What’s Topical: Continuation Funds

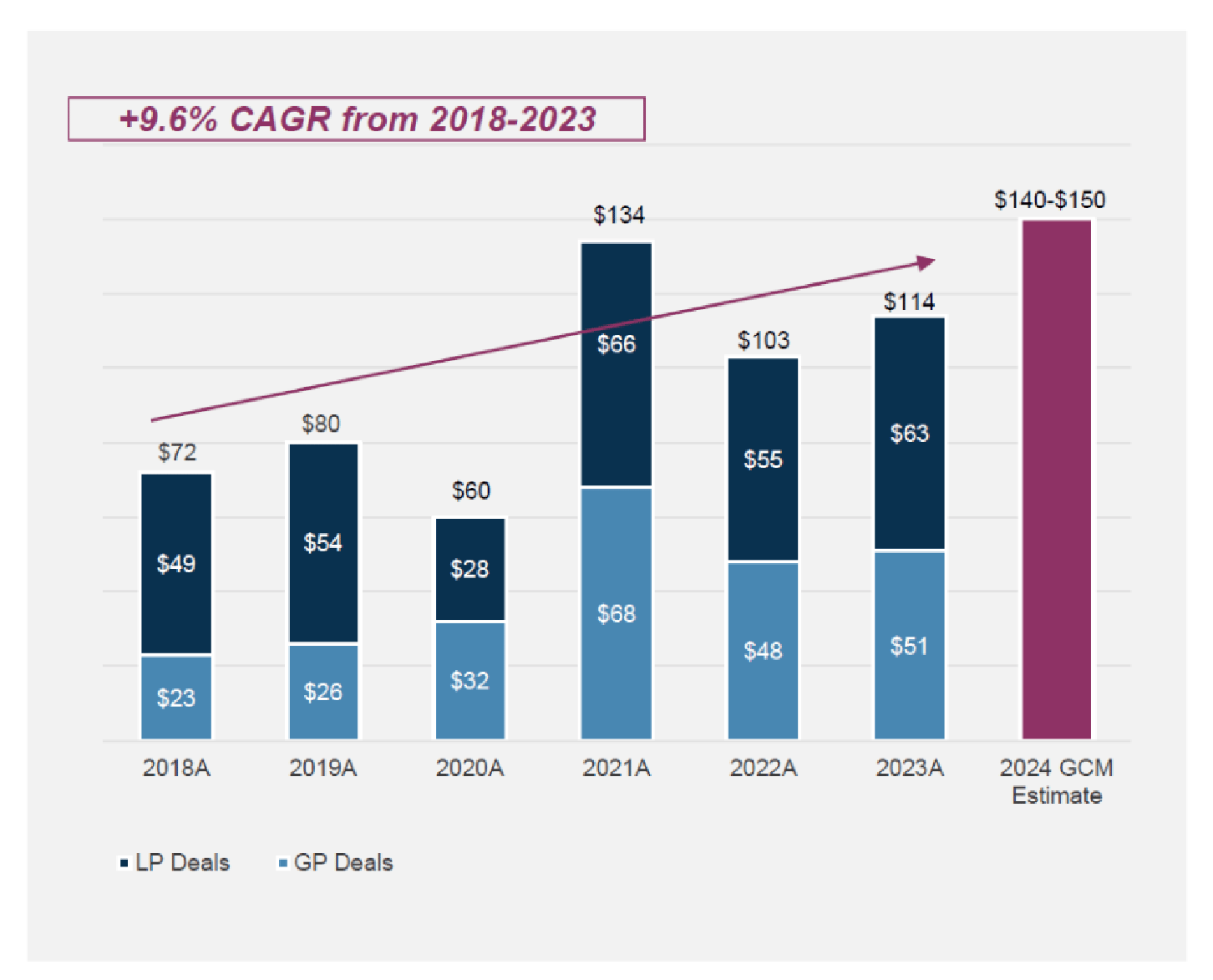

Secondary Market ($ in billions); Source: Evercore, GCM Grosvenor

2024 marked a landmark year for continuation funds, with transaction volumes rising to over $70 billion. Some of the largest deals in the last few years include:

- Alpine Investors’ $3.4 billion continuation fund for Apex Services Partners with capital support from Blackstone Strategic Capital, HarbourVest, Lexington Partners, and Pantheon

- KSL Capital Partners’ $3 billion continuation fund for Alterra Mountain Company, the largest heli-skiing company

The rise of continuation funds, which is a key part of the secondaries market as we will explain below, highlights a major shift in private equity. What’s more, traditional buyout firms like New Mountain, Warburg Pincus, and Leonard Green are now trying to launch their own continuation fund strategies.

History of Continuation Funds

Most readers are likely familiar with the traditional private equity structure, where limited partners (LPs) commit capital to general partners (GPs; i.e, PE firms), who then invest throughout the fund’s lifecycle, calling capital from LPs as needed.

On the other hand, continuation funds, which is a sub-category of secondaries, focus on purchasing existing LP interests, typically midway through a PE fund’s lifecycle. This strategy, first developed in the 1980s, gained traction following the Great Recession when liquidity dried up. In recent years, the secondary market has surged, offering PE firms a way to provide liquidity to existing LPs while maintaining ownership of their assets.

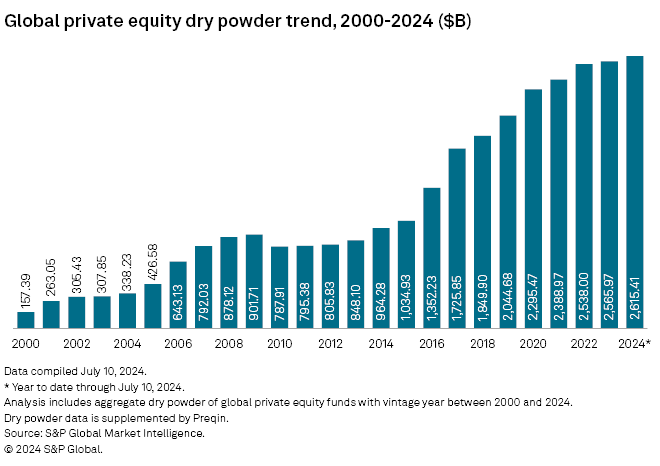

As the private equity landscape has grown increasingly competitive and deployment challenges mount—evidenced by record-high levels of dry powder in 2024—continuation funds have become an essential tool. By rolling over investments into these vehicles, GPs can extend their hold periods, sidestep traditional exit pressures, and maximize long-term value creation.

Source: S&P Global

👍 Why LPs invest in secondary markets

Larger LPs with in-house investment teams utilize the secondary market to actively manage their private equity exposure within their broader investment strategy. They can immediately increase exposure by purchasing secondary interests, rather than committing capital to PE funds and waiting for deployment.

Smaller LPs, on the other hand, typically participate by committing capital to secondary funds managed by firms like Blackstone Strategic Partners and HarbourVest Partners. These funds offer several key benefits: