Visiting family in North Carolina this past week, we hiked in Asheville and Boone. Today's edition explores how AllTrails—the hiking app with 80M+ users—grew to dominate outdoor leisure with PE backing from Spectrum and Permira.

As always, if there’s a sector or company you’d like me to dig into, drop me a note at [email protected]

PE Playbook: AllTrails

State of Play

AllTrails has become an essential tool for hikers, campers, and outdoor enthusiasts. The app offers reviews, photos, and maps for more than 450,000 trails globally, helping users discover new spots and avoid getting lost—even without cell service.

But when Spectrum invested $75M for a majority stake in 2018, it caught me by surprise. A consumer app? Freemium model? For an activity that's literally free? I was wrong. By 2021, Permira validated the thesis with a $150M growth round while Spectrum retained control—signaling massive value creation.

Let’s unpack AllTrails’ success to-date and where private equity could take it next.

Company History

Founding & Early Growth

AllTrails was founded in 2011 by Russell Cook to address a personal pain point: lack of digital trail maps and user reviews. Riding on the proliferation of smartphones and GPS technology inside them, Russell raised $400k seed funding to launch the product.

And it was an instant hit–1,000 users signed up on day 1. One year in, AllTrails reached 200k users. In that same year, the company partnered with National Geographic to directly integrate NatGeo’s mapping data and redirect NatGeo website visitors to AllTrails. By year 2, AllTrails reached 1 million users.

Early version of AllTrails

Source: TechCrunch.com

Then in 2016, AllTrails made a strategic move to acquire its main competitor EveryTrail from TripAdvisor. The combined app became an instant leader with over 5 million users.

Revenue Model

AllTrails has operated on a freemium model ever since its launch.

Free Tier (AllTrails Basic) | Paid Tier (AllTrails+ / Premium) | |

Price | $0 (monetized with ads) | ~$35/year (ad-free) |

Features | Trail search, user reviews, GPS tracking | Offline maps, turn-by-turn navigation, alerts, overlays |

Target User | Casual hikers | Serious hikers, backpackers, runners, international travelers |

Conversion Drivers | Trail discovery | Safety (offline maps, alerts), convenience (route planning, overlays) |

While financials are not public, the company disclosed in 2021 that it had 25 million total users, of which 1 million were paid (equating to ~$35M ARR + ad revenue).

By 2018, AllTrails had 9 million total users, which implies (using the same % paid user as 2021) ~360k paid users (equating to ~$12.5M ARR + ad revenue).

In 2018, Spectrum acquired the business with a $75M investment, which implies a ~6x revenue multiple–rich for a B2C mobile app. But with its explosive growth, AllTrails has been a success story for Spectrum that Permira validated with its $150M minority investment.

Source: AllTrails

Spectrum Investment Thesis / Value Creation

1. Massive Outdoor Recreation Market–Hiking As the Entry Point

Silly to state the obvious but outdoor reaction is practically a universal hobby. And it is one of the largest sectors of the economy, after the essential healthcare and financial services industries.

Source: OutdoorIndustry.org

And within outdoor activities, hiking is the 3rd most popular activity by participant count.

Source: Travelness.com, Outdoor Foundation

So how did AllTrails/Spectrum go about dominating a huge market like this?

2. M&A Fueled Global Consolidation–Winner Takes All

AllTrails immediately stepped on the the M&A gas pedal following the Spectrum investment in October 2018:

In April 2019, acquired iFootpath–a UK-based walking trails app with over 1,300 curated guides on trails in the UK

In July 2019, acquired Trails.com-a U.S.-based outdoor trail site that grew combined library of trails to over 75k

In August 2019, acquired GPSies-a Germany-based trail platform with hiking, walking, and cycling trail maps across Europe. Also added route planning capabilities.

These acquisitions, combined with the 2016 acquisition of EveryTrail, propelled AllTrails to be the dominant player. By the end of 2019, the company grew to over 10M registered users and ~50M unique app/website visitors.

Much like how big players in other user-generated-content markets (e.g., TripAdvisor in travel and Meta in social media), AllTrails and Spectrum understood that M&A is a powerful tool to cement dominance in self-reinforcing, network-based businesses.

Source: GrowthLoopTearDown newsletter

3. Hyperlocal SEO Dominance–Explosive Organic Growth

AllTrails and Spectrum quickly amassed 10 million users by 2019 via M&A. But they also executed on key organic growth initiatives to reach 25 million users by 2021. Here are some interesting stats (per GrowthLoopTearDown newsletter):

68% of AllTrail’s 18M monthly visitors come from organic search (zero cost)

Of that search traffic, ~80% is not branded (i.e., they are not searches for “AllTrails”)

So how do they do it? Hyperlocalized SEO.

When we search trails, we typically search for “hiking trails near [me] / [specific location]”. And unsurprisingly, these are the #1 search keywords that lead to AllTrail’s website/app.

Source: GrowthLoopTearDown newsletter

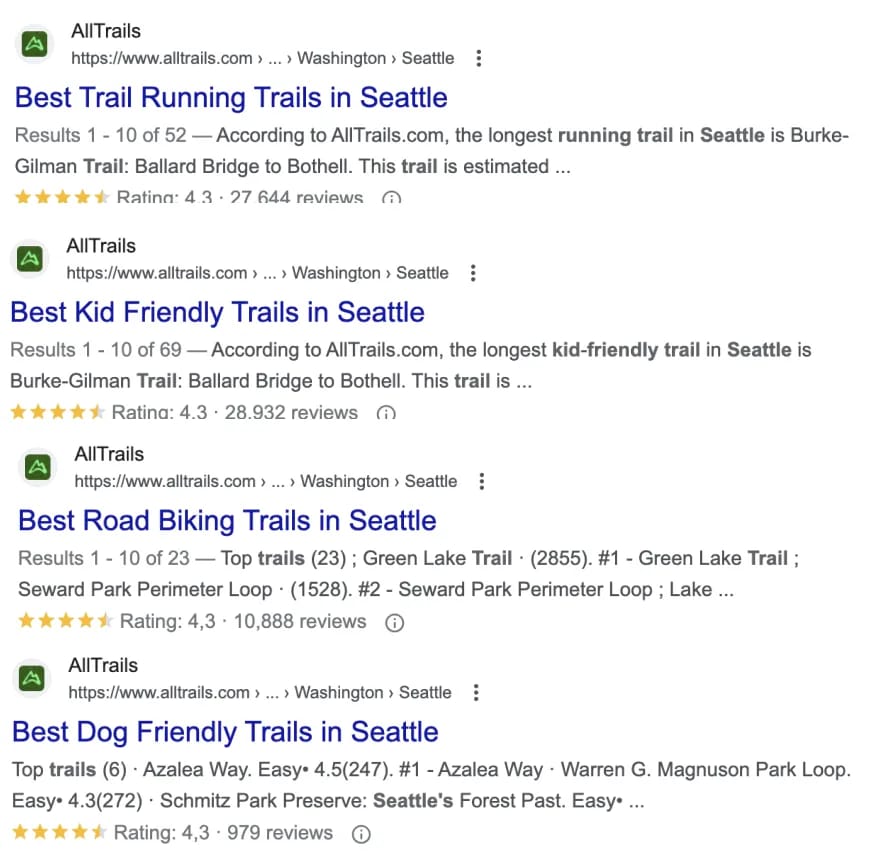

And they sliced up the landing pages in a million ways via automation. You simply can’t miss AllTrails if you are looking to hike, walk, bike, or do anything on a trail.

Source: GrowthLoopTearDown newsletter

In a low-price B2C app ($35/year), outbound sales doesn’t make sense and within inbound, organic search is critical to grow profitably. And AllTrails nailed it–they grew organically from 25M users in 2021 to 80M users by 2025.

Source: AllTrails

These organic and inorganic initiatives were very quickly implemented over a 3 year period between 2018-2021, culminating in a $150M minority investment from Permira. This is one of the best examples of B2C app investment well-done by PE.

Looking Ahead

Since Permira’s investment in 2021, M&A has been muted, and instead AllTrails has focused on:

Product development. Personalization, social/community features, and internationalization with in-app language localizations

TAM expansion. Expanding beyond hiking into other activities like mountain biking, trail running, camping, and rock climbing, aiming to be the go-to guide for all outdoor pursuits

This expansion of use cases and user base grows AllTrails’ TAM even further before the company eventually shifts into “harvest mode” on monetization.

But, despite reaching 80M users, AllTrails remains relatively small—estimated <$100M revenue in 2025. So where could it go next?

Potential Playbook: PSG’s “Consumer App to B2B Software” Play

In April 2020, PSG acquired Untapped, the most popular consumer app & community website for craft beer enthusiasts. It’d go onto acquire other B2C beer magazine and events companies (Hop Culture, Oznr, BeerAdvocate) in the same year, before pivoting to B2B software acquisitions in 2021 (brewery management/ERP software Fermentable and B2B2C distribution marketplace in Ollie).

AllTrails could go on to acquire B2B outdoor events and program management software tools. Afterall, Vista’s outdoor events software Active Network was sold to Global Payments in 2017 for a staggering $1.2B.

Or,

Spectrum and Permira could sell out to a consumer brand–similar to Under Armour’s acquisition of MyFitnessPal, which became an orphan asset later divested at a loss to Francisco Partners.

What do you think—should AllTrails pivot to B2B or stay consumer-focused? Hit reply and let me know.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies