Roll-Up Playbook: Lawn Care

State of Play

In January 2025, Huron Capital completed the sale of ExperiGreen Lawn Care—the 60th largest lawn care company in the U.S.—to Wind Point Partners. While financial details remain undisclosed, ExperiGreen saw a 10x increase in EBITDA 📈 and executed 19 acquisitions under Huron Capital’s ownership since 2022.

The lawn care roll-up strategy continues to gain momentum. Just last month, nearly 10 acquisitions were announced publicly, including LawnPro Partners’ 10th acquisition, backed by HCI Equity Partners.

Investment Thesis

Private equity’s involvement in lawn care isn’t new. The industry’s first private equity deal dates back to 1998 when CIVC Partners acquired The Brickman Group. CIVC held the business for nearly a decade, completing a dividend recap with a minority investment from Leonard Green before selling its controlling stake to KKR in 2007. Today, The Brickman Group is now BrightView (NYSE: BV)—the largest lawn care company, generating ~$3 billion in revenue with a ~$1.5 billion market cap.

Why Private Equity Loves Lawn Care 🚀

The lawn care business model boasts several attractive attributes for investors:

🌱 1. Non-Discretionary Service

For anyone who grew up in the suburbs, it’s no surprise that grass grows fast—and maintaining it requires more than just mowing (think fertilizers and weed control). However, only ~33% of the market is residential. The majority serves commercial properties and vegetation management, including clearing trees for utilities. Strict regulations around commercial landscaping make these services essential, not just aesthetic—reinforcing their non-discretionary nature.

💵 2. Recurring, Subscription-Like Revenue

Lawn care has evolved from a pay-as-you-go service (where providers knocked on doors and collected checks) to a subscription-based model. As consumer comfort with subscriptions and digital payments grew in the 2010s and 2020s, the industry followed suit. While no definitive industry-wide retention data exists, company interviews and forums suggest annual customer retention rates of 80-90%. For private equity, predictability is key—and lawn care delivers.

🧩 3. A Massive, Yet Fragmented Market Ripe for M&A

The U.S. lawn care market is valued at ~$150 billion (per IBIS), yet remains highly fragmented. Despite ongoing consolidation, the top 150 companies collectively generate only ~$18.5 billion, or just ~12% of the total market. This leaves significant room for further roll-ups and acquisitions.

So, Why Now?

Private equity has been actively investing in the lawn care and landscaping space since the 2010s, and the momentum isn’t slowing down. One of the key drivers? Housing and homeownership trends.

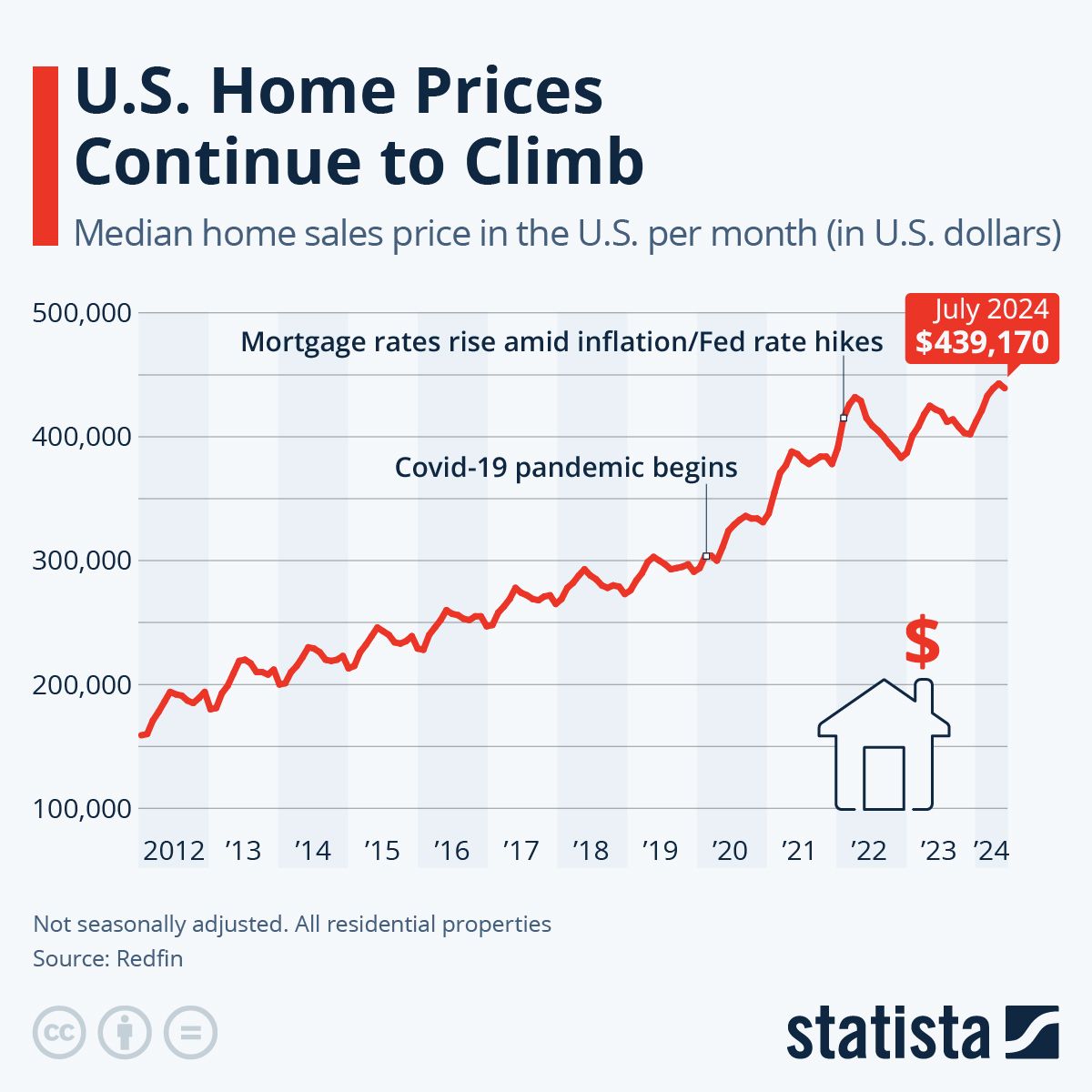

🏡 1. Increasing property values.

The median home price has nearly 1.5x’ed since the COVID pandemic.

Source: Statista

Beyond aesthetics, lawn conditions have a direct impact on property values. A survey of over 1,000 realtors found that poor landscaping can reduce home values by up to 30%.

👨👨 2. Shift in home ownership to Millennials.

Home ownership among Millennials have skyrocketed since COVID.

Source: Redfin

Millennials want their lawns to impress—but they’d rather pay someone else to make it happen. A 2016 John Deere study found that 44% of Millennial homeowners aspire to have the best lawn in the neighborhood, compared to 37% of older generations. Yet, despite this desire, fewer people are doing their own lawn care.

While recent data is scarce, it’s likely that DIY lawn care spiked during COVID before declining again with the return to office.

Source: BLS

🛠️ 3. Aging Baby Boomers and Gen X.

Despite Millennials’ home ownership increasing, Baby Boomers and Gen X’ers are still the largest owners of homes.

Source: Redfin

Baby Boomers are in a unique stage of life—old enough to retire, but not yet old enough for senior housing. As they stay in their homes longer, their aging bodies will push them to outsource more household chores—including lawn care.

Source: Marcus & Millichap Limon Net Lease Group

Value Creation Playbook

Value creation for lawn care services is relatively simple. Given the low barriers to entry, the name of the game is scale, meaning, it starts with consolidation and ends with synergies:

1. M&A Roll-Up

The U.S. is home to over 600,000 lawn care service firms, according to Greenwich Capital. As shown in the 2024 top 150 landscaping management companies report, the size of these firms drops off quickly.

Private equity thrives in fragmented markets like this, which offer highly accretive consolidation opportunities. Banker sources indicate these acquisitions are being executed at mid-to-high-single-digit EBITDA multiples, while platform companies are being sold for double digit EBITDA multiples.

2. Back-Office Consolidation

A benchmark study by Landscape Trades magazine estimates that overhead costs—including sales and marketing, rent, professional services, owner compensation, and back-office labor—typically range from 20-30% of revenue.

Private equity platforms can quickly reduce these costs, except for sales and marketing, which are often consolidated more gradually to preserve revenue growth. If 15% of the 20-30% overhead is eliminated, EBITDA margins can expand from 10% to 25% post-synergy.

This efficiency unlocks significant multiple arbitrage—a business acquired at 8x pre-synergy EBITDA effectively drops to a 3x multiple post-synergy, creating substantial upside as platforms trade at double-digit multiples.

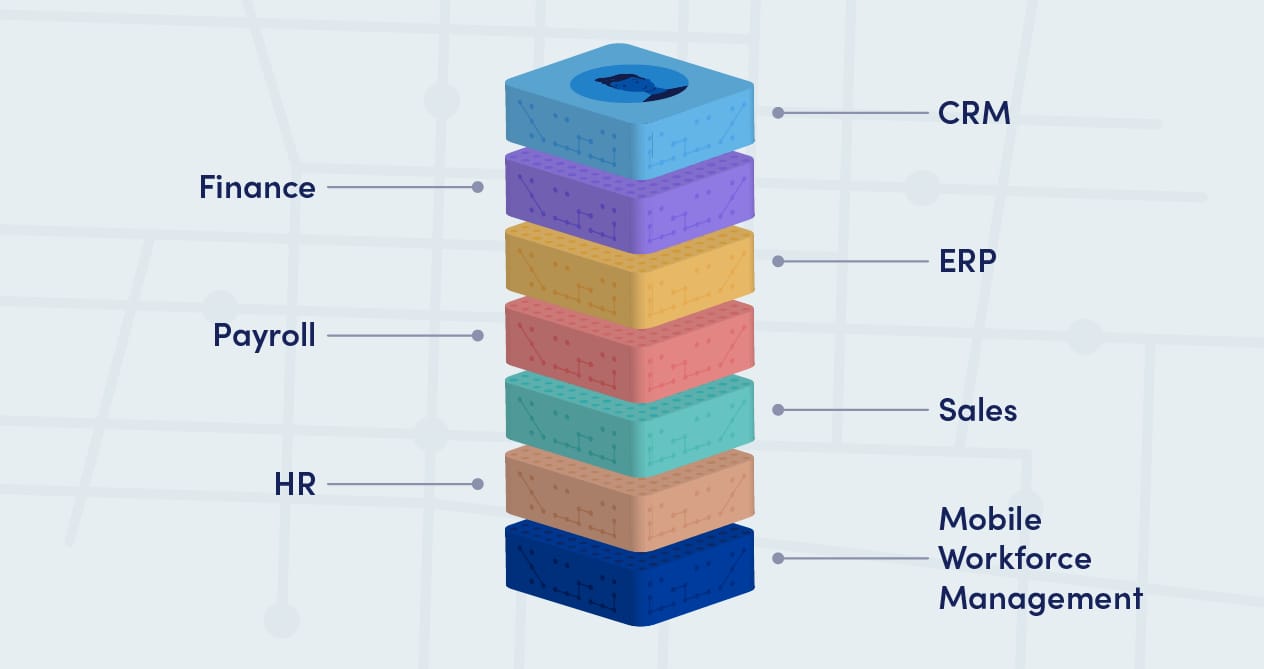

3. Systems Digitization

After cost synergies, one of the first things that private equity will do is to integrate the newly acquired company’s operations into the platform company’s technology stack.

Source: Skedulo

Back-office systems play a critical role in post-acquisition efficiency. Financial and ERP systems ensure smooth operations after eliminating redundant back-office headcount, while HR and mobile labor management systems keep field employees coordinated, maintaining high customer satisfaction.

Most importantly, integrating acquired companies into a centralized CRM allows the platform company to streamline sales and marketing efforts at the parent level. This enables strategic reinvestment into the most profitable channels with the highest LTV/CAC, driving long-term growth.

4. Marketing (Digital and Localized)

Most mom-and-pop businesses lack a strong digital presence. After being acquired by private equity firms, and assuming the brand is retained, the new owners typically invest upfront in:

Building a professional website and improving search rankings

Enabling digital payments for a smoother customer experience

Automating review collection to boost visibility on Google Reviews

Once integrated into modern CRM systems, which often connect with marketing automation tools, these businesses can significantly enhance their customer acquisition efforts by:

Targeting specific geographies with digital marketing

Building lookalike audiences based on existing customers

Launching cold-calling and cold-emailing campaigns

This transformation helps turn traditional businesses into scalable, data-driven operations, unlocking new growth opportunities.

Source: Surefire Local

Looking Ahead

Private equity’s consolidation of the lawn care market isn’t slowing down—unless Millennials and Gen Z suddenly embrace DIY lawn care (which seems unlikely). Over the next few years, we can expect several notable exits as firms begin monetizing platforms launched or acquired in the late 2010s/2020. Some key platforms include:

Asplundh / CVC (2017)

Moore Landscapes / Clearlight Partners (2017)

Treeways / NMS Capital (2019)

Yellowstone Landscape / Harvest Partners (2019)

Landscape Workshop / Carousel Capital (2020)

United Land Services / Centre Partners (2020)

URW / Montage Partners (2020)

Instead of a direct sale, some firms opt for dividend recaps—like CD&R with TruGreen. After acquiring TruGreen’s parent company in 2007 and spinning off TruGreen in 2014, CD&R completed a $350 million dividend recap in 2020, returning capital while retaining majority ownership of the third-largest lawn care company with $1.5B revenue.

Grass keeps growing—and so do private equity returns. 🌱💰

RATE TODAY’S EDITION

If you enjoyed the newsletter, please share with friends and subscribe at https://perollup.beehiiv.com/subscribe