This week’s edition was a reader request—thanks for the suggestion. If there’s a topic you’d like me to cover, drop me a note at [email protected]

PE Playbook: Insurance Brokers

State of Play

For the past two decades, insurance brokerage has been one of private equity’s favorite playgrounds. The space checks all the boxes: fragmented, capital-light, recession-resistant, and built on recurring commissions.

And 2024 wrapped up with a high note for private equity investors. In December 2024, GTCR successfully sold their investment in AssuredPartners to Arthur J. Gallagher & Co. (NYSE: AJG), a publicly traded insurance broker, for a whopping $13.5 billion.

Let’s break down the broker model, what makes the sector so attractive to PE, and how the AssuredPartners case study illustrates the broader playbook.

How Insurance Brokers Make Money

At a high level, insurance brokers act as intermediaries between clients (businesses or individuals) and insurance carriers (the actual underwriters of risk). Brokers don’t bear risk themselves—they’re paid to place policies and manage the relationship.

So, why go through a broker? That’s a fair question—especially in a world where platforms like Policygenius make it easy for consumers to compare quotes online. For standard personal insurance like home or auto, the risk is relatively straightforward. But in B2B, insurance is rarely one-size-fits-all.

1. Risks are complex.

A construction firm needs contractor liability insurance. A SaaS company needs cyber insurance. No two companies face the same exposures

2. Coverage terms are not standardized.

Unlike personal insurance, where state regulators and carriers define clear policy templates, commercial insurance is often bespoke coverage. Brokers play a critical role in customizing terms.

3. Brokers provide value-added service.

Beyond placing policies, brokers help clients navigate claims submissions and renewals. HR, finance, and legal teams outsource these tasks to brokers.

Revenue typically comes from commissions paid by insurers (as a % of premium), though some brokers charge placement or advisory fees directly to clients. Renewal rates are high—often exceeding 90%—making the model inherently sticky.

Category | Description | Common Revenue Model |

Commercial Property & Casualty | Covers property damage, general liability, auto, workers’ comp, etc. | Commission paid by insurer / carrier |

Employee Benefits | Group health, dental, vision, life, and disability for employees | Commission from carrier or per-employee broker fee |

Specialty Insurance | Covers niche or complex risks (e.g., cyber, rep & warranty M&A, directors & officers) | Commission from carriers plus placement or advisory fees from insured |

Risk Consulting | Risk control audits, exposure analysis, loss modeling, industry benchmarking | Fee-for-service (hourly or project-based) |

For example, a private equity firm would use a broker to:

- (One-time) Purchase a rep & warranty insurance as part of acquiring a company

- (One-time) Purchase commercial and employee benefits insurance for post-closing operations of the acquired company

- (Re-ocurring) Every year, either renew or ask the brokers to request pricing from competitor carriers

- (One-time) Conduct compensation and benefits benchmarking project as part of overall cost savings initiatives

You can quickly see how an insurance broker would establish a repeat business model with its clients.

Investment Thesis

Insurance brokerage is, in many ways, a perfect industry for private equity.

📈 1. A massive market–every company needs insurance

Global brokerage revenue topped $287 billion in 2023 and is projected to grow at 9.2% CAGR through 2030. About 40% of that is tied to B2B, suggesting a $110B+ commercial brokerage opportunity.

Source: Grand View Research

Source: Grand View Research

💰 2. Recession resilient–insurance is non-discretionary

Outside of specialty insurance such as rep & warranty insurance that are tied to M&A / economic cycles, most business insurance—property, workers’ comp, health benefits—is mandatory. Even during downturns, companies can’t afford to go uninsured. This results in steady performance through cycles.

As seen below, the top public insurance brokers (Aon, Gallgher, Brown & Brown, Marsh, Willis Towers Watson) grew through the COVID crisis in 2020 and also rode on the post-COVID bump in 2021 with 10% annual growth.

Source: Leader’s Edge

And the industry was able to grow through the cycle while maintaining its margins. Per survey of 160 brokers (including relatively small firms, as the median revenue of the participants was only $15 million), the industry achieved a 4% growth in 2020 with a 2% bump in EBITDA margins.

Source: Leader’s Edge

💡 3. Capital light–high cash flow business without any risk

The brokerage model is extremely capital-light. In 2024, the top public insurance brokers only spent 1.5% of revenue into capex–meaning, of the 22.5% EBITDA margin they achieved, they took 22% as cash flow (~93% free cash flow conversion).

Source: 10-k

Brokers also face zero underwriting risk, unlike insurers. They don’t hold capital reserves or face balance sheet exposure to natural disasters or bond market swings. It’s pure service revenue.

🧩 4. Fragmented–ripe for M&A

With existing operations being a cash cow, insurance brokers have continued to consolidate the industry, which still remains fragmented.

According to AgentMethods and IBISWorld, there were ~930k licensed insurance brokers and agents in the U.S. and ~430k broker and agent businesses. This implies an average of 2 brokers per business, reflecting a long-tail of SMBs in the industry.

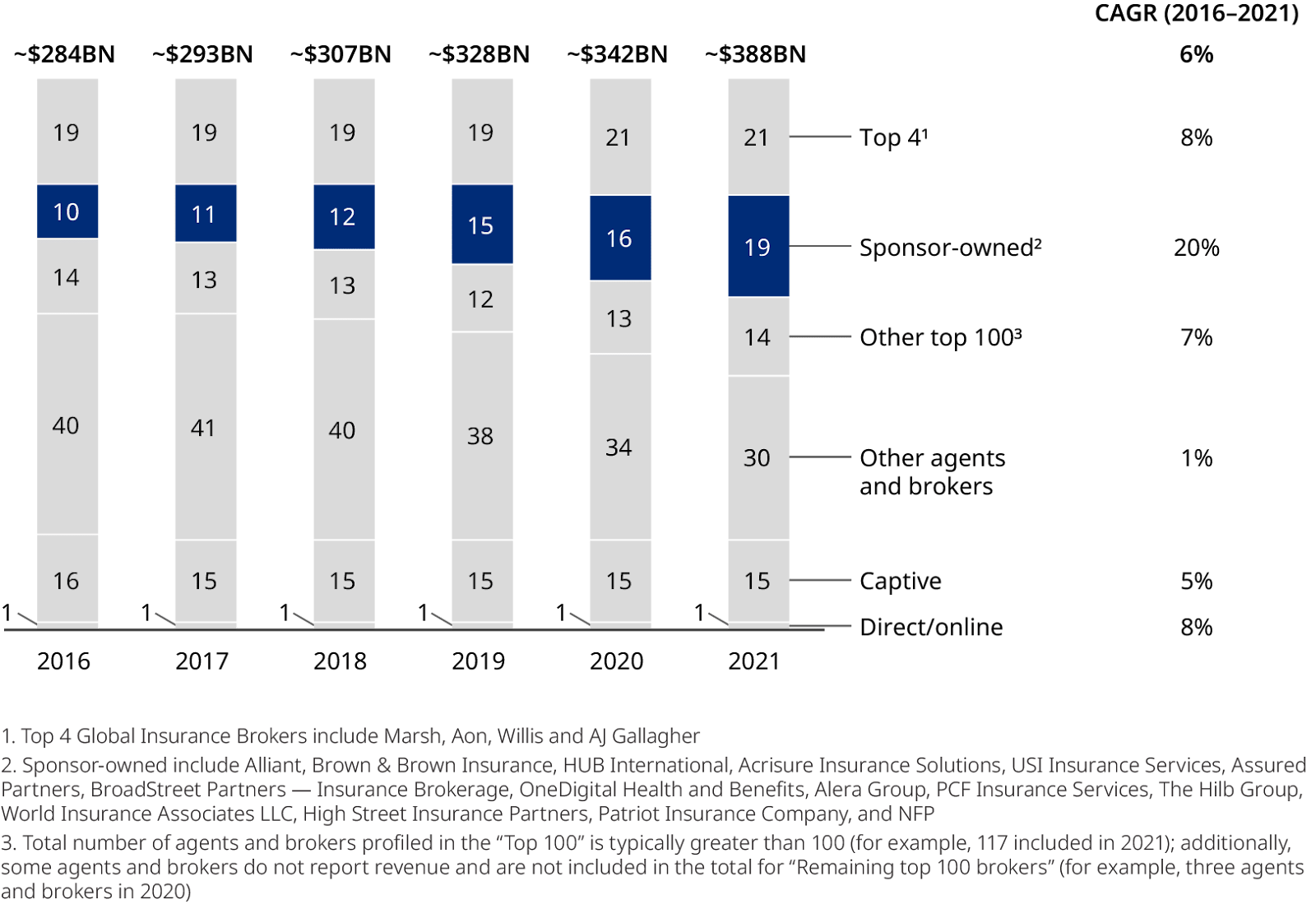

The below Oliver Wyman report also shows there’s still fragmentation, although the consolidation is happening very quickly. As of 2021, top 100 firms accounted for 55% of the market vs. ~45% just 5-years ago in 2016. Private equity has been a major force behind the consolidation–according to Accenture, private equity accounted for over 70% of M&A activity in the brokerage space in 2024.

Source: Oliver Wyman

Case Study: Assured Partners:

Source: Houlihan Lokey; as of Q2 2024

Over the last two decades, many PE-backed insurance brokerages came and went with many active investments still in play. Few platforms better illustrate the PE roll-up model than AssuredPartners:

2011 - Founded by GTCR as a Roll-up Platform

- AssuredPartners was founded in early 2011 through a partnership between private equity firm GTCR and two veteran insurance executives, Jim Henderson (ex. Vice Chairman / COO of Brown & Brown) and Tom Riley (ex-CFO at Brown & Brown).

- Henderson and Riley launched AssuredPartners to build a leading middle-market insurance brokerage by acquiring independent agencies, while retaining local agency leadership and relationships through equity ownership from sellers.

- Within the first few months of operations in 2011, AssuredPartners completed four acquisitions – including its inaugural deal in Neace Lukens, one of the largest independent agencies in Kentucky. They quickly scaled to $75 million of revenue through these acquisitions.

2011-2015 - Growth under GTCR Ownership

During GTCR’s first ownership, AssuredPartners experienced explosive growth through an aggressive acquisition program. In just four years, the company completed 112 acquisitions, including below acquisitions that helped establish “regional hubs” in different states:

Year | Acquisition (Location) | Description |

2011 | Neace Lukens (KY) | Large independent agency (first platform); gave AssuredPartners a strong foothold in the Midwest/Southeast |

2011 | SKCG Group (NY) | White Plains-based insurance agency; added Northeast U.S. presence (NY metro area) |

2011 | Herbert L. Jamison & Co. (NJ) | West Orange, NJ broker with professional liability focus; used as a platform to expand in the Northeast |

2012 | Dawson Companies (OH) | Full-service broker in Cleveland; became an AssuredPartners platform for the Great Lakes region |

2012 | SRA Benefits (KS) | Kansas City agency specializing in commercial lines; expanded AssuredPartners into the Plains states |

2014 | Baronsmead Partners (London) | Niche London-based broker (via Jamison) providing specialty liability cover for investment fund managers; marked AssuredPartners’ first overseas acquisition. |

By 2015, AssuredPartners had become the 6th largest independent P&C broker in the U.S., with approximately ~$500 million in revenue. In July 2015, GTCR agreed to sell AssuredPartners to Apax Partners for reportedly ~15x EBITDA and ~4x return in just four years.

2015-2019 - Apax Ownership

- Apax maintained the rapid roll-up strategy. Under their hold, AssuredPartners completed 124 additional acquisitions, bringing the cumulative total since founding to over 230 deals by 2019.

- Under Apax, Assured Partners also went after larger acquisitions. In 2017 AssuredPartners acquired Keenan & Associates, the largest independent broker in California with over $170 million in revenue. This single acquisition pushed Assured’s total revenue above $850 million in 2017. By the end of Apax’s ownership in 2019, AssuredPartners was approaching $1.1 billion in revenue with over 200 offices in 30+ states.

- On top of M&A, Apax invested heavily into IT infrastructure for digital capabilities and into sales infrastructure of Assured Partners. For example, Apax hired an ex-CTO of Marsh to lead their technology revamp initiatives.

- In February 2019, GTCR led an investor group to reacquire a majority stake in AssuredPartners from Apax. The recapitalization valued AssuredPartners at around $5.1 billion – nearly triple the valuation from 2015.

2019-2024 - GTCR’s 2nd Go

- Under GTCR’s second ownership, AssuredPartners pushed its acquisition engine into overdrive – surpassing 500 total acquisitions by 2024. This means that the firm averaged 40–50 acquisitions per year.

- During this time, AssuredPartners undertook international expansion via M&A. Notably, in 2021–2023 the company (i) entered Ireland by acquiring Gallivan Murphy Insurance Brokers (GMIB); (ii) opened a Brussels, Belgium office in 2021 to pursue deals in mainland Europe; and (iii) in the UK, acquired regional brokers such Romero Group, one of the largest UK broker, in 2023.

- In December 2024, AssuredPartners agreed to be acquired by Arthur J. Gallagher & Co., for $13.45 billion in cash, implying a multiple of 15–17x EBITDA and a ~2.5x return for GTCR.

Looking Ahead

Insurance brokerage has been one of private equity’s most reliable plays for two decades. But the question is—how much juice is left?

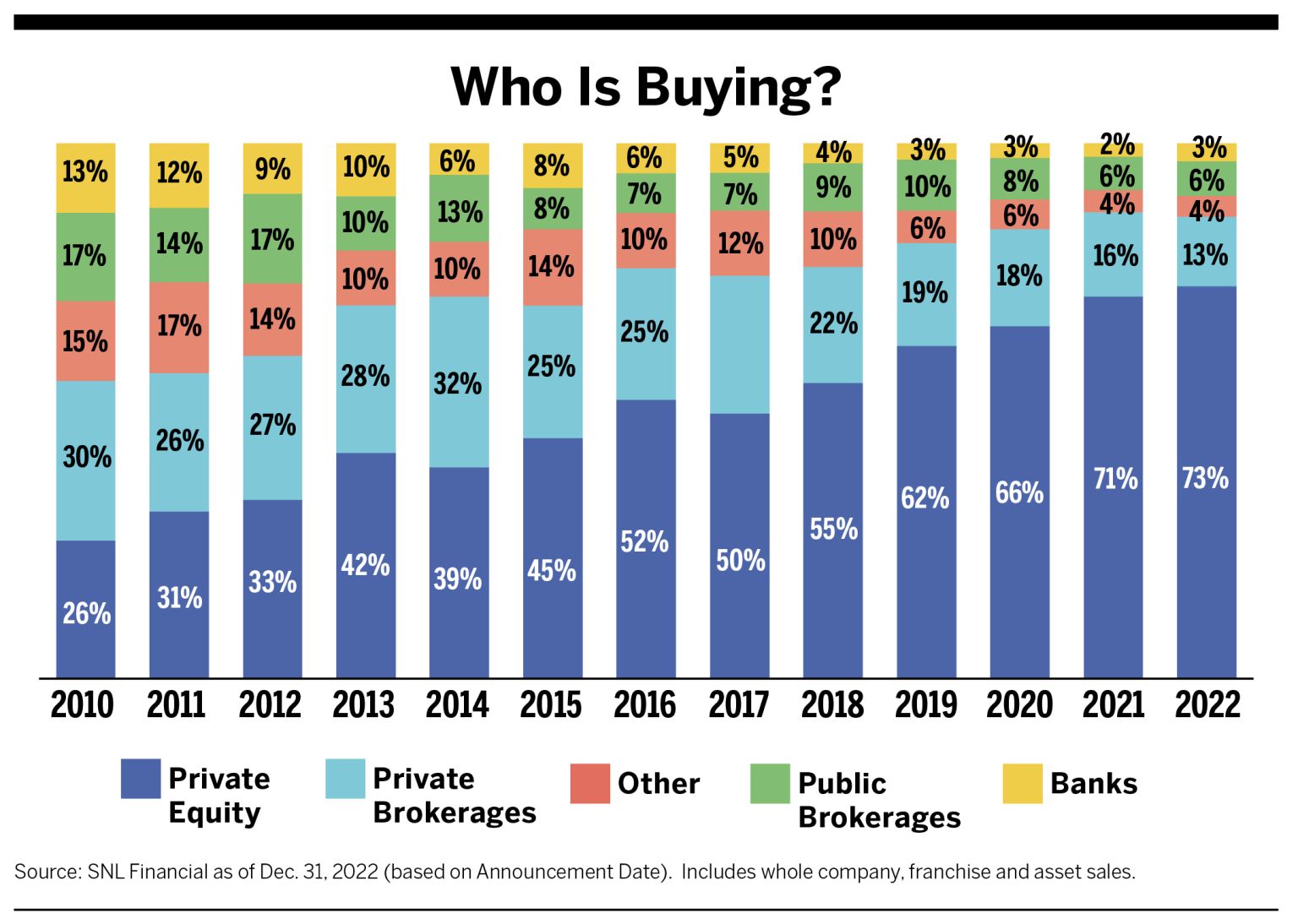

According to SNL Financial, private equity has been the dominant acquirer since 2015, and accordingly, valuations have climbed:

Source: Leader’s Edge

Source: Leader’s Edge

With public brokers still trading in the high teens, there’s arguably room left for arbitrage—but the gap is closing.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies