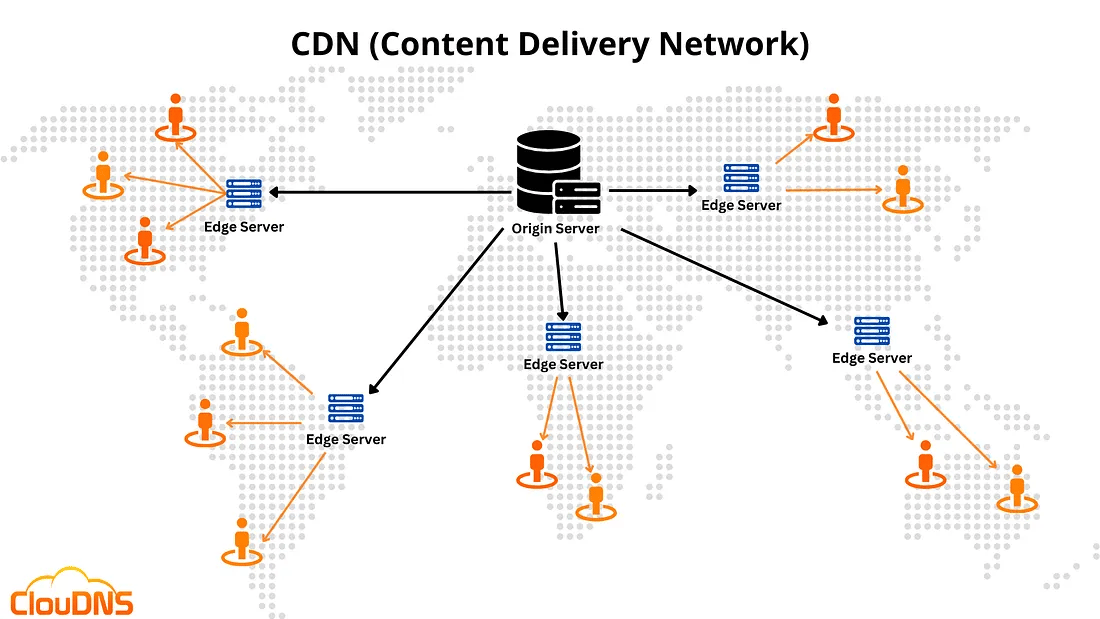

Traditional centralized data centers–which were clustered around large metros since they were serving enterprises–couldn't efficiently deliver this content to globally distributed users. The solution was edge computing and Content Delivery Networks (CDNs), a system of distributed servers storing pre-cached content closer to the users to reduce latency.

Source: ClouDNS

As more and more internet traffic went through CDNs, the need for edge servers exploded.

Source: Cisco

We focused on digital content here but also note that other megatrends–such as 5G and IoT (“internet of things”; think Tesla)--also required low-latency supported by edge servers

Private Equity Play

The edge computing need presented PE firms with an opportunity to roll up regional facilities and build interconnected networks optimized for content delivery.

Sponsor / Backers | Target / Platform | Launch / Entry Date | Strategy & Notes |

|---|---|---|---|

Providence Equity | EdgeConneX | Founded 2009 | Edge colocation play. Pioneer of edge data centers — started by building local content delivery nodes for cable firms like Cox. Scaled to 40+ markets. |

Liberty Global + DigitalBridge | AtlasEdge | Formed 2021 | European edge platform. Formed via JV; now operates 100+ edge data centers across Europe (Amsterdam, Berlin, Milan, etc.). Focused on Tier 2 cities with strong enterprise and 5G edge use cases. |

Berkshire Partners (early investor), Crown Castle (infra partner) | Vapor IO | Founded 2015 | Wireless edge play. Focused on ultra-low-latency edge colocation for 5G and autonomous workloads. Partners with tower, fiber, and wireless providers to deploy metro edge zones. |

Efficiently storing and effectively delivering data to end users became a global problem that edge data centers helped solve. And in the background, the data center asset class became more and more institutionalized with many deals in the billions and 20x+ multiples throughout the mid 2010s to early 2020s (partially fueled by lower interest rates, which buoyed all real estate / heavy capex industries).

Phase 3 - AI Compute

The Backdrop

The launch of ChatGPT in late 2022 catalyzed a fundamental reimagining of data center infrastructure. Amazon, Microsoft, Google, and Meta are expected to spend hundreds of billions on data center capital expenditures in 2025 and 2026.

AI workloads demand another set of requirements compared to traditional cloud computing:

Power: AI requires much more power than traditional enterprise compute

Network: Ultra-low-latency connectivity required between thousands of GPUs

Cooling: high power requirements = more heat, forcing adoption of new cooling methodologies

Scale: Mega-campuses with contiguous power availability

Data center demand now is all about powering the adoption of AI across consumers and enterprises.

Source: McKinsey

Private Equity Play

These are the deals that you hear about in the news right now. In summary, it’s a gold rush at an unprecedented scale.

Sponsor / Consortium | Target Company | Date | Deal Size | Strategy & Notes |

|---|---|---|---|---|

GIP (BlackRock) / AIP (Microsoft, Nvidia), MGX | Aligned Data Centers | 2025 | ~$40B | AI-focused platform. Scalable, AI-ready campuses built by previous investor Macquarie Infrastructure Partners. |

Blackstone (with CPP Investments) | AirTrunk | 2024 | ~$16B | Asia-Pacific AI expansion. Acquired hyperscale operator across 11 sites in APAC from previous investor Macquarie. Investment driven by surging AI workloads and cloud demand in Tier 1 and Tier 2 markets. |

AI has turned data centers from a yield play into a global arms race.

In summary, phase 1 was about shifting capex (on-prem servers) to opex (rent out space) with the internet and cloud boom, phase 2 was about efficiency in storage and delivery of data to end users, and phase 3 is about the birth of a whole new technology in AI.

Second-Order Investment Theme

In every gold rush, it's the picks-and-shovels sellers who quietly get rich. While headlines fixate on billion-dollar data center deals and hyperscaler spending sprees, private equity is making a parallel bet: acquiring the contractors, electricians, and maintenance crews that make these facilities possible.

This second-order play captures the recurring, infrastructure-driven growth without the capital intensity of owning data centers themselves, which allows smaller PE firms (without tens of billions of committed capital) to touch every phase of the data center lifecycle: construction, commissioning, maintenance, and modernization.

We’ll do a deeper dive in this theme next week, but here’s a preview:

Case Studies: The Boring-Turned-Sexy Deals

Initial Sponsor → Buyer | Target Company | Date | Strategy & Notes |

|---|---|---|---|

Tailwind Capital → Braemont Capital | Loenbro | 2024 | Electrical & industrial services. Originally a regional contractor; expanded under Tailwind into a service provider for hyperscale and enterprise data centers. Now backed by Braemont and on a data center-focused roll-up spree. |

New Mountain Capital → CBRE Group | Pearce Services | 2025 | UPS / cooling / maintenance. National field services platform with 4,000+ technicians across 50 states. Provides UPS (Uninterruptible Power Supply), generator, battery, and HVAC maintenance — key to uptime in colocation and hyperscale sites. |

Gryphon Investors → Blackstone (Energy Transition Partners) | Shermco Industries | 2025 | Electrical testing & power systems. Rolled up high-voltage testing and maintenance specialists. Serves utilities and mission-critical clients (including data centers). |

Learn how PE firms actually do deals—from start to finish.

Road To Carry PE course walks you through the full PE deal process, not just modeling. Bite-sized videos & exercises & 40+ real-life files. For analysts, associates, or anyone interested in learning how PE firms do deals. Past alumni include associates from Carlyle, Apax, Charlesbank, and Gryphon. Click below for a free preview and 50% subscriber discount.

Looking Ahead

Where are we in the data center PE investing boom? On one hand, big tech companies have already poured hundreds of billions into new builds. On the other, the AI wave is still accelerating.

The digital infra funds aren’t the only ones benefitting from the data center boom. It’s everything around them. The contractors wiring the power lines and maintaining the HVAC are suddenly in play.

Next week, we’ll unpack that second-order opportunity — the service ecosystem behind the data-center & broader telecom infra buildout — and how PE is quietly turning electricians, mechanics, and maintenance crews into billion-dollar businesses.

What should I cover next? Send ideas to [email protected]