Today’s newsletter is about business strategy—how a seemingly simple form-building tool Formstack transformed from a lightweight product for individuals and small businesses into a robust enterprise-grade workflow suite.

As always, if there’s a sector or company you’d like me to dig into, drop me a note at [email protected].

PE Playbook: Formstack (now Intellistack)

State of Play

In private equity, enterprise B2B businesses tend to get preferential treatment—and for good reason. Compared to B2C and SMB counterparts, enterprise software companies offer:

- Higher revenue per customer

- Lower churn

- Combine the two, greater customer lifetime value

These traits make them durable and scalable. That’s why most PE firms chase vertical-specific enterprise software—the “Salesforce of X” or the “SAP of Y.” You rarely see firms pursue horizontal tools built for smaller users.

But in 2018, PSG made a contrarian bet on Formstack, an online form builder that started at $5 per month pricing. By 2021, Formstack had tripled revenue and raised $425 million from Silversmith. Its customers now include Kaiser Permanente, Shell, Shopify, Netflix, YMCA, and the University of Michigan.

Let’s dive into how PSG transformed a consumer-grade tool into an enterprise tool—by plugging into massive platforms instead of trying to replace them.

History of Formstack & Its Transition

Although PSG executed the pivot in just three years, Formstack’s journey had been unfolding for over a decade.

Before PSG (2006-2017)

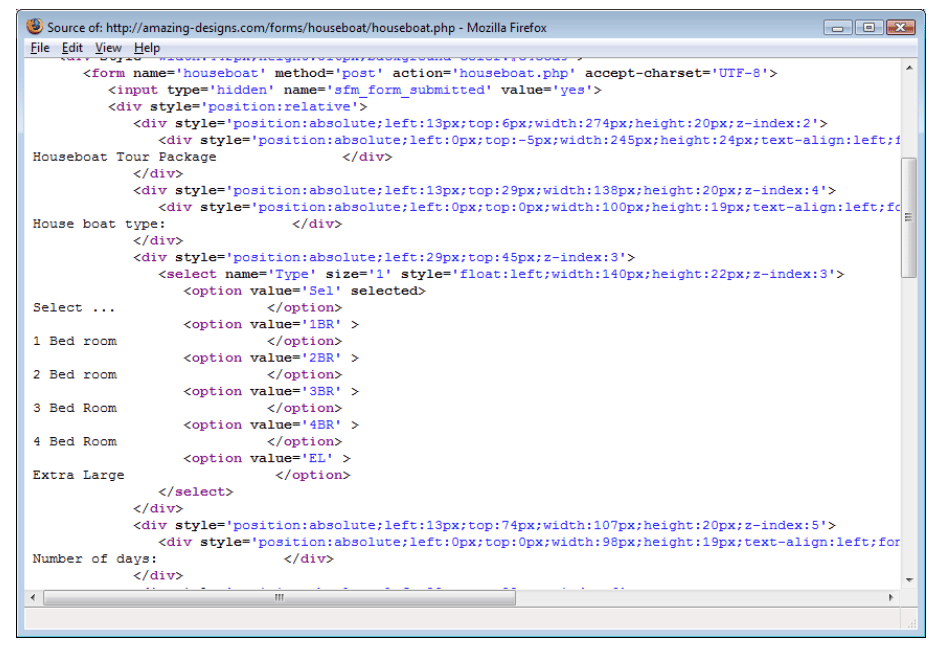

Formstack was founded in 2006 by Ade Olonoh, an engineer turned entrepreneur. At the time, building a web form required actual coding. For the benefit of the younger readers…you literally had to draw the form and code the backend.

Source: JavaScript-Coder.com

Source: JavaScript-Coder.com

Riding on the “no-code/low-code” movement that started with the launch of Wordpress (in 2003) and Shopify (in 2006), Ade started Formstack as a tool to embed forms on websites without coding.

But Formstack’s beginning was slow. According to this interview, Formstack was making only thousands in revenue by 2009 mainly serving bloggers and individuals. By 2017, Formstack was able to grow to $14 million ARR with 27,000 customers (equating to $520 annual revenue per customer).

After PSG Investment (2018-2021)

When PSG made an investment in 2018, Formstack went on an acquisition spree that led to their pivot to B2B.

FastForms

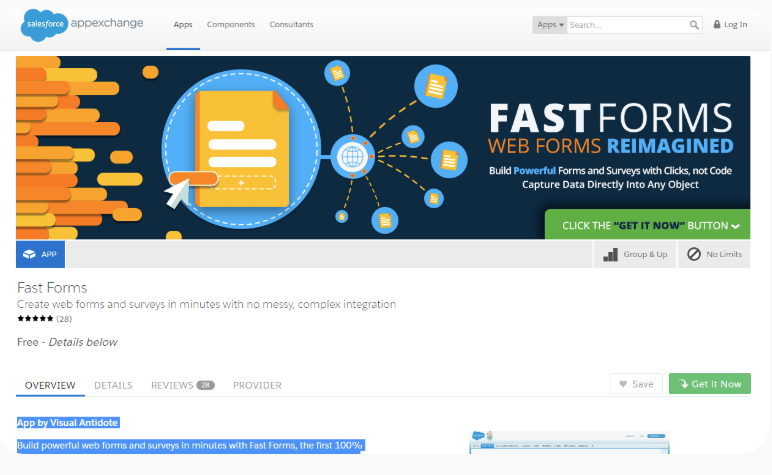

In 2017, Formstack acquired FastForms, another no-code online form builder. What was unique about FastForms was that it was a plug-in app on Salesforce’s AppExchange, meaning Salesforce users (i.e., mid-to-large enterprises) were the main customers. They used FastForms because Salesforce did not have a native form functionality (native meaning that users can build forms within the Salesforce interface and the data submitted via the forms flow directly into the Salesforce database automatically).

Source: Getthekt.com

As we will discuss in the investment highlights, this acquisition opened up Salesforce’s enterprise customer base as a channel for Formstack to penetrate into the B2B enterprise market.

Bedrock Data

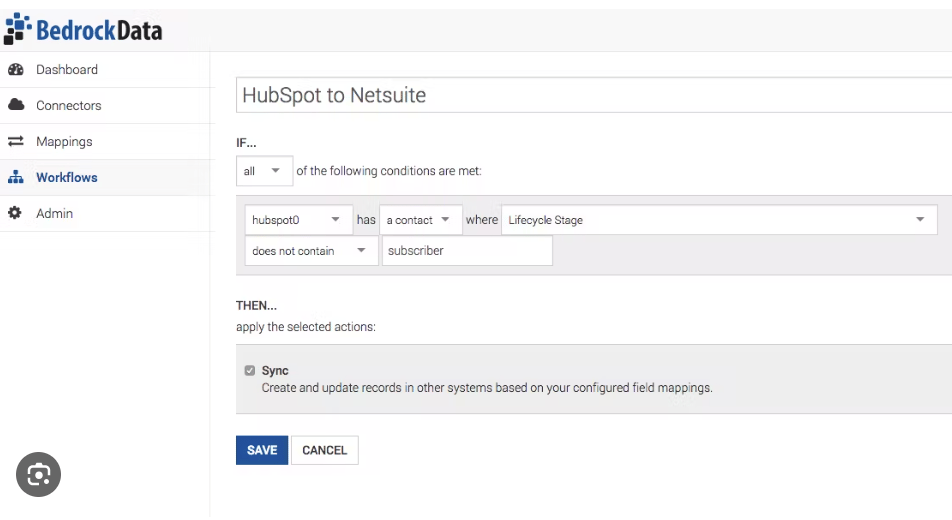

In 2019, Formstack acquired Bedrock Data, a data integration platform. Bedrock enabled Formstack to connect its data collection (forms, documents, payment information) capabilities to its customers’ ERP/CRM databases for automatic data ingestion and workflow automation (it’s like Zapier, but older).

Source: Bedrock Data

But the real goal for Formstack was getting access to a large audience of B2B enterprise customers. Similar to how FastForms opened up the Salesforce customer base, Bedrock Data–through its tight integration to enterprise tools like Dynamics and Netsuite–opened up access to Microsoft, Oracle, HubSpot, and Marketo’s ecosystem.

Through these two acquisitions, Formstack became the de-facto no-code online form builder that is easy to plug in alongside the existing ERP/CRM softwares sitting inside large enterprises (and large enterprises hate moving off of existing systems or using tools outside of them).

Once the distribution channel was established, PSG shifted focus to functionality.

QuickTapsSurvey

In 2018, Formstack added mobile and tablet capability through QuickTapsSurvey.

Source: Soft112

WebMerge and InsureSign

In 2019, Formstack acquired two companies WebMerge and InsureSign.

WebMerge broadened Formstack’s apparatus from surveys-only to any online documents (automated contracts, applications, and proposals across PDF/word).

For example, one use case is automated invoices. Because Formstack is already connected to ERP/CRM systems via the Bedrock Data acquisition, invoices can be filled out automatically based on data feed from ERP and then sent out to the right recipient through the CRM contacts integration.

Source: Crozdesk.com

The next acquisition InsureSign was an e-signatures capturing company. With all forms and documents automated on Formstack/FastForms/WebMerge, customers could now also sign these documents online (so they don’t have to print out anything and instead finish all paperwork online).

Source: SoftwareSuggest.com

Within two years, Formstack had transformed from a consumer point solution into a full document automation platform. By leveraging integration-first acquisitions, the company inserted itself into the software stack of Fortune 1000 enterprises.

During 2018-2021, Formstack reportedly tripled its revenue (implying a $40-50 million ARR off of 2017 ARR of $14 million), resulting in a massive $425 million growth investment from Silversmith in 2021 (implying 10x+ ARR multiple).

Investment Thesis

PSG’s Formstack strategy was grounded in four interlocking insights.

1. Riding the No-Code Wave

Formstack started like other no-code pioneers—WordPress, Shopify, SurveyMonkey, which solved pain points for individuals and small businesses with no technical teams.

By the mid-2010s, though, even large enterprises began adopting no-code. Microsoft launched PowerBI. ServiceNow and Shopify entered the Fortune 500. And analysts projected massive growth. In 2018, RBC estimated the market would grow from $6 billion to $52 billion by 2025. The real number is closer to $30 billion today, but the trajectory held.

Source: Grand View Research

2. Plug Into Enterprise Ecosystems

The biggest unlock that Formstack needed was the enterprise sales channel. Instead of building a B2B enterprise sales team (which would have been very time-consuming and expensive), Formstack acquired their way into becoming plug-ins to enterprise CRMs (Salesforce, Hubspot, Marketo) and ERPs (NetSuite, Dynamics). These platforms have massive customer bases:

Salesforce: 150,000+ business customers

Oracle: 42,000+

Microsoft Dynamics: 40,000+

Marketo: 23,000+

By embedding into these platforms, Formstack could ride the coattails of their growth.

Source: Cyntexa

3. Use Channel Partners, Not a Sales Force

Formstack was not priced like an enterprise platform. The economics didn’t support a traditional sales team. A typical B2B enterprise salesperson is compensated at ~$200-400k, and that’s a lot of $520 annual licenses (i.e., Formstack’s avg. revenue per customer in 2017) to sell to make the numbers work.

So Formstack relied on system integrator / reseller channels. For those unfamiliar, enterprise software companies like Salesforce and Oracle have a large ecosystem of system integrators and resellers who sell their software and provide value-added services (e.g., implementation, customizations, support). For example, Salesforce alone has ~3k partners around the world.

Source: Alten Capital

SIs/resellers and Formstack had a mutually beneficial relationship. Formstack provided functionalities that Salesforce and other tools did not provide off-the-shelf, allowing SIs/resellers to package together Salesforce/other solutions with Formstack to meet potential customers’ requirements. In return, the SIs/resellers received commission from Salesforce/others and Formstack.

This model worked. By 2021, half of Formstack’s new mid-market and enterprise customers came from these channel partners.

4. Expand the Wallet Share

Forms were the foot in the door, but the real value came from broader workflow automation—documents, payments, signatures, and integrations.

Knowing all too well that a low-ticket form builder won’t drive enterprise revenue growth, PSG/Formstack transformed itself into a workflow automation company, which is a much bigger $15 billion market (vs. $2.5 billion online form market).

Source: Verified Market Reports

Source: Verified Market Research

Looking Ahead

PSG helped turn a niche form-builder into a broad workflow automation suite through a well-timed spree of tuck-in acquisitions. But the recent layoffs and slowdown in deal activity suggest the strategy may have hit its ceiling.

Formstack’s story underscores the power—and limits—of a buy-and-build strategy in software.

RATE TODAY’S EDITION

Invite friends and receive free resources! Click “Click to Share” button at the bottom to get your unique referral link.

🔒 1 referral – a clean PE recruiting resume template

🔒 2 referrals – a ready-to-use, interview-tested LBO model template

🔒 3 referrals – a detailed 30-page guide on the private equity landscape and selecting your ideal PE firm. Review this guide before your headhunter meetings

🔒 4 referrals – a comprehensive PE interview questions bank that includes behavioral, technical, deal experience, and brainteaser questions with detailed explanations / answers on the technical questions

🔒 5 referrals – six real interview case studies from TPG, Silver Lake, HIG, Madison Dearborn, Oaktree, and Fortress with full LBO answers for two case studies