Fresh off the Nova Scotia golf trip, I couldn't resist a golf-inspired case study. This one's particularly relevant—it shows how timing and operational discipline can turn a distressed asset into a 9x return.

PE Playbook: TaylorMade

State of Play

Today, TaylorMade sits near the top of the golf world with a star-studded roster of tour sponsorships—Tiger Woods, Rory McIlroy, Scottie Scheffler, and more. But the path here wasn’t straight.

In 2017, Adidas gave up on golf and sold the money-losing TaylorMade to KPS Capital for $425 million. Four years later, KPS sold it to South Korea’s Centroid Investment Partners for ~$1.7 billion, reportedly a 9x equity return. Now, Centroid is prepping an exit at a rumored $3.5 billion valuation.

Let’s unpack this fascinating private equity turnaround story.

Company History

Pre-Adidas Ownership (1979-1997)

Founded in 1979 by golf salesman Gary Adams, TaylorMade made its name by introducing the modern “metalwood” drivers to the golf world, which was then dominated by “persimmon wood” drivers.

Old-school persimmon wood driver vs. modern metalwood driver

Source: GolfWRX

With more distance and more forgiveness, the TaylorMade metal clubs quickly gained massive adoption. Riding that success, Adams sold the company to French sports conglomerate Salomon in 1984. Adidas later acquired Salomon in 1997, bringing TaylorMade under its wing.

Adidas Era (1997-2017)

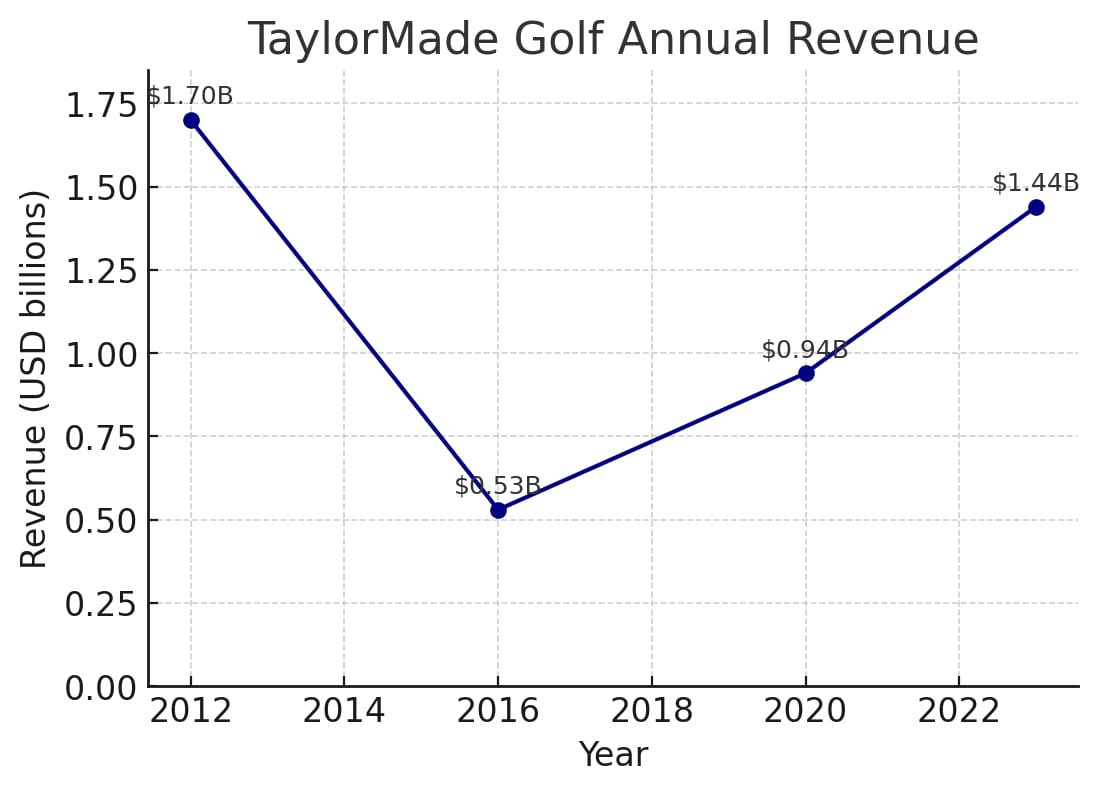

Under Adidas, TaylorMade became one of the leading golf brands, topping $1.7 billion sales by 2012. Along the way, the company acquired smaller brands such as Adams (exactly…you’ve probably never heard of this brand or maybe you’ve seen one sitting in your dad’s garage) and Ashworth (clothing brand).

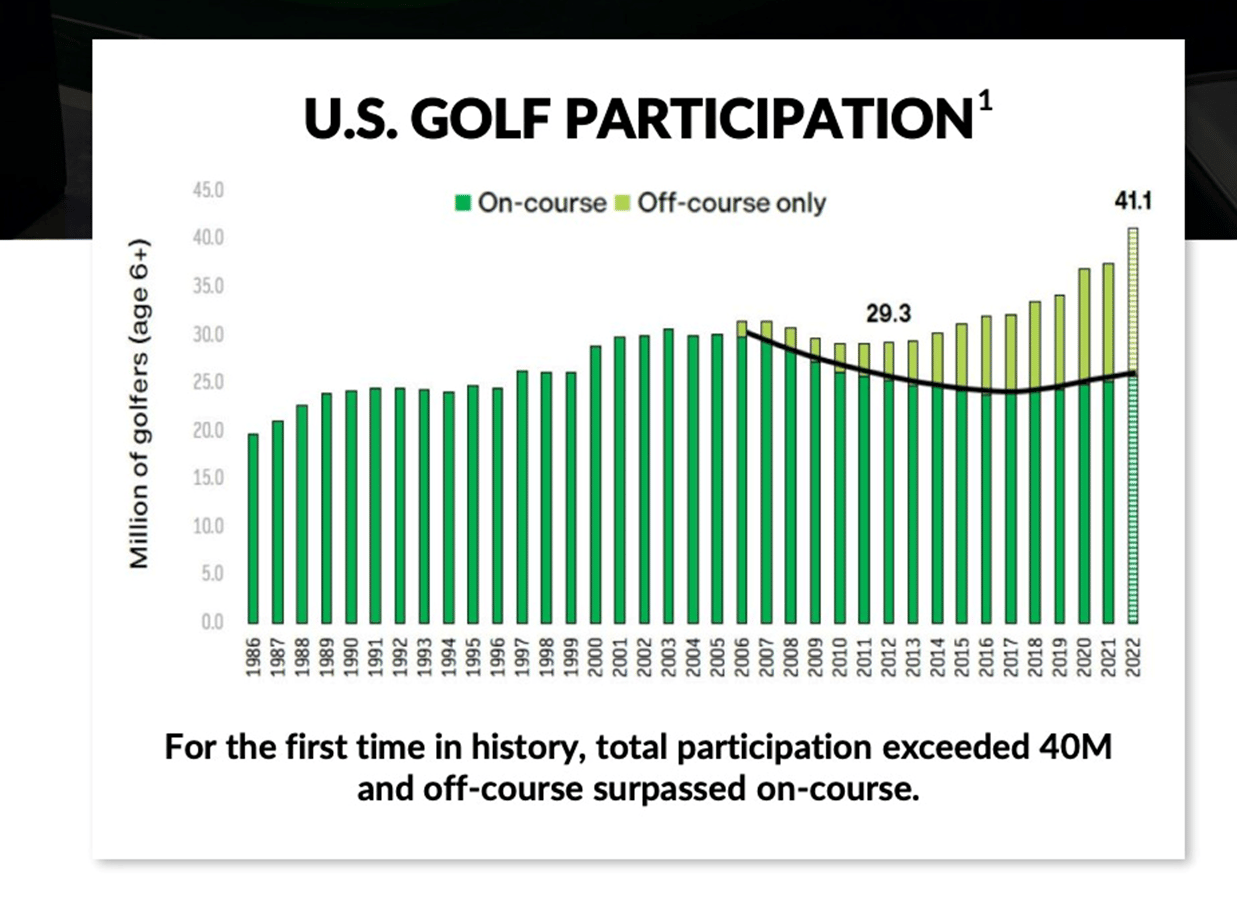

Then came the slump. Between 2012 and 2016, sales fell 70% to $500 million. Golf participation declined and brands waged discounting wars. By 2017, TaylorMade was losing $7 million in EBITDA, and Adidas offloaded the company to KPS for just $425 million—half in cash, half in debt and contingencies.

Source: National Golf Foundation

KPS Investment Thesis / Value Creation

1. Catching the Golf Participation Bottom–Luck or Skill?

Unknown to Adidas, golf participation in 2017 was the bottom.

Source: National Golf Foundation

It’s impossible to tell as an outsider if KPS proactively had a thesis around rebound in golf participation. But there were signs.

While on-course participation was declining, golf was experiencing an off-course boom (think Topgolf). The off-course channel was quietly building a massive pipeline of golfers that’d commit to purchasing their own golf sets to play on the field.

Source: HuddleUp Newsletter

And this pipeline was bursting–the number of new on-course golfers jumped in 2017, and it was a matter of time before the on-course golf participation decline bottomed out. Luckily for KPS, it was the same year they bought TaylorMade.

Source: National Golf Foundation

2. R&D and Inventory–Addition by Subtraction

The golf industry is notorious for introducing “new” technologies and brands every year. The marketing tactic works great for upselling golfers, but also significantly increases the risk of inventory obsolescence in downmarkets. TaylorMade fell into this trap.

Between its peak in 2012 and trough in 2017, TaylorMade churned out six driver models and nine iron lines—cluttering operations and inflating R&D costs.

Drivers: R11, RBZ, SLDR, Jetspeed, AeroBruner, M-series

Irons: Burner, RBZ series, TP series, SpeedBlade, SLDR, RSi-series, PSi-series, M-series, P750/770/790 series

When KPS took over between 2017-2021, they cut it down to two main driver families and a tighter iron lineup:

Drivers: M-series and SIM-series

Irons: M-series and P770/P790/P7MB&MC-series

Fewer SKUs meant simpler manufacturing, better inventory control, and lower marketing spend.

3. E-Commerce Channel–Direct-To-Consumer and Online Customizations

Having simplified the portfolio, TaylorMade found other ways to improve margins and increase average order value.

First, they doubled down on e-commerce and tripled e-commerce revenue during 2017-2021. Not only did the e-commerce channel result in higher margins (vs. going through big-box sporting retailers), but it also enabled TaylorMade to offer customizations online which drove higher average order value.

TaylorMade iron customizations online

Source: Company website

Selling direct improved margins, gave them control over pricing and promotions, and enabled online custom fitting—boosting average order value.

4. Sponsorships-Staying Culturally Relevant

Earlier in 2017, TaylorMade had signed top golfers Tiger Woods and Rory McIlroy to equipment deals. Instead of shedding these sponsorships to save cost, KPS doubled down.

Under KPS, TaylorMade’s sponsorship roster included Dustin Johnson, Jason Day, Sergio Garcia, Collin Morikawa, and Tommy Fleetwood among others. By creating the “Team TaylorMade” brand, it was able to regain the #1 market share in drivers and also became the most popular driver on the PGA Tour.

KPS understood that golf was a brand game (no “new” technology has fixed my game!).

Source: TaylorMade

5. Expansion Into Asia—Gearing Up for Centroid Sale

KPS treated Asia—especially Japan and South Korea—as priority growth markets and backed regional initiatives across product, retail, and supply chain.

Flagship retail & premium localization: In 2019, TaylorMade opened a flagship store in Tokyo’s Ginza shopping district—showcasing Japan-exclusive lines (e.g., Gloire) and deepening brand presence with premium merchandising. That brick-and-mortar anchor complemented a broader push to make the Asia-specific assortment and services feel native to local golfers.

Ginza, Tokyo store

Source: Air-Golf.com

Fitting network build-out: TaylorMade expanded dedicated fitting centers in Japan and Korea, leaning into custom-fit as a margin-accretive growth lever and aligning with KPS’s emphasis on mix/price realization over pure volume.

Supply chain advantage during COVID: When Western markets shut in 2020, demand in Asia recovered earlier. TaylorMade reinforced supply into Asia to ride that rebound—keeping sell-through momentum alive while preparing for the global snap-back.

These moves gave TaylorMade a sturdier, higher-margin Asia base (premium retail + fitting + earlier post-COVID recovery) that helped power the broader turnaround KPS executed—positioning the company for its 2021 sale to Seoul-based Centroid.

Through these key efforts, TaylorMade achieved a phenomenal turnaround—going from a $7 million EBITDA loss in 2017 to more than $100 million* by 2021 under KPS. Market share climbed from 17% to 22%, driven by both favorable industry tailwinds and meaningful operational changes.

*Note: EBITDA estimates vary by source and definition. The key point: KPS drove a massive turnaround from negative to positive territory.

Looking Ahead

When Centroid paid $1.7 billion in 2021, I thought they were buying at the top. Having just worked on the Topgolf-Callaway merger at Providence, I was keenly aware of COVID-driven participation spikes.

But the numbers proved me wrong. Revenue climbed from ~$950 million in 2020 to ~$1.5 billion today. EBITDA doubled to ~$220 million. Sponsorships expanded to target younger and more diverse players—new sponsorships include LPGA player Nelly Korda for the female audience and YouTube golfer Grant Horvat for the younger audience—and golf participation hit an all-time high of 47 million in the US.

Centroid’s next buyer will have to bet on whether this is a cyclical peak or a new normal. For KPS, it was textbook buy-low, sell-high.

Source: ESPN, FrontOfficeSports

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies