In last week’s newsletter, we explored how Petco’s strategy diverged from PetSmart and how it lost 90%+ of its market cap in the last few years.

Today, we’re taking it one step further—with a PIPE investment analysis into Petco and a new growth strategy focused on Vetco (Petco’s in-store veterinary services business).

For those interested in learning how to model a PIPE (including how to build a thoughtful forecast), I recorded a step-by-step video walkthrough you can follow with free model templates you can download. YouTube Video

Let’s dive in.

PE Playbook: Petco PIPE

State of Play

Petco’s stock popped 30% on 3/26 after releasing FY2024 earnings that beat EBITDA and free cash flow expectations. But beneath the surface, things are still shaky:

- Revenue declined for the first time in 6 years

- Management propped up cash flows by aggressively cutting capex and delaying payables

- Meanwhile, leverage remains elevated at ~4.5x EBITDA

In this post, we’ll explore:

1. What’s driven the current underperformance

2. Why a Vetco-first strategy could reignite growth

3. How a PIPE investment could give Petco the capital and flexibility to make it happen

How Petco Makes Money

Before we get into the details, here’s a snapshot of Petco’s revenue mix:

Segment | % of Revenue | Description |

Consumables | ~50% | Lower-margin food and daily pet essentials |

Supplies & Companion Animals | ~34% | Higher-margin but shrinking due to fewer pet adoptions post-COVID |

Vetco (Services) | ~16% | Fast-growing vet clinic business that was initially started as a joint venture in 2017 and then fully acquired in 2020 |

Mexico JV | N/A (reported separately) | ~150-store JV in Mexico with Grupo Gigante |

📉 Petco’s Recent Performance

Petco stock’s underperformance can be summarized as a “post-COVID hangover.” Despite other business lines holding up well, the steep declines in the Supplies & Companion Animals segment, combined with inability to control operating costs, has pulled down the overall business.

Revenue Trends

Source: Petco 10-K

Consumables have held up well—likely buoyed by inflation-driven price increases

Supplies & animals have dropped sharply, driven by a decline in dog adoptions post-COVID

Vetco grew at a 14% CAGR… until FY2025, when only 12 new locations opened (vs. 40–50 in prior years), due to capex cuts

Gross Profit Trends

Source: Petco 10-K

Flat product revenue, but a 5% annual decline in gross profit, driven by mix shift to lower-margin consumable goods

FY2025 showed signs of margin stabilization, likely from inventory optimizations and less discounting

Vet services, meanwhile, have continued to show margin expansion as clinics mature

EBITDA Trends

Source: Petco 10-K

EBITDA declined sharply again in FY2025, as the company was not able to control costs despite declining revenue and gross profit

SG&A remains bloated. For example, the company still maintains a $5M/year stadium naming rights deal

CFO and CEO were both recently replaced, hinting at a coming cost discipline pivot

Cash Flow Trends

Source: Petco 10-K

Management cut capex by $100M, largely by slowing Vetco expansion

Working capital payments were delayed to inflate free cash flow—a red flag hiding in the details

🩺 A Vetco-Led Growth Strategy

Wall Street analysts have been anxious to hear how the company plans to turn back to growth. However, so far, the new management has focused on cutting costs to stabilize EBITDA (rightfully a good action to take as new management), but long-term upside needs a top-line lever. And Vetco could be it. Here’s why:

High synergy with retail footprint

- Petco has 1,400 stores, but only ~300 Vetco clinics. There is ample geographic footprint to continue expanding Vetco locations aggressively, and the company can leverage existing infrastructure and fixed costs (e.g., real estate, HR, IT systems)

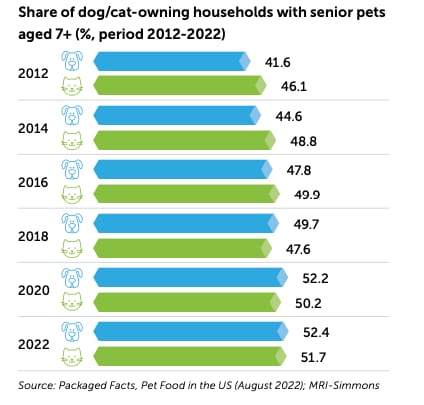

- Vet clinics can drive recurring services, attract foot traffic, and boost average revenue per visitGrowing market with aging pets

- Many COVID-era pets are now aging, which provides a near-to-medium term growth tail for vet services

The vet services market is expected to continue growing steadily, driven by long pet lifespans and a “treat them like family” mentality

Source: Precedence Research

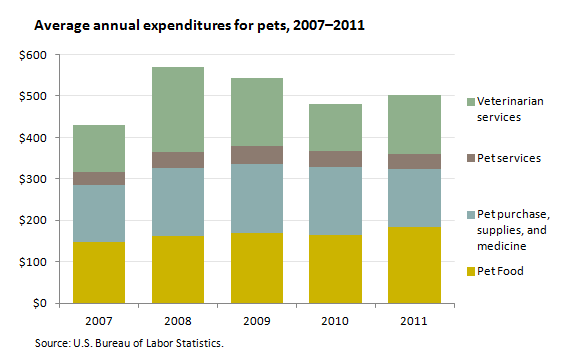

Recession resilient

- Pet spending rose 4% annually during the 2008 recession, even as overall consumer spending declined. With the near-term macroeconomic uncertainty, growth in the vet services revenue could further strengthen the business’s resiliency by adding to the core, stable pet consumables revenue

Source: US BLS

What a PIPE Investment Could Do

A PIPE (Private Investment in Public Equity) is when a private equity firm invests in a public company—typically via preferred equity with structured terms (such as fixed dividends), plus upside participation through warrants (which are options to buy common stock at a predetermined price; more upside if the stock price recovers).

Illustrative PIPE Deal Assumptions:

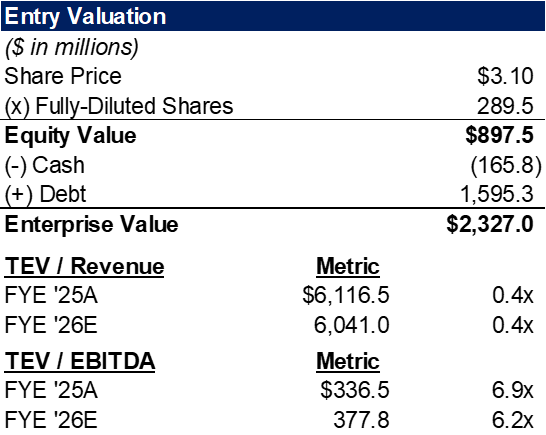

Entry share price: Petco stock is trading at around ~$3.10 these days, which implies ~7x EBITDA valuations. The multiple is not low for a struggling retail business, but there are more favorable growth drivers in the pet industry vs. say, pharmacy retail like Walgreens.

Source: Petco 10-K

Investment size: a private equity firm could invest a $250M preferred equity (with 7% dividend), which translates into a ~19.5% ownership

The $250M investment could:

De-lever the balance sheet

Give room for the company to aggressively invest capex into expanding Vetco again

Build investor confidence in a new, credible growth story

Return Potential:

Under a hypothetical scenario where:

Product sales stabilize;

Vetco revenue re-accelerates with resumed store openings; and

SG&A is better managed (with the new CFO having just joined in Q1)

…the modeled return is ~3.0x MOIC / 25% IRR over 5 years (you can download the Excel model for free here to see the forecast details).

And in downside scenarios (for example, the 0% growth scenario in the bottom table below), the preferred dividend provides a 7% floor on returns—limiting losses and giving the private equity investor downside protection.

Looking Ahead

PIPEs are often overlooked, but they can be highly strategic tools when paired with an operational pivot.

While Petco isn’t out of the woods, a PIPE into Petco could create a compelling turnaround story with the right thesis—potentially one focused on Vetco, and not on product sales.

Execution risk is high. But for firms already bullish on vet services (like Silver Lake or Shore Capital, who just merged $8.5B+ worth of vet hospitals), this may be a natural extension play.

📹 Watch the full PIPE model walkthrough video