Roll-Up Playbook: Registered Investment Advisors (RIAs)

WealthManagement.com

State of Play

The registered investment advisor (RIA) industry kicked off 2025 with record-breaking M&A activity, as 43 deals—representing nearly $340 billion in assets under management (AUM)—were announced in January alone.

Private equity has been the dominant force behind this surge. Fidelity reports that PE firms and their portfolio companies accounted for ~90% of RIA transactions in 2024, a dramatic increase from just ~40% in 2016.

This week, we’re taking a deep dive into private equity’s track record in wealth management—particularly in RIAs—to explore what’s driving the continued consolidation in this space.

Investment Thesis

Before the 2000s, the investment advisory market was largely dominated by broker-dealers like Merrill Lynch, Morgan Stanley (formerly Smith Barney), and Wells Fargo Advisors. These firms employed armies of advisors who earned commissions based on the financial products they sold to clients.

In contrast, Registered Investment Advisors (RIAs) operate independently of brokerage firms and are held to fiduciary standards, meaning they must act in their clients’ best interests. Instead of earning commissions, RIAs typically charge a percentage of assets under management (AUM) or a flat fee.

Starting in the early 2000s, regulatory shifts and growing consumer demand for transparency and personalized services fueled the rise of RIAs. The 2008 Financial Crisis was a major turning point, prompting many investors to move away from commission-based models in favor of fee-based, fiduciary-driven advisory services.

Source: Willis Johnson & Associates

The rise of online brokers like Schwab, E-Trade, and Fidelity in the 2000s introduced lower-cost, self-directed trading platforms, allowing investors to manage their portfolios with minimal reliance on traditional brokers. As a result, many advisors at brokerage firms transitioned to the RIA model, where they could focus on providing holistic financial, tax, and estate planning services rather than just selling financial products.

These industry shifts set the stage for private equity’s first major foray into the RIA space. In 2012, Lee Equity Partners took Edelman Financial Group private in a $257 million deal. Just three years later, in 2015, Lee Equity sold Edelman to Hellman & Friedman for over $800 million, marking a highly successful exit. Hellman & Friedman was already familiar with the space, having invested in broker-dealer LPL Financial in 2005.

Why Private Equity Loves RIAs 🚀

The RIA model boasts several attractive attributes for investors:

💵 1. Recurring and Growing Revenue

Many RIAs initially adopted a percentage-of-assets-under-management (AUM) revenue model, which, when combined with client retention rates in the high 90s among top-tier firms, creates a subscription-like revenue stream. Additionally, individual client assets tend to grow over time due to incremental savings, investment gains, and general market appreciation, providing a natural long-term revenue growth driver.

To diversify revenue streams and reduce exposure to extreme market volatility—such as during the 2008 Financial Crisis—many RIAs have also introduced flat-fee models, ensuring greater stability regardless of market fluctuations.

S&P 500 Historical Chart

Source: Macrotrends

🚚 2. Continued Market Shift to RIAs

Both advisors and their clients continue to shift away from the broker-dealer model in favor of RIAs. Not only is this transition ongoing, but the growth in the number of RIAs is significantly outpacing the decline in broker-dealers, indicating that more independent, smaller RIAs are emerging.

As a result, RIA market share (measured by total AUM) has been steadily rising. According to Cerulli Associates, RIAs were projected to manage 29% of total assets in 2022, up from 23% in 2017 and 17% in 2007—a clear indication of their expanding dominance in the wealth management industry.

Source: Mercer Capital

🧩 3. A Massive, Yet Fragmented Market for M&A

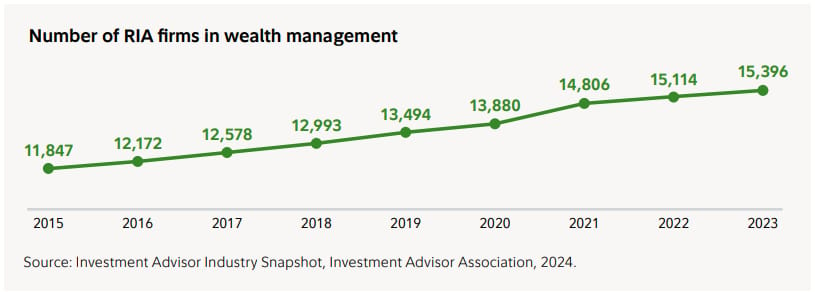

The U.S. market is massive with RIAs managing more than $8 trillion in AUM, growing at an 18% CAGR over the last 5 years. The number of RIA firms continues to increase year-over-year, despite continued PE-driven consolidation.

Source: Fidelity

So, Why Now?

Despite being at least a decade-old playbook, private equity activity in the RIA market is not skipping a beat.

👴 1. Faster Than Expected Retirements

The COVID-19 pandemic triggered a wave of retirements, surpassing historical projections. Additionally, the surge in asset valuations—coupled with layoffs across industries—has accelerated early retirements or, at the very least, increased preparations for retirement. This demographic shift has fueled demand for RIA services, as retirees seek personalized financial planning and wealth management to navigate their post-career years

Source: St. Louis Fed

👨👨 2. The Great Wealth Transfer

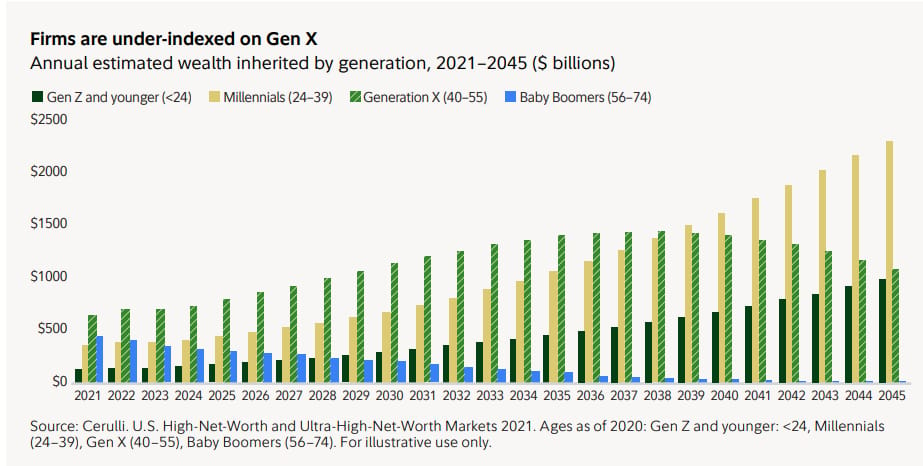

Generational wealth is on the move—Cerulli projects that $105 trillion will transfer from Baby Boomers and older generations to Gen X and Millennials over the coming decades. This shift presents a massive opportunity for tech-forward RIAs to engage historically underserved demographics.

For example, only 44% of Gen X currently have a financial advisor, leaving a large untapped market. By leveraging digital tools, automation, and modern client experiences, RIAs can attract and retain younger investors who expect a more tech-driven, personalized approach to wealth management.

Source: Fidelity

👨🏻🏫 3. Increasing Awareness and Higher Bar for Retirement

According to a Northwestern Mutual survey, Millennials who work with financial advisors typically start seeking formal financial advice at age 29—nine years earlier than Gen X and 20 years earlier than Baby Boomers.

This shift highlights two key trends:

✅ Earlier Engagement – Younger generations are proactively seeking guidance to build wealth sooner.

✅ Higher Financial Goals – Millennials and Gen X expect to need ~$1.6M to retire comfortably, compared to $990K for Boomers.

With higher financial targets and a greater willingness to seek advice, RIAs that embrace technology and modern engagement strategies stand to win over these younger, high-potential clients

Value Creation Playbook

The widespread adoption of online brokerage firms, financial planning tools, and low-cost financial products (e.g., ETFs) have significantly lowered the barriers to entry for RIA firms. However, consolidation, scale, and synergies continue to pay off for private equity.

1. M&A Roll-Up

The U.S. has more than 15,000 RIAs, according to Fidelity, creating a highly fragmented market. This fragmentation presents prime opportunities for private equity to execute highly accretive roll-up strategies. Sources suggest these acquisitions are happening at high-single-digit to 10x EBITDA multiples, with platform companies reaching teens to 20x EBITDA multiples upon exit. This dynamic allows private equity firms to consolidate smaller firms and create significant value through scale and operational synergies.

Source: DeVoe & Co

Source: Fidelity

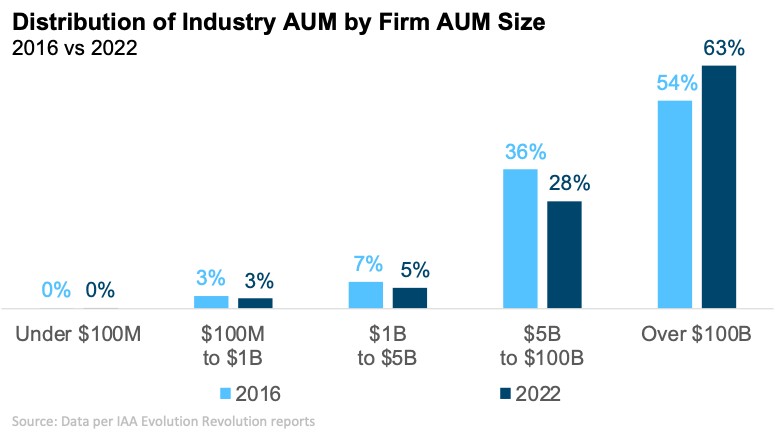

2. Back-Office Synergies

According to LLR Partners, over 90% of RIAs manage less than $1 billion AUM, equating to annual revenues of less than $5-10 million. Larger RIAs acquiring smaller firms can achieve cost savings in areas such as custodial fees and technology/overhead expenses. Additionally, these acquisitions provide back-office support to advisors, allowing them to focus more on client relationships rather than administrative tasks. This wave of consolidation has led to the creation of mega-RIAs, which are increasingly capturing market share through M&A activity.

Source: Mercer Capital

3. Cross-Sell Services

Clients increasingly seek a holistic set of services for comprehensive financial planning, which has led many RIAs to expand their offerings. These services now include:

Tax services and accounting

Estate planning

Insurance products

Private investments

There have been notable mergers between RIAs and accounting firms to provide this expanded service menu. For instance, in 2023, Creative Planning, an RIA firm that received a minority investment from General Atlantic in 2020, acquired Bergen KDV, a $100 million revenue accounting firm. This acquisition represents an important shift towards integrated financial services within the investment advisory industry, combining the strengths of both sectors.

Looking Ahead

The private equity acquisition spree in the RIA sector has continued strongly through the 2020s, driven by the sharp and sustained increase in asset values (with only a brief dip during COVID-19). This surge in asset values has certainly benefited the RIA business model. However, it remains to be seen whether there will be more market volatility in the near future and how that might affect the ongoing trend of private equity's roll-up strategy in the RIA space. While the sector has seen continued success, the question remains whether private equity will continue to blindly roll up RIAs without encountering any hiccups along the way.

Private equity employees get little sleep, but money never sleeps and private equity firms like RIAs for it 💰

RATE TODAY’S EDITION

If you enjoyed the newsletter, please share with friends and subscribe at https://www.penewsletter.com/subscribe